“An investment in knowledge pays the best interest.” — Benjamin Franklin

Kerr Financial Group

Kildare Asset Mgt.

Jeffrey J. Kerr, CFA

Newsletter

March 8, 2024 – DJIA = 38,791 – S&P 500 = 5,157 – Nasdaq = 16,273

“An investment in knowledge pays the best interest.” — Benjamin Franklin

The financial markets have greatly changed. The days of reading through financial statements and economic reports as a part of investing might be going the way of pay phones and fax machines. In a world of video clips and tweets, investors have decided that reading a 10-page earnings report is unnecessary.

Of course, Wall Street, who is always trying to sell stuff, is happy to offer quick and easy solutions that fit our shortened attention spans. Over time, Wall Street accommodates investors’ demands with new strategies and products. This has led to the development and popularity of passive investing.

Passive investing is the approach where inflows into a security have a predetermined strategy. For example, one of the most popular passive investments is buying funds and ETFs that mirror the S&P 500. These vehicles deploy their assets across the components of the index according to the proper weighting.

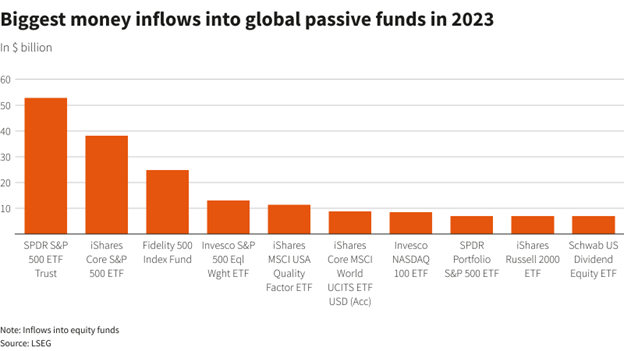

Passive investing can be implemented across many asset classes. Within the stock and fixed income markets, there are multiple indexes many of which have passive vehicles. Also, indexing can be done for international markets. Here is a chart which shows the largest inflows to the various passive funds in 2023. As you can see, the S&P 500 funds took in well over $100 billion in the top three funds.

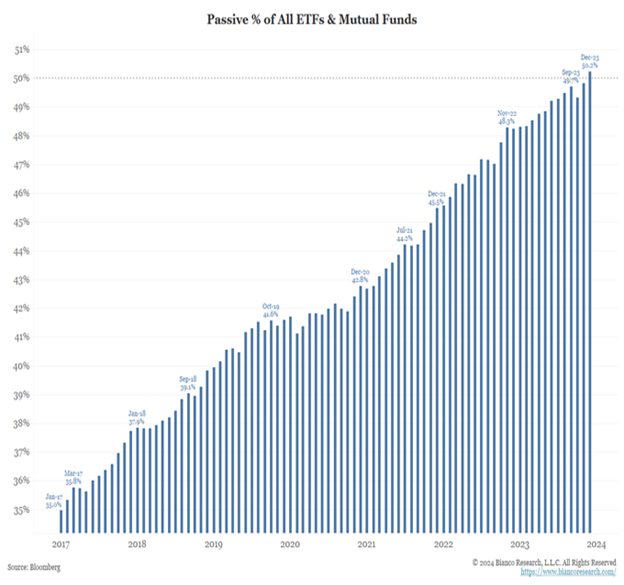

These investing options have gained enormous popularity and these securities have seen the assets invested in them skyrocket. Bloomberg recently reported that passive investing mutual funds and ETF has exceeded over 50% of all mutual fund and ETF assets. This chart shows how the passive ETFs and mutual funds have grown vs. all investment assets in ETFs and mutual funds.

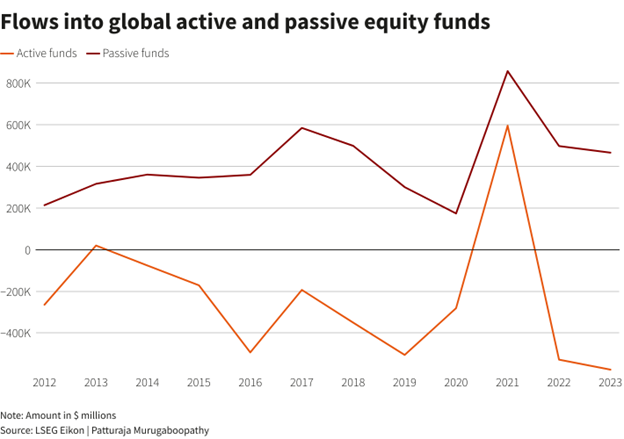

Not only have passive and indexing approaches increased, but it is not just from new investment dollars. This graph shows the shift of assets from global active funds to passive and indexing products during the past decade.

Despite the many offerings that the industry has created, passive investing is heresy to traditional Wall Streeters. Brokerage houses spend a lot of time and resources on research. Indexing and passive strategies don’t consider these efforts as constructive. Things such as the economy, interest rates, inflation and corporate earnings are irrelevant.

When a passive security receives new investment dollars, they are put to work immediately. There is no analysis on whether it’s a good or bad time to buy. There is no thought process on upcoming events (inflation report, earnings announcement, etc.) which could provide a better entry point for this fund’s inflow. The money is invested on the day of receipt, and it goes into the components of the index in the same amount as the weighting of the index.

This leads to another passive investing characteristic. The S&P 500 is weighted upon the stock’s market capitalization (the total value of a publicly traded company’s outstanding common shares). Microsoft and Apple are the two largest stocks in the index and account for 14% of the index. The top 10 stocks make up over 30% of the index while the bottom 250 only make up around 15%.

This is hardly the diversification that most people sign up for when they invest in an index. Further this concentration is self-fulfilling. The top companies get more of the incoming money which makes their stock value rise further which means that these stocks will get more of next week’s flows, and so on and so on. It becomes a cyclical process where the big get bigger which could lead to an extremely concentrated and overvalued market.

The growth of indexing and passive investing has its critics. David Einhorn founded and president of Greenlight Capital, a leading hedge fund, recently referred to the markets as “fundamentally broken” by passive and quantitative investing (Bloomberg, February 8, 2024). Einhorn and Greenlight were noted for their value and deep analytical investing approach. Einhorn has adapted his approach because of the growth in passive and algorithmic trading. He is partially implementing indexing and similar strategies.

While things like dial up internet go out of style, passive investing and computerized trading are likely here to stay. They may even continue to become a bigger part of the capital markets. As they do, it’s important that investors better understand these strategies, their widespread influence, and the risks that they contain.

Leave a Reply

Want to join the discussion?Feel free to contribute!