3rd Quarter Review Letter

KERR FINANCIAL GROUP

KILDARE ASSET MANAGEMENT

45 Lewis Street, Lackawanna RR Station

Binghamton, NY 13901

The following is a copy of the 2019 3rd quarter letter sent to clients. It reviews the markets and the client account’s activity and performance for the 3rd quarter of 2019.

On July 31, 2019, the Federal Reserve cut the key short-term interest rate (federal funds rate) by one-quarter of one percent (0.25%). This was the first cut in over 10 years. The last cut was on December 16, 2008 as the Fed was responding to the global financial crisis. That cut reduced the fed funds rate to 0%.

Interest rates are one of the common tools used by those in charge of monetary policy. When the economy is slowing or contracting, interest rates are reduced in order to stimulate conditions. A central bank (the Federal Reserve in the U.S.) usually has a direct control on the short-term rates only. Reducing this rate normally results in more liquidity in the banking system which is expected to make its way into the financial system and encourage businesses to expand and hire more workers.

Central banks also use interest rates to slow down an economy that is expanding too rapidly. There is constant fear that strong growth might cause inflation. Higher interest rates increase the cost of capital and, generally, dampen business activity.

When the fed cut the fed funds rate to 0% in December 2008, the rate stayed there until December 2015, when it was raised one-quarter of one percent (0.25%). Since the first-rate hike, it has made its way back to 2.5% over a series of 9 raises with the taking place last December.

This latest interest rate cut was not your run of the mill type fed decision. Like a detective mystery, controversy and intrigue surrounded the announcement. First, many wondered why a cut was necessary when the unemployment rate is at record low levels and the economy is expanding. This led others to questioned if the Fed knew of a situation like an impaired financial institution or government that would increase stress on the global system.

Some wondered if Fed Chairman Jerome Powell was caving to pressure from the White House. The central bank claims independence from political influence (although there have been previous times that call this into question). Nevertheless, throughout the spring, President Trump posted a series of tweets calling for the Fed to lower interest rates. The president pointed out that the U.S. had the highest interest rates in the world and projected that the economy would be doing even better if the Fed lowered interest rates close to our international competitors.

The inverted yield curve within the U.S. treasury market could be another reason behind the July rate cut. Inversion means that bonds with short maturities have higher yields than longer maturities. Within normal fixed income markets, bonds that mature further in the future have higher yields than shorter maturing securities. This is to compensate for the increased uncertainty that comes with longer time frames.

Inverted yield curves, especially as measured by the difference between the 10- year Treasury note to the 2-year Treasury bill, are important. Historically, when inversion occurs between these two bonds, a recession follows. The Treasury yield curve was inverted in the spring and this could be another reason behind the July cut.

The Federal Reserve is the most powerful among the global central banks. And while central banks are traditionally focused solely on their economy, the U.S. central bank has an undefined role as the world’s central bank. This is supported by the fact that the U.S. dollar is the world’s reserve currency. With our interest rates being the highest in the world, the cost of acquiring needed greenbacks has becoming painful. This may have played a big part in the reducing interest rates in the U.S.

As significant as the July rate cut was, two more cuts have followed (one in September and one in October). Furthermore, the markets are expecting another cut in 2020. Meanwhile, the economy has not stumbled and continues to expand. Clearly these three cuts have lowered the amount of ammunition available. If interest rates are the chief mechanism in monetary policy, the Fed has 150 percentage points less to work with when the real problems arrive.

Of course, this assumes that the Fed is bound by 0% as the lowest level for interest rates. A large amount of the world’s debt currently carries a negative interest rates which leads to the question will the U.S. adopt negative interest rates. At a recent press conference, Jerome Powell declared that we won’t be needing negative interest rates and that there are other tools to use.

Still it is a situation to consider. Europe and Japan have had negative interest rates for several years and their economies have not imploded. On the other hand, they haven’t done exceptionally well. Negative interest rates in the U.S. could be a much different condition in the global financial system given our stature and critical role. If this were to occur, it could result in a loss of confidence. This would likely lead to large economic disruptions and financial system turmoil U.S. bond yields moved lower during the 3 rd quarter. The 10-year Treasury note began July at 2% and ended September at 1.67%. Likewise, the 30-year Treasury bond moved from 2.53% to 2.12% during the three months.

These may not seem significant but, for the bond market with its reputation as a lower risk asset class, these are big moves. This would be considered high volatility during any year for fixed income but, remember, this happened in three months.

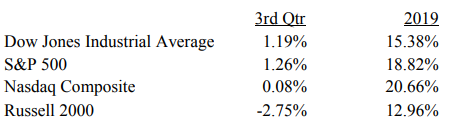

While the bond market rallied (lower yields mean higher bond prices), the stock market zig zagged during the quarter. The major averages rose to all-time high levels in July but declined in August. This was followed by another move higher in September, but this reversed in the middle of the month and prices retreated. By the end of the quarter, stocks closed marginally higher from where they began July. Here are the numbers for the quarter and year to date.

Using a size weighted average, here is how the average Kildare Asset Management-Kerr Financial Group client’s account performed. This is calculated after all fees and expenses.

3rd Quarter YTD

Kerr Financial Group- Kildare Asset Management- -4.37% 6.31%

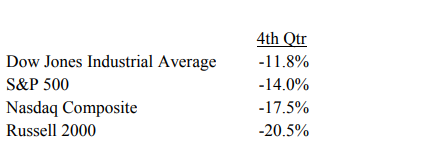

Stocks have enjoyed a very good year. In fact, for the first 9 months, the S&P 500 is having its best year in two decades. However, 2019’s gains are basically recapturing the losses for the 4th quarter 2018. The markets suffered wide significant losses at the end of last year. Here are the numbers for the major averages during the last three months of 2018.

Looking at a 52-week measurement gives a more subdued picture as compared to the 2019 year-to-date. Over the past 52-weeks (the end of September 2018 vs end of September 2019), the Dow and S&P are up only 1%, the Nasdaq is flat, and the Russell 2000 is down almost 9%.

During these time frames the indexes with the large companies have outperformed broader indexes. For both the 2019 year-to-date and the 2018 4th quarter data shown above, the large cap indexes did better than the Russell 2000 (the index with the most number of stocks of the 4 listed).

The S&P 1500 is an index that is comprised of the S&P 500 (large cap) the S&P Midcap 400, and the S&P 600 Smallcap 600. It offers a farther-reaching view of the U.S. stock market. This index provides a less exciting situation. The S&P 1500 is up 1.3% during the past 52 weeks. Going back to the end of 2017 (1¾ years) this average is up 10.4% or a little more 5% per year. If we measure from Lee’s IRA -6.34% 9.44% the highs in January 2018 (again almost 2 years), this index is up less than 3% or less than 1.5% annually if we count it as a 2-year stretch. This is a much different market than looking at 2019’s first 9 months.

Turning our view forward, there are many cross currents within the capital markets. Perhaps the largest is the social and political divide which has resulted in an impeachment inquiry of President Trump. Also, there is ongoing protests sitting governments in Hong Kong, Paris, Spain, and Chile. Brexit drags on with no resolution in sight. Tariffs and trade disagreements are extending longer than many had forecast.

Despite this list of bad headlines, the markets hold near record levels. Within the 3 rd quarter, there were plenty of opportunities for the pessimists to gain control and push stock prices lower. The bears weren’t able to succeed. That is not a claim that the sellers can’t return, but they may have missed their chance.

As mentioned, the economy continues to expand and, with lower interest rates, could accelerate that rate of growth. Although these are not normal times, markets usually don’t encounter material declines in election years. Further, the excitement and interesting news flow will carry on. It promises to be a fascinating end to this year and 2020. There will be opportunities and we will continue to work hard to find them.

Please feel free to call with any questions. Thank you for your business and continued confidence placed in me.

Sincerely,

Jeffrey J. Kerr, CFA