Copy of the 2nd Quarter Review Letter

KERR FINANCIAL GROUP

KILDARE ASSET MANAGEMENT

45 Lewis Street, Lackawanna RR Station

Binghamton, NY 13901

Phone: 607-231-6330 email: [email protected]

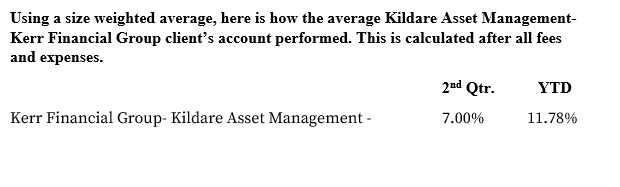

The following is a copy of the 2021 2nd quarter letter sent to clients. It reviews the markets and the client account’s activity and performance for the 2nd quarter of 2021.

August 10, 2021

Wall Street is always introducing new products to trade and new ways to trade them. 2021 has provided both with the rise of SPACs and the Robinhood app. SPAC stands for Special Purpose Acquisition Company. It is a company that sells shares of their stock to raise money that is then used to buy another company. These target companies are usually a private organization.

SPACs became very popular in the first half of the year, and they generated a lot of speculation. The SPACs often disclosed their target company which led to investors bidding up the SPACs based on excitement and projections on the target company’s potential. The enthusiasm around these stocks isn’t as great as past bubbles but it was certainly a big part of the first half of 2021.

Another noteworthy financial market development is the battle between individual investors and the Wall Street establishment. The skirmish began when some investors connected by an online chatroom named “Wall Street Bets” targeted stocks that were heavily shorted by Wall Street including many hedge funds.

The “Robinhoodies” (one of the nicknames of the group of individual investors because they often used the Robinhood app to do trades) targeted the stocks of GameStop, AMC Entertainment, and Blackberry. Their buying pushed these stocks higher – GameStop’s stock spiked from under $20 per share to over $480 in two weeks. This resulted in heavy losses for some firms that had shorted the stocks (short positions look for falling stock prices to be profitable).

Wall Street fought back by restricting buy orders on the stocks. After a few days the friction decreased, and full trading access was restored. However, the battle between the Army of the Apes (another nickname for the individual investors) and established Wall Street is far from over. This could continue to influence trading in certain stocks and potentially impair other over leveraged Wall Street firms.

While I am normally skeptical on investing fads and gimmicks, not all of them are bad and some present opportunities. MP Materials Corporation (symbol MP) is a good example. MP came public after the operations were acquired by the SPAC Fortress Value Acquisition Corporation (symbol FVAC).

MP Materials is the owner and operator of Mountain Pass, the only rare earth mine and processing site in North America. Rare earth elements are important parts in industries such as manufacturing, technology, and defense. They are also required for many clean energy applications.

MP was included your account in the 4th quarter of 2020. Purchases of FVAC were before the merger (de-SPAC) and the entry price was in the low to mid-teens. After the deal was closed, the MP stock spiked to $40 in December and closed 2020 at $32. MP’s stock price has been volatile in 2021. It traded above $50 in the 1st quarter and then was cut in half in May. The stock rebounded and closed the quarter in the high $30’s.

MP’s volatility is partially a function of size as it is a small company and operations are growing. Further mining is a high-cost industry with steeper break-even metrics from other businesses. Finally, rare earth elements have a geopolitical component as China is the largest exporter of rare earths. This could be an advantage during tense international relationships. Despite the over 100% profits, I think MP’s stock price could continue to move higher over time as the importance of their mined elements grow.

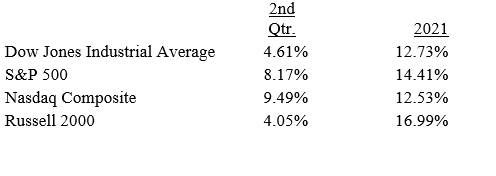

Looking at the market in total, stocks had a good first half of 2021. The Russell 2000 Index which is a small cap index led the way. The Nasdaq Composite did some catching up in the 2nd quarter after lagging the other indexes in the 1st quarter. Here are the major indexes’ performance numbers for the 2nd quarter and the year-to-date.

As noted, the stock market leadership changed during the 2nd quarter. In addition to the shift from small cap to large cap, and low quality (SPACs and highly leveraged companies) to better balance sheets and higher quality, investors seem to be shifting to sectors that can succeed in inflationary times. This includes industries that can pass along their higher input costs and maintain their margins.

Technology and energy are two areas of the market that have historically done well in this environment. Commodities and the industries that supply them are another sector. Value and defensive stocks have lagged in inflationary times.

The fixed income market saw a steepening of the yield curve as inflation expectations have risen. This typically helps financial companies who normally rely on the spread between longer dated interest rates and short-term rates (they invest long-term at higher rates and borrow short-term at lower rates, taking advantage of the spread).

The current investment landscape is facing many unknowns. Uncertainty surrounding Covid and a delayed reopening could be a large economic hurdle. Continued shutdowns will squash any recovery. Societal division and widespread cultural acrimony are further massive challenges.

In the glass half full bin, the world is slowly reopening. Furthermore, history is full of examples of pandemics and dramatic shocks that resulted in an explosion of demand as the recovery takes hold – the millennial reference is YOLO or You Only Live Once. This path will result in a higher growth trajectory with expanding opportunities.

As we journey through the rest of 2021, I will look to balance these cross currents and take advantage of opportunities. I will focus on the changing risks to the system as well as individual securities.

Thank you for your support and confidence in Kerr Financial Group. Please contact me with any questions or comments.

Sincerely,

Jeffrey J. Kerr, CFA

Leave a Reply

Want to join the discussion?Feel free to contribute!