Copy of the 4th Quarter Review Letter

KERR FINANCIAL GROUP

KILDARE ASSET MANAGEMENT

45 Lewis Street, Lackawanna RR Station

Binghamton, NY 13901

Phone: 607-231-6330 email: [email protected]

The following is a copy of the 2020 4th quarter letter sent to clients. It reviews the markets and the client account’s activity and performance for the 4th quarter of 2020.

The volume of books and articles that will be written about 2020 will reach to the boundaries of our universe. Any time span that includes a presidential impeachment, a global pandemic, an economic shutdown, a disputed presidential election, and vast social divide is a good candidate for a defining and historic year.

Of course, given these events, the economy and capital markets also experienced a historic year. We had record high unemployment, a record contraction in economic activity, record low interest rates, and, after a broad painful stock market selloff, a recovery to record levels.

Looking at some of these financial market details, the U.S. unemployment rate reached 14.8% in April and remained above 10% until September. Government bond yields plunged to incomprehensible levels as the 10-year note fell below 40 basis points (0.40%) and the 30-year bond sank to 83 basis points (0.83%).

Think about that – bond buyers were lending money to the U.S. government at less than 1/2% for 10 years and less than 1% for 30 years! For those who have bond mutual funds in a retirement account or a target date mutual fund, you were part of the lending posse lining up to buy these bonds at ridiculous prices.

The major stock market indexes fell over 30% from February’s peak to March’s trough. The Russell 2000 was down over 40% in the same period. The Russell is a broader reaching benchmark that is made up of small cap stocks and, in many cases, is more representative of the average stock.

It was unclear, at the time, what was going to happen. The economy was being closed and no one knew for how long and to what extent. Further, there were estimates that the virus would claim millions of lives. Uncertainty ruled the day.

The equity market’s rebound began as a function of government programs to stabilize the economy. The Federal Reserve announced astounding sized bond buying programs to inject liquidity into the financial system. Our central bank’s balance sheet spiked from $4.1 trillion to $7.4 trillion or an 80% increase during the year. This means that within a few months our Treasury Department printed a mindboggling $3 trillion and then turned it over to the Fed. The Fed went into the markets and bought all kinds of bonds.

The financial markets quickly regained confidence as they understood that the government was going to use all possible options and use them in an enormous scale. The result was that the Nasdaq Composite recaptured its losses by June. It took until August for the S&P 500 to recover and November for the Dow Jones Industrial Average and the Russell 2000.

From the view point that Washington was back stopping everything, the stock market’s steady climb made sense. However, looking through the lens that showed burning cities, an economy that was shut down, and an upcoming election, it was inexplicable. Viewing this conundrum without seeking a logical narrative provides a possible answer.

Quantitative analysis and trading are playing a big role across the financial markets. This approach is driven by hundreds of computer algorithms and programs. The software scans the markets looking to capitalize on patterns or outlier events. Although some do include headline keywords and other news influences, the variables usually look at things such price action, volume, volatility, and standard deviations. They watch how differing asset classes trade relative to each other. For example, the U.S dollar in the foreign exchange market vs. the S&P 500 or the 10-year Treasury note vs the price of crude oil. These seemingly unrelated markets can influence each other, and the quantitative models attempt to discover trends.

Importantly, these relationships and their derivatives normally have nothing to do with fundamental and real-world developments. Computer algorithms typically don’t care who won an election or about a switch in monetary policy. These types of events will likely work their way into factors of price or the standard deviation of a security, but it may take some time. In the meantime, the trend that the quants are following remains intact and that is what determines the trading.

The use of quantitative trading has grown, and I think it is a big reason that the Dow can trade above 30,000 while the economy and small businesses are being crushed. Of course, the reverse can be true as markets can be tumultuous despite rosy headlines.

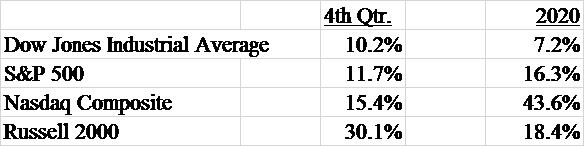

The stock market closed 2020 at record levels which contrasted with the year’s challenges. The Nasdaq lead the way and the indexes had very good years. Here are the 4th quarter and full year performance numbers.

In addition to stocks, bonds performed well as the Barclay’s Aggregate Index (a composite of many sectors of the fixed income market) had a 7.5% total return. Gold climbed 24.6% in 2020. In general, commodities were higher during the year except for oil. Crude oil fell to the single digits during the initial shutdown and recovered later in 2020 but was down around 20% for the twelve months. The U.S. dollar fell against the other major currencies and the dollar index declined 6.7% in 2020.

I spent time throughout 2020 learning and trying to better understand the quantitative approach. This included reading several books on the topic as well as adding a subscription to a math-based investment approach. The combined influences helped your performance.

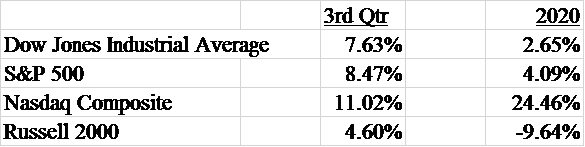

One example of a quantitative assisted decision relates to Cerence, Inc. (symbol = CRNC). The company develops voice recognition software for the automobile industry. The 3rd quarter review letter contains more details on the company. CRNC was a strong performer in 2020 and it doubled in the 4th quarter jumping from $50 to $100 per share.

On a purely fundamental basis the stock was overpriced in the $50’s but from a quantitative view, the trend was up, and the company is growing quickly. In many cases, algorithms focus on relative performance (are things improving or deteriorating) more than absolute performance (traditional fundamental valuation). From this perspective, we held the stock and were rewarded.

Another holding that was included from a computer algorithmic basis was MP Materials (MP). This was purchased in November in the low teens and it closed the year in the $30’s. MP is a rare earth mining company that came public via a SPAC (special purpose acquisition company). SPAC’s are organizations that raise money with the goal of buying an operating business. They are a growing part of the stock market and MP is one example.

Returning to the old fashion fundamental research approach, Popular, Inc. (BPOP) also drove 4th quarter performance. Popular is the largest bank in Puerto Rico. There is limited competition as many of the U.S. banks have left the island. This is understandable given the challenges to the Puerto Rican economy. Natural disasters, a population exodus, and slowing business activity have hurt.

As mentioned, Popular has a dominate position on the island. When it was purchased for your account, the company was solidly profitable, and the stock was trading at half of its book value. Our entry price offered a 4% dividend yield. BPOP’s stock price moved from the mid-$30’s to the mid $50’s during the 4th quarter. Despite this move, the stock remains cheaply valued.

The capital markets overcame the country’s and the world’s struggles. While they recovered and performed well, many of the issues are unresolved. The events from last year will impact our world for many years and they will produce opportunities as well as new risks. I will look to balance these conflicting forces to help you grow your assets.

Sincerely,

Jeffrey J. Kerr, CFA