“Those who vote decide nothing. Those who count the vote decide everything.”

Kerr Financial Group

Kildare Asset Mgt.

Jeffrey J. Kerr, CFA

Newsletter

January 4, 2021 – DJIA =30,606 – S&P 500 =3,756 – Nasdaq = 12,888

“Those who vote decide nothing. Those who count the vote decide everything.”

Although the above quote is associated with Joseph Stalin, there is debate whether he is the actual source. Regardless, it appropriately describes the 2020 U. S. Presidential election and is emblematic of our divided country.

The right to choose our government representatives fairly and freely is a core component of the United States. From local office to federal positions, the right to vote gives the individual an equal say in our country’s direction and leadership. And despite some nasty and messy examples, our elections have been the envy of the world

This latest election was different. Unconventional campaigns, censorship and biased news reporting, and newly instituted tabulation methods intersected during 2020. These developments clearly damaged the election’s transparency which resulted in voter doubt. This loss of confidence further widened the country’s divide.

Throughout the year there was hope that after the presidential election, the social ill will would recede. This kumbaya moment would be a period of healing and then a return to our pre-2020 existence. Unfortunately, the election has inflicted more and deeper wounds which will not easily heal.

The soldiers and battle lines of this civil war are different from the conventional conservative Republicans vs. the liberal Democrats. The new battleground cuts across different sectors of our culture which brings together diverse elements into the opposing groups. Populists squaring off against globalists, the middle class opposing the elites, and the Davos crowd vs. the deplorables. And as the war matures, there will likely be other curious alliances and divisions.

While the election has inflamed the emotions of the fight, the core of the conflict centers on the balance between individual freedoms and providing for the common good. This struggle is as old as mankind. This war has countless fronts and battles, and both sides have dug in. It is difficult to see a path to unifying the United States citizens in 2021.

This social division will ultimately alter our economic wellbeing. To many, it is one of the great mysteries of 2020 that the financial markets performed as they did. Not only did they recover from March’s air pocket, but they functioned well in a year with a pandemic, economic shutdowns, riots and protests, and the turmoil surrounding the election.

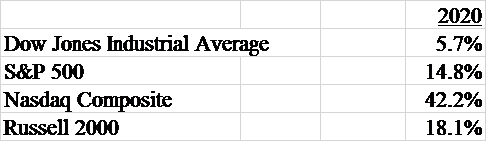

The stock market had amazing returns given this backdrop. Here are the 2020 performance numbers for the major averages.

An interesting 2020 stock market development was the influence of the individual investor. As a result of working from home (or just at home and not working), stock trading became a favorite pastime. In addition to online trading, a stock trading mobile app called Robinhood became the preferred platform.

Robinhood offered $0 commissions, the ability to purchase partial shares, and option trading. It became so popular that websites began tracking and reporting on the most widely held positions. Unfortunately, education and experience weren’t required. One young investor mistakenly thought he lost $700,000 in his trading account and, sadly, took his life.

Looking at the other markets, the bond market provided good returns. The Barclay’s Aggregate Index (a composite that tries to capture the treasury, mortgage, and corporate bond markets) had a total return (price and income) of 7.51%.

The yield on the 10-year Treasury bond began the year around 1.9% and ended at 0.91%. This yield traded below 40 basis points (0.40%) during the March turmoil which an all-time low for this security. Of course, global central bank intervention played a huge role in holding interest rates low to help the economy. This could be a place to watch in 2021 as interest rates have been moving higher. The 10-year yield traded around 0.50% in August but has been steadily rising since then.

The U.S. dollar declined from its March peak and lost 7.14% in 2020. As measured by the U.S. Dollar Index (symbol = DXY), it reached 103 as stocks plunged in March. It gradually declined the rest of the year and closed 2020 at 89.68. A falling dollar can coincide with rising inflation as the cost of imports go up. Again, this is a trend that could become a problem in 2021 especially if it signals that the international community is losing trust in the U.S.

Commodities often trade opposite the dollar and it happened in 2020. The Dow Jones Commodity index rose 13.9%. Gold sold off in the 4th quarter but was up almost 25% for the year. Crude oil did not trade with other commodities and declined 20.5%. Oil plunged during the start of the shutdown and traded at a negative price in the futures market in April (Yes – the sellers paid the buyers to take the contract for oil). Since then, prices have been rising and the price approached $50 per barrel at the end of the year.

Bitcoin and crypto currencies returned the spotlight in the second half of the year. Bitcoin fell to $5,000 in March but finished the year over $29,000. The trade, like other currencies, has a weak dollar element so the falling DXY has been a tailwind. However, there is a perception that it could become a stronger store of value against inflation. If that proofs to be true, Bitcoin and the crypto currencies will be a big story in 2021.

2020 will be remembered as a year full of calamities. It will be a defining point in history like the Great Depression or World War II. While many expect a much different and brighter 2021, regrettably, many of the same challenges continue to confront us. There is no guarantee that 2020 was an inflection point and 2021 could turn out to be worse. Nevertheless, our country is resilient and, somehow, we will eventually regain some sort of cultural reconciliation and move forward. That will be good for everyone including Mr. Market.