“You can look around and there’s not a sign of hypocrisy. Nothing but sincerity as far as the eye can see.”

Kerr Financial Group

Kildare Asset Mgt.

Jeffrey J. Kerr, CFA

Newsletter

–

October 26, 2020 – DJIA = 28,335 – S&P 500 = 3,465 – Nasdaq = 11,548

–

“You can look around and there’s not a sign of hypocrisy. Nothing but sincerity as far as the eye can see.”

One of the highlights of October is Halloween. A time of the year when deception and trickery is encouraged. Of course, if you are in politics, trickery is not just limited to the end of the October – it’s an everyday event. And with this being an election year (what else would you expect from 2020!), the shenanigans have increased exponentially.

Naturally, the financial markets also have their level of chicanery. Stock prices are near record highs while Main Street struggles, small businesses try to stay afloat, and the unemployment numbers remain stuck at uncomfortable levels. Many are counting on a “V” shaped economic recovery and anything different could be a material disappointment.

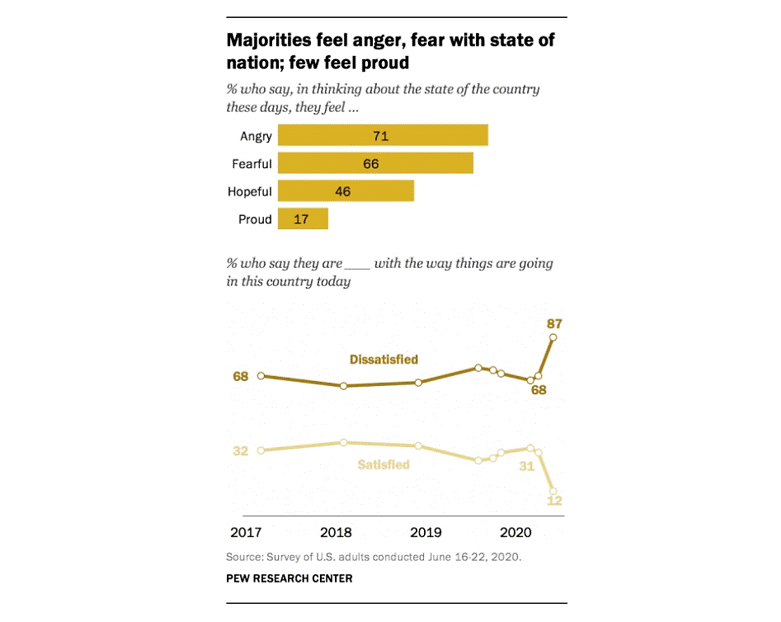

In addition to the economic troubles, another mystery involves the market’s rally given the massive cultural division, civil unrest, and the uncertainty over the election. Turmoil and doubt about the county’s future path would often result in volatile markets and a move to safety. Currently, however, that doesn’t appear to be the case. Rather, the capital markets are driven by optimism that the stimulus packages and economic bailouts will save the day.

Stocks are not the only asset class that is masquerading. There was a time when bonds were considered a boring but safe investment. But thanks to central banks’ intervention, they no longer fit that description. Interest rates across the markets are down to inconceivable levels. The 10-year Treasury note closed last week (October 23rd) with a yield of 0.84% which is up from a recent yield of 0.71%. The 30-year bond closed at 1.64% This means that to receive an interest rate of 3 or 4%, investors must get creative or assume a lot more risk.

Instead of offering investors interest payments, many of today’s fixed income securities exchange hands with negative yields. In other words, the price of the bond (the price that it is traded at after it has been issued) is so high that the interest payments don’t offset the premium paid. The total return is negative.

The European Central Bank, the Bank of Japan, and other central banks buy bonds in the secondary market as a stimulus tool This massive demand forces prices higher and the result is that the higher price outweighs the interest rate received – a negative yield. With central banks cornering the fixed income markets, those who are forced to buy bond (fixed income mutual funds, insurance companies, etc.) must overpay for the securities they need.

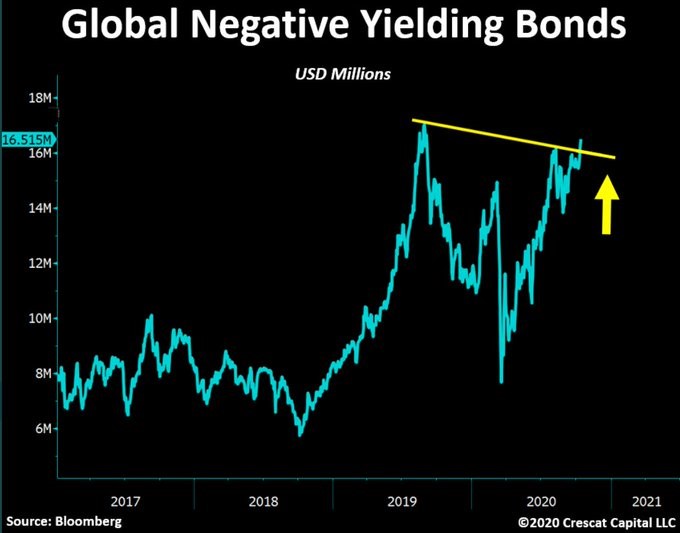

The graph below shows the total amount of bonds (as measured in U.S. dollars) that have negative yields. After a drop in the amount of negative yielding bonds in the spring, we are again approaching record levels. Massive stimulus, which includes central banks (the Federal Reserve) buying bonds to save the economy, is the chief reason behind this.

With so much of the world’s bonds trading at prices that result in negative interest rates, fixed income securities are massively mispriced. This impacts many other sectors of the financial markets as fixed income securities can no longer offer lower risk. This forces conservative capital to move somewhere else. Which then causes imbalances in other markets.

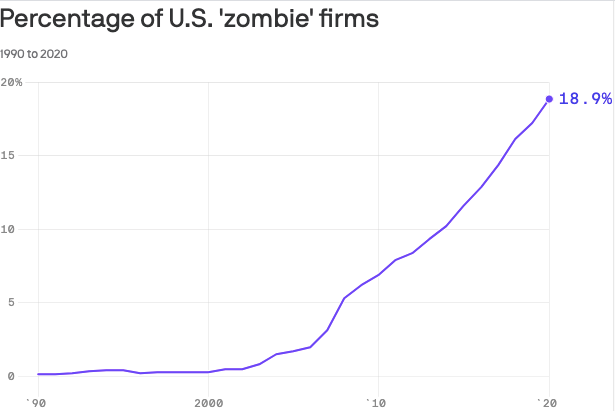

An example of this rippled distortion is the high number of zombie companies. A zombie company is a highly leveraged, unprofitable organization that uses the bond market as a source of cash and capital. Unfortunately, these zombies, if they can get funding, survive past Halloween.

Under normal conditions, these companies would go out of business because a lack of profits and additional funding. Central bank manipulation and bond buying injects money into the markets which eventually reaches the riskiest sectors including the zombies. Without this liquidity, they would fail. That wouldn’t be all bad as their demise would reward the zombies’ profitable competitors which would strengthen the economy with higher growth rates.

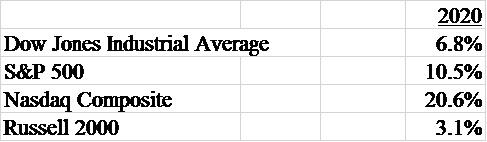

Along with Halloween, it is also earnings season. This raises the question of which one will be scarier. The quarterly results, in general, have been good but the stock market’s reaction has not reflected these earnings reports. The major stock averages declined last week as spooked investors were more concerned the possibility of an increase in Covid-19 and delays in the getting another round of stimulus approved. Given that a lot of the economy remained constricted or shutdown, the better than expected corporate earnings could be an encouraging sign for a continued recovery.

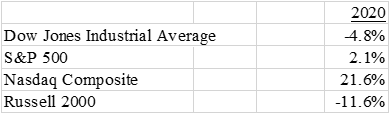

Here is where the major averages closed on October 23rd.

Everyone is aware of the Great Pumpkin’s reputation of only visiting sincere places so clearly, the corner of Wall and Broad Streets and Washington D.C. won’t be on the itinerary. However, like the Great Pumpkin’s mystical power, there might be a larger force behind the stock and bond markets peculiar ability to remain higher as the world is crumbling.

Modern Monetary Theory (MMT) is a controversial approach that might be the driving force behind the capital markets. First, MMT uses fiscal policy to impact the economy. It calls for printing unlimited amounts of money and giving to the federal government to spend. Budget deficits, according to this, are not a concern. The only risk is inflation. But if that happens, taxes are raised, and this is supposed to slow demand and eventually calm inflation.

One of the first to embrace MMT was Bernie Sanders as he included it as his economic policy for his latest presidential campaign. It was the cornerstone as the method of financing the expansive social programs that he was to implement. Outside of Sanders’ supporters, MMT has been widely criticized and disparaged by traditional economists.

Difficult times call for desperate decisions and it sure looks like the Federal Reserve and the Federal Government borrowed Bernie’s playbook in battling the economic shutdown. During 2020 we have printed a lot of money and expanded the Federal Governments deficit to unimaginable levels.

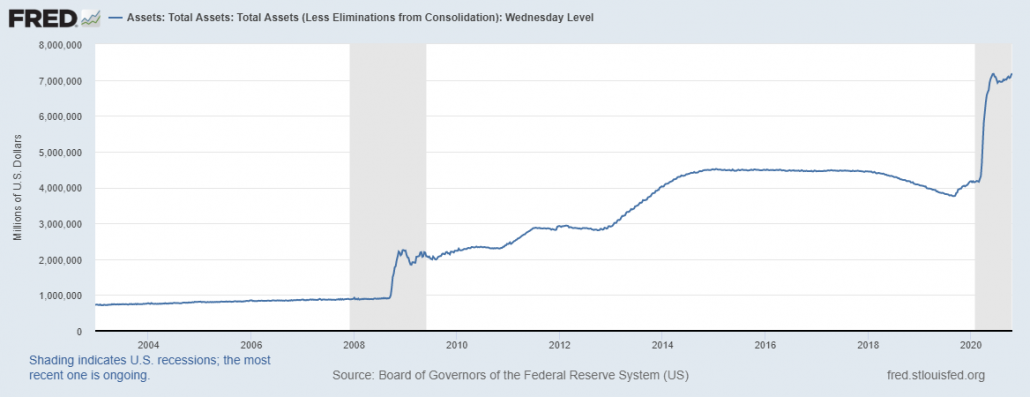

A measurement of the money that is in circulation is the Federal Reserve’s balance sheet. The Treasury Department may print the currency, but the Fed puts the money into the banking system. This distribution process puts the dollar bills on the Fed books.

Below is a graph of assets held by the Fed. To be clear, these ‘assets’ were bought by the dollars the Fed put into the banking system so money supply is the other side of the ledger. Before the financial crisis on 2008-09, these assets totaled less than $1 trillion. This quickly quadrupled to over $4 trillion by 2014 through the countless QE programs.

The Fed attempted to normalize monetary policy and return their balance sheet to more traditional levels in 2018 and 2019. However, the bailouts, PPP, and various stimulus programs have pushed the total of assets held at the Fed to the current heights. Of course, the Federal Government’s budget deficit will be equally astounding which gives the current situation all the markings of Modern Monetary Theory.

As measured solely by the rebound of the financial markets and the economy, so far so good. This incredible amount of liquidity injected into the economy has certainly helped in pushing up the financial markets. And until there some signs of inflation, central bankers have little appetite to turn off the printing presses.

However, there is typically some unintended consequences when untested theories are put into place. It’s not being discussed but there is risk that inflation isn’t brought under control as easily as predicted. Further, history has shown that high growth in the money supply causes bubbles to arise. The downside to MMT aren’t limited to these goblins as there are many other dangers that could develop. We must remember, there’s no free lunch.

In the meantime, whether Bernie Sanders gets credit or not, further increases in stock prices and financial assets could be in the future. This economic trick or treat could keep going until everyone fills their bags with candy. But like believing in the Great Pumpkin, as long as there is confidence in the Fed’s ability to deliver, the system carries on with only Charlie Brown getting the rocks.