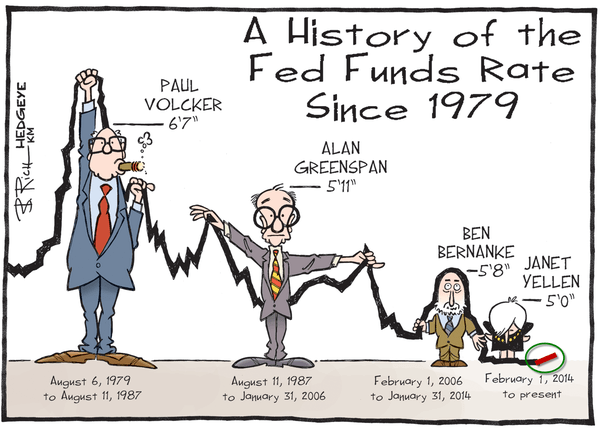

May 30, 2017 – DJIA = 21,080 – S&P 500 = 6,210 – Nasdaq = 5,805

“Too Much of Everything is Just Enough”[i]

From tulips to technology, investors have a long history of becoming fixated on fads. Sometimes these trends become so popular that they develop into bubbles. Of course, Wall Street is happy to feed these infatuations by offering products and strategies to meet their clients’ desires. But don’t misjudge this as enhanced customer service and increased altruism – it generates increased commissions.

Under the heading of there’s nothing new under the sun, in recent years, investors have been flocking to an old approach – indexing or passive investing. We’re not suggesting that this movement ends the same as past overcrowded manias, but it should have investors’ attention.

Passive investing or indexing is a buy and hold approach where investor’s capital is diversified across asset classes. Typically, this involves assets invested in large cap, mid cap and small cap equity sectors. It can be further divided on both value and growth styles. Also, international and emerging markets can be included. And most passive strategies include fixed income, real estate, and precious metals.

Some of the advantages are ease and economics. Instead of conducting the research needed to develop a portfolio, it is much easier to buy the index. Also, buying the index and holding it for the long term reduces trading expenses.

Although many have recently become more aware of indexing, it is not new. The mutual fund industry has been offering the strategy for decades and Vanguard built an industry powerhouse based on the indexing philosophy.

Passive investing’s popularity has grown to incredible heights during the past few years. It is estimated that inflows into U.S. equity ETFs have exceeded $15 billion per month for the past 6 months. For the twelve months ending February, a record $281 billion was invested in ETFs. Since March 2009 (the start of the bull market), ETFs have received net flows of $1.67 trillion. This compares to $179 billion into equity mutual funds during the same time. The chart below illustrates the growth in the investment capital into ETFs.

[ii]

When an index ETF receives inflows, they have to invest these dollars in order to maintain the portfolio’s proportional match to the index. Holding cash is a no-no even if you think the market is risky. This results in some interesting market dynamics.

Let’s look at the most popular index, the S&P 500, and some of the ETFs that index to it. Before getting into the ETFs, it’s important to remember that the S&P 500 is a cap weighted index meaning that the larger the market capitalization, the more influence it has on the index.

iShares and Vanguard are the two ETFs families with the largest year-to-date inflows. The iShares Core S&P 500 ETF (symbol = IVV) has around $9 billion of assets. Their top ten holdings have to match the S&P 500’s 10 largest stocks and they do. They are Apple, Microsoft, Amazon, Facebook, Exxon, Johnson and Johnson, Berkshire Hathaway, JP Morgan, Google, and General Electric.

Sticking within the iShares stable, the iShares Core S&P Total U.S. Stock Market ETF (symbol = ITOT) has $1.653 billion under management. Its top ten holdings are exactly the same as the IVV.

Turning to Vanguard’s S&P 500 ETFs, the Vanguard S&P 500 ETF (symbol = VOO) has $4.475 billion under management including $310 million of recent inflows. Its top ten holdings are exactly the same as the iShares IVV and ITOT. The Vanguard Total Stock Market Index Fund (symbol = VTI) is a $3.148 billion ETF which enjoyed a $550 million addition of investment dollars. It too owns the exact same top ten holdings.

Of course, there are some adventurous mavericks that still participate in the capital markets. These guns slingers might be courageous enough to deviate from the stock indexes if only for a small amount to complement their passive assets. Say our brave investor wished to move part of his or her portfolio into the $25 billion Vanguard High Dividend Yield ETF. Among the top holdings for this independent thinker’s decision are some familiar names – Microsoft, Exxon, Johnson and Johnson, and JP Morgan. So much for diversification!

Or maybe someone wants to speculate further and include the Vanguard Mega Cap Growth ETF in their portfolio. Once again, our decision doesn’t add much to a broadening of the investment reach as this ETF’s top holdings include Apple, Google, Amazon, and Facebook.

Naturally, distortions can happen when there is too much demand for something with a stable supply and the stock market provides another the example. At the end of last week S&P 500 was up 7.89% year-to-date. If we remove Apple, Amazon, Facebook, Google, and Microsoft, the S&P 500 is up 42 percent less or 4.6%. This means that the ‘Fab Five’ in addition to accounting for a little less than half of the year’s gains also represent 14% of the index.

Of course, that these leaders are up so much means that they attract even more interest which bids their prices higher. Where and when this cycle ends is guesswork. This touches upon an important point to passive investing – economic fundamentals and stock valuations do not matter. Index ETFs don’t care about such things as earnings, GDP growth, the Fed’s next meeting, or Brexit. Index ETF’s buy the components of its index, everything else is noise.

Not only has the number of indexes grown, they have gotten creative. HACK is the symbol for Purefunds ISE Cyber Security ETF. The Vaneck Vectors coal ETF’s symbol is KOL while their Agribusiness ETF is MOO. The SPDR Bloomberg Barclays High Yield Bond ETF is appropriately listed as JNK. Oh those crazy Wall Streeters.

Here is a graph from the Bloomberg report of the history of the number of stocks as compared to the number of indexes. The number of publicly traded stocks peaked at 7,487 in 1995. This downward trend seems to have stabilized during the past few years. On the other hand, the indexes’ hockey stick shaped growth is remarkable.

The ETF population remains well below the number of mutual funds which have plateaued since around the turn of the century. Here is a chart which includes the mutual fund industry.

[iv]

While the popularity of indexing is not an evil, it has distorted the markets. The market price-to-earnings ratio is historically high and bond yields are low across all sectors. Both are influenced by capital inflows into passive investing. It might be hard to imagine but someday, away in the future, investors may want to reduce market exposure. Perhaps one day the capital markets negatively react to an interest rate increase or a terror attack or some Washington wackiness. If this happens in a large quantity, ETFs will be selling the same positions at the same time likely causing prices to fall. This could strain liquidity which would cause the retreat to accelerate. The melt up we’ve witnessed but in reverse.

Of course, there is the possibility that stock and bond prices have experienced a permanent landscape shift and that valuations and yield spreads are at new and proper levels. In other words, it is different this time. Investing history tells us that those words can be a dangerous description. But for now, investor worries are few. We just hope that someday we don’t have to sing more lyrics to the song we began this newsletter with – “I Need a Miracle Every Day”.