Copy of the 1st Quarter Review Letter

KERR FINANCIAL GROUP

KILDARE ASSET MANAGEMENT

45 Lewis Street, Lackawanna RR Station

Binghamton, NY 13901

Phone: 607-231-6330 email: [email protected]

The following is a copy of the 2021 1st quarter letter sent to clients. It reviews the markets and the client account’s activity and performance for the 1st quarter of 2021.

April 30, 2021

When investors consider the bond market, it is often within a strategy of safety. This is because fixed income securities historically have had less volatility and come with periodic interest payments. These qualities typically attract conservative, income seeking investors which has contributed to a view that bonds are safe and rarely lose money. As 2021’s 1st quarter has shown, this is not the case.

On the surface, fixed income securities are pretty simple. They are a loan that the bond buyer gives to the issuing company, organization, municipality, or government in exchange for interest payments and, hopefully, a return of the money at the bond’s maturity. Like many things, there are numerous variables below the surface.

Bonds have two main risks – credit and interest rate. Credit risks are centered on the financial strength of the issuing entity. In other words, it is the risk that bond holders get their capital back at maturity. This risk is minimal on U.S. Treasury notes and bonds as the belief is that the Federal government can raise taxes or print the money to repay the bonds. Logically, credit risk is much higher for a small speculative company in a competitive industry.

Interest rate risk applies to all fixed income instruments and it is the risk that interest rates move higher while holding the bond. An explanation of a bond would be helpful. Bonds usually are issued in $1,000 increments and have a fixed interest rate. For example, ABC Company, who is a stable industry leader, sells bonds with a 20-year maturity and a 4% interest rate. This means that the buyer receives $40 per year per bond (4% X $1,000). Most U.S. bonds make their interest payments every 6months. For the ABC example, this would be $20 payments twice a year.

Trouble arises if interest rates increase because it makes existing bonds less attractive. Our ABC bond’s interest rate is fixed at 4%. If interest rates rise (for whatever reason), investors would prefer the newer and higher yield vs. our 4% rate. Within this environment, let’s assume the new market level for an issuer such as ABC might move to 4.5%. Who wants 4% when they can get 4.5%? The bond market makes the adjustment by reducing the price of the 4% debt to a point where the $40 dollars of interest equals 4.5%.

The market adjusts the ABC bond’s price to account for this shortfall. Here is the math; $40/X = $45/$1,000. “X” equals $888.88 and this becomes the new, reduced price of the ABC bond which was originally priced at $1,000. The $40 in annual interest payments divided by new price of $888.88 equals 4.5%. The holders of the ABC bond have experienced a drop in the price of their bond.

Holders of the ABC 20-year 4% issue have a couple of decisions. They can sell it and incur a loss. The investor can hold it and hope interest rates fall (the bond price would move back toward $1,000). They can even hold the bond to maturity at which time the investor will receive the $1,000 of principle.

Of course, the result would be different if interest rates declined. In this case, the price of our pretend ABC bond would increase, and the position would be positive. If the market interest rate for this type of bond fell to 3.5%, the price of the bond would increase to $1,142.85 ($40/$1,143.85 = 3.5%). Obviously, the direction of interest rates has a big influence on the price and performance of fixed income investments.

Rising interest rates were a big part of the financial market landscape in the 1st quarter. The 10-year U.S. Treasury note began the year with a yield of 0.9% and ended the quarter at 1.7%. Consequently, a lot of fixed income securities took haircuts with the longer maturities getting hit the hardest.

One of the most widely held ETFs is the iShares Treasury Bond Fund (symbol =TLT). The TLT tries to track an index of U.S. Treasury bonds with maturities 20 years and more so it is a good barometer for the long maturing bonds. Many consider this a good conservative holding that pays an interest rate. Because interest rates rose, TLT lost 14.1% in the first quarter which was one of the worst starts to a year ever. The ETF’s dividend return is around 1.6% which means that it lost 8 ¾ years of annual interest payments in 3 months. This is a huge loss for something that is expected to provide stability.

The carnage was across the fixed income market. Looking at some other sectors, the iShares Investment Grade Bond ETF (symbol = LQD) is made up of high-quality corporate bonds. It fell 5.8% in the first quarter. Finally, the Barclay’s U.S Aggregate Index (a wide-reaching index that includes treasuries, municipals, corporate, and government agency bonds. It is like the Dow Jones Industrial Average for the bond market) was down 3.4%.

The bond market’s carnage is one of the best kept secrets of 2021’s 1st quarter. Of course, the first three months of the year provided much headline competition. We had the GameStop/Reddit/Robinhood theater, the invasion of the SPACs, a hedge fund failure (Archegos), a surge in crypto currencies, and record levels in the stock market.

It’s little wonder that the bond market’s bloodbath got pushed to the back pages. However, this pain might get more attention as investors are disappointed by quarterly mutual fund statements. Mutual funds that have fixed income exposure, as well as “blended”, “balanced” and “target date” funds were challenged by interest rates and underperformed.

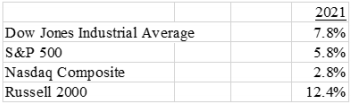

In contrast, the stock market had a good 1st quarter. The major indexes steadily moved from lower left to upper right logging a series of record highs. A curious development was that technology and growth sectors underperformed. Financials(higher interest rates help), energy, industrials, and areas that will benefit from an economic reopening led equities. Small caps were stronger than the large caps.

Here are the performance numbers for the major averages.

Here’s the performance for the 1st quarter 2021 for our clients averaged and weighted against the total:

Within the portfolio holdings, American Outdoor Brands (symbol = AOUT) reported strong numbers and the stock moved higher. AOUT makes products and accessories for hunting, fishing, camping, and other outdoor activities. The company was spun out of Smith & Wesson in 2020.

AOUT navigated 2020’s economic problems well and took advantage of growing interest in outdoor recreation. The company is projected to generate around $270 million of sales in their first fiscal year as a stand-alone company. This will be an increase of over 50% from the prior year. Their net income for the 9 months ending January 31, 2021 was $1.20 per share which was an improvement from a loss in the prior year.

The American Outdoor Brands’ stock price moved from $17 per share at the beginning of the year to over $25 at the end of March. Importantly, the company has successfully brought new products to the market. Management believes they can continue to drive growth through expanding their market share as well as exciting new products.

Looking forward at the financial markets, they will wrestle with many crosscurrents in the remaining part of 2021. The economy will re-open but it could be an uneven process. Inflation has returned and this has potential to be a big problem. Interest rates will likely continue to climb which is something that has not happened in almost40 years. Recent government proposals are historic in size and reach. If enacted, it will dramatically change the U.S. economic system.

As always, these situations present both risks and opportunities. It could easily result in new and different economic leaders as initiatives change the way industries and businesses operate. I will work hard to keep up with these developments and identify the prospects that will lead to continued success.

Please feel free to call with any questions. Thank you for your business and continued confidence placed in me.

Sincerely,

Jeffrey J. Kerr, CFA