Copy of the 1st Quarter Review Letter

KERR FINANCIAL GROUP

KILDARE ASSET MANAGEMENT

45 Lewis Street, Lackawanna RR Station

Binghamton, NY 13901

Phone: 607-231-6330 email: [email protected]

The following is a copy of the 2023 1st quarter letter sent to clients. It reviews the markets and the client account’s activity and performance for the 1st quarter of 2023.

May 24, 2023

Economic and monetary conditions have a big influence on the capital markets. It is easier for businesses to grow sales and profits when the economy is expanding together with monetary conditions that are not restrictive. Of course, growing revenues and net income support higher stock prices and a stronger bond market.

2022 was an historic example of a negative backdrop causing market turmoil. It was an unusual time where both stock and bonds declined together. There were many headwinds last year, but the main sources of the chaos were extraordinary inflation and aggressive interest rate increases.

In the middle of 2022, the year-over-year inflation rate exceeded 9% which is the highest rate in over 40 years. Disruptions in the supply chain caused shortages and higher prices across many markets. Inflation spread throughout the economy and it impacted consumers’ spending. The higher cost of necessities meant less was left over for discretionary items.

For corporations, higher costs and less revenue reduced corporate profits. This challenged those companies that were previously profitable and crushed speculative areas that were losing money.

Prior to 2022, interest rates had been declining for a generation. The Federal Reserve’s shift to a tighter monetary policy was implemented to battle the accelerating inflation. As was the case with rising prices, corporate managements had limited or no experience facing higher interest rates. It was a challenging landscape that upset the financial markets.

These market dynamics remained in place to start 2023. In addition to inflation and the Fed continuing to raise interest rates, the markets had to deal with increasing geopolitical tensions, even wider social division, and bank failures. It appeared that the news was getting worse.

Despite a deteriorating landscape, the financial markets stabilized throughout the first quarter. The fixed income market stopped going down and stocks strengthened. Markets often trade illogically, especially in the short term, but with some further investigation, possible explanations can be found.

The narrative associated with the financial markets’ first quarter touched many parts of 2022’s issues. From a broad view, the bulls believed that all the bad news had been priced in. It was assumed that the news flow would not be getting worse, and, if all damage from interest rates and inflation was discounted, the market might be ok.

An extension of this is that, if all the bad news had been discounted, the recession would be shallow, and inflation would be transitory. And once inflation is fixed, the Fed can stop raising interest rates, start cutting rates, and a strong recovery will begin. This is a big part of what drove the markets in the 1st quarter.

In addition to this storyline and as prices started to rally, there was another development that contributed to momentum. Daily expiring options in the SPY (S&P 500 ETF) and QQQ (Nasdaq 100 ETF) became a big part of the trading activity in the first quarter.

These options are referred to as 0DTE which stands for “0 days to expiration”. Traders and institutions are the big players in this strategy, and it developed into an influential part of trading in 2023. While this is an extremely short-term approach, it takes place every day and can have an outsized impact. Through a relatively small amount of capital, the option buyer can potentially manipulate the markets. This was not the only reason that stocks traded better but it played a role.

While the major averages were positive for the 1st quarter, the leadership was very select. Apple and Microsoft accounted for 40% of the S&P 500’s return in the quarter. Further, seven stocks drove the Nasdaq which was the best performer.

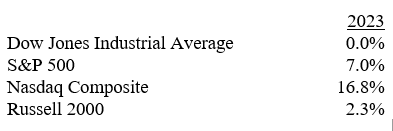

Here are the major indexes’ performance numbers for the 1st quarter.

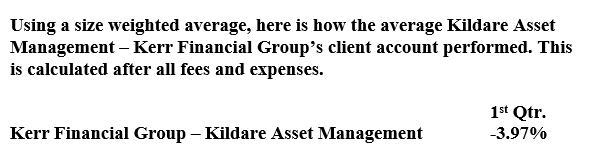

Within your accounts, there are positions that hedge market risk. These performed well in 2022 as they helped manage risk. They were a significant drag in the 1st quarter as stocks rallied. It was compounded as our bullish positions did not move higher with the indexes. The narrowness of the rally meant that it was critical to have exposure to the few stocks that drove the move and that was not the case.

It is noteworthy that the economic problems that disrupted the markets in 2022 continue. The Fed has raised rates further in 2023. Inflation has fallen from last July’s reading but has remained higher than the Fed’s goal. Also, new risks have arisen in 2023. Silicon Valley Bank and two other banks have failed. This brings added stresses on the economy and financial system. There are signs that the troubles in the banking system continue.

The economy and markets are facing historic obstacles which present unique risks. Additionally, there is a lot of uncertainty in how to address these problems which could bring many unintended consequences. The bottom line is that the systemic turmoil of 2022 could return. Accordingly, risk management remains important. At some point opportunities will arise, but the timing is unclear.

Please contact me with questions or comments. I’m happy to explain what I think is going on within these volatile conditions. As always, thank you for your support and confidence in Kerr Financial Group.

Sincerely,

Jeffrey J. Kerr, CFA

President

Kerr Financial Group