“I’d Love to Change the World”

Kerr Financial Group

Kildare Asset Mgt.

Jeffrey J. Kerr, CFA

Newsletter

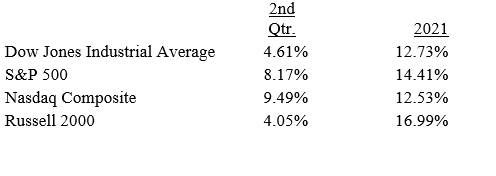

October 25, 2021 – DJIA = 35,677 – S&P 500 = 4,544– Nasdaq = 15,090

“I’d Love to Change the World”[i]

The financial markets are accustomed to dealing with a lot of changes. Change is in every nook and cranny of the markets as our dynamic economy constantly offers new opportunities. In addition to these normal market transformations, there are recent changes that have been different and much more dramatic, and investors need to understand them.

Let’s take a closer look at three critical areas that are undergoing historic upheaval that can have big impacts on the markets. First interest rates are going up. A year ago, the 10-year Treasury bond’s yield was around ½%. This rate is now 1.67% and this is up from 1.25% in September.

The reason that this is important is that interest rates have been going down for 40 years. Obviously, 40 years is a long time. As expected with such a lengthy history, the global economic system has become addicted to low interest rates. Any change, let alone an increase, could be problematic. If interest rates keep moving higher it will be an obstacle that few business executives and investors have faced and are not likely to handle well.

What could be the reasons for the spike in rates? Record government deficits, that look to be growing even larger, will need to be financed in bond market. Investors could easily demand a better return (higher yield) with this large increase in bond issuance. Further, higher inflation (more on that below) will force rates higher. This is an environment that few have experienced so how the financial system reacts is unknown and could cause further problems if bad decisions are made.

Another turbulent development is the shortage of goods. Supply chain complications and labor issues have helped produce widespread delays and scarcity of things like appliances, electronics, cars, as well as commodities like copper, lumber, and iron ore. This is a drastic change in an economy that has excelled at innovation and delivery of goods and services often at lower cost.

Worker shortage is a big part of this issue. A record 4.3 million workers quit their job in August. This represents 2.9% of our workforce. It’s hard to believe that the labor shortage is cured if millions of people are leaving the workforce.

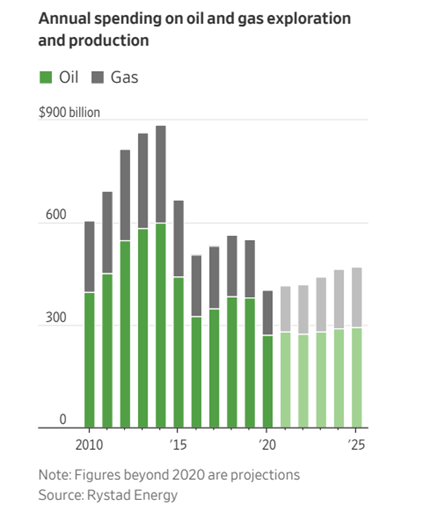

But in addition to the labor problems, the capacity to supply the materials needed for goods and products could be limited. This is a result of lower capital investment for things like energy, commodities, and materials. Annual spending by mining companies (copper, lead, zinc, etc.) is forecast to be 30% or more below the 2012 peak.

Energy exploration is seeing a more dramatic cutback. Analysts expect a small increase in capital investment, but it will likely remain below 2019’s levels and 40% – 50% below 2014’s record amount.

Investors are watching these events as the global economy reopens. The increased demand for commodities and energy is taking place at a time when the supply might be limited. This is impacting the markets through increased demand in alternative things that are available. The price of coal is up over 200% this year as power plants switch from using natural gas to coal to produce electricity. Maybe electric vehicles aren’t as clean as they proclaim.

Here are two graphs that reflect the projected investments for the energy and mining industries as published in The Wall Street Journal (September 24, 2021). Despite higher prices that would encourage increased production, ESG initiatives appear to be influencing this reduction.

Naturally, higher energy and commodity prices are feeding into the inflation measurements. Once again this is something we haven’t seen in decades. Prices are spiking in everything from necessities such as gasoline, food, electricity, heat, and rent. This is also seen in the industrial areas of the economy – higher transportation costs, higher raw materials, and higher labor costs.

The optimistic view is that these issues are temporary. We are told by bureaucrats and politicians that once the economy opens these troubles will be fixed. They tell us that we have to get past the pandemic, and everything will return to normal.

The changes in interest rates, goods and material shortages, and inflation represent a new economic landscape. Furthermore, the forces behind these developments are closely linked. The conventional wisdom is that this is all temporary and will go away. This could turn into a dangerous mindset if the obstacles facing economy are not easily resolved and become long term problems. It would be a new world with a different set of risks as well as opportunities. Feel free to contact us to hear the specifics on how we are handling these changes.