Copy of the 3rd Quarter Review Letter

KERR FINANCIAL GROUP

KILDARE ASSET MANAGEMENT

45 Lewis Street, Lackawanna RR Station

Binghamton, NY 13901

Phone: 607-231-6330 email: [email protected]

The following is a copy of the 2020 3rd quarter letter sent to clients. It reviews the markets and the client account’s activity and performance for the 3rd quarter of 2020.

There was a time when all stock trades were done on a floor of an exchange that had a physical location. The New York Stock Exchange was the most famous but there were additional regional exchanges that included the American Exchange (also in New York), the Boston Exchange, and the Philadelphia Exchange. Specialists and floor brokers were the men and women at these locations who handled the trades.

The world has changed so naturally the mechanics of trading stocks have also changed. Computers handle most of the today’s transactions as floor brokers are as relevant as a phone book. As progress has accelerated, computers have taken a larger role in finance. Now, in addition to handling transactions, computers are widely used in research and investment decisions.

Financial markets used to seek out and reward successful companies that had growing sales and profits. Things have changed and the correlation between strong financials and a rising stock price has decreased. Math based algorithms look at a much different set of factors to make decisions which reward not so successful companies (as measured by traditional methods).

Computer programs and algorithms scan oceans of data within seconds looking for price patterns or anomalies that offer trade setups. These algos are driven by sophisticated mathematical formulas. Unlike traditional investment research which focuses on financial statements and economic conditions, computers utilize calculus and statistics as they concentrate on such things as price action, volatility, and correlations between asset classes.

This high-tech approach has changed the investment decision making process. Algorithmic trading tends to be more frequent and have short holding periods. It doesn’t rely on price-earning (P/E) ratios, book values, or dividend yields. Instead, sales growth rates and relative movements (are things getting better or worse) are the focus. Further, the rates of change of the indicators such as revenues and EBITDA is an important driver of the computer programs. This can lead to stocks with upward price momentum becoming be a market leader even if its financial condition is weak.

This new landscape can be maddening as stocks that appear to have challenges and outsized risks surprisingly become market leaders. As an example of this new landscape, “If you bought every company that lost money in 2019 that had a market cap of over $1 billion (of which there were about 261)…you’d be up 65% for far this year”. (This quote is from Grant’s Interest Rate Observer, October 30, 2020.)

Institutions, trading firms, and hedge funds devote big resources to algorithmic trading and it is responsible for a significant amount of daily trading activity. There is fierce competition to find the newest and most accurate program that provides an edge over others. Algorithms are important part of the capital market environment and will continue to play an important role.

Given the importance of computer programs, I have tried to implement some of these approaches into my decision making process. Many data providers now include a computerized ranking systems or similar type service offering recommendations. On their own, none of these are the Holy Grail. But, they become part of the equation and are helpful in determining such things as entry points and slowing price momentum.

As reported by The Wall Street Journal, more stocks have risen 400% or greater than any year since 2000. Given that stocks plunged at the end of the 1st quarter, these moves largely took place in the 2nd and 3rd quarters. The list of this year’s highfliers has many technology and biotech stocks. Many of these names are losing money or are marginally profitable but the rates of change for their sales and EBITDA are improving.

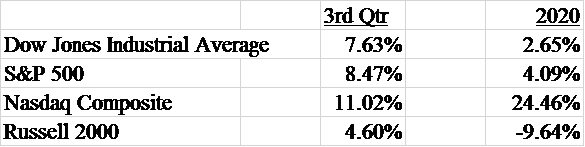

Beyond these shooting stars, the broader stock market had a good quarter. The indexes steadily rose during July and August but was down in September. Despite the upcoming election, the capital markets’ chief focus was on stimulus programs and the possibility of another economic shutdown. Here are the major averages’ performances for the 3rd quarter and year-to-date.

We had some positions that were helped by the algorithmic trading. Cerence Inc. (symbol – CRNC) is a developer of software and artificial intelligence products that does voice recognition for automobiles. They have relationships with every car maker throughout the world. Until 2019, they were a division of another voice recognition software developer (Nuance) but were spun out in the 3rd quarter of 2019.

Cerence generates over $300 million of annual revenues and is forecasting growth. The company has a history of working with auto manufacturers and is continuing to add features for new voice commands for the next generation of cars. Importantly, they are involved in the autonomous navigation developments.

CRNC’s stock began the year in the mid-teen’s. Since the markets’ lows in March, the stock has dramatically climbed. It recently has traded in the mid $60’s. At current levels, the stock is overvalued and could see a pullback if the market suffers a correction. However, Cerence is experiencing positive rates of change across many indicators and that might be enough to keep the algorithms happy.

New Fortress Energy is another example of a fast growing company with a surging stock price. NFE builds and operates LNG (liquefied natural gas) import terminals and facilities in smaller markets who need cheaper energy. Current operations are in Jamaica, Puerto Rico, Mexico, Nicaragua, Pennsylvania, and South Florida. New Fortress delivers LNG to these areas and converts it back to natural gas which is a lower cost energy source for the local economy.

NFE’s stock was in the low and mid teen’s as recently as June. It recently reached $52. While the company is young, New Fortress has been adding new operations and signing agreements for future projects. The current growth rate is high and the potential for further expansion looks bright.

Once again, NFE is an overpriced stock and it took a large dip at the end of October on their quarterly report. However, if business conditions are favorable and the company can execute on its growth plans, the stock price will recover and move to new highs.

There are many approaches to investing. Computerized trading and algorithms have become a large part of the landscape. This is a much different approach from the traditional research and portfolio construction methods. While there have been much development and success using these new techniques, they have not eliminated risks. Nevertheless, they offer additional pieces into the decision making process which will help spot future opportunities.

Leave a Reply

Want to join the discussion?Feel free to contribute!