Copy of the 2nd Quarter Review Letter

KERR FINANCIAL GROUP

KILDARE ASSET MANAGEMENT

45 Lewis Street, Lackawanna RR Station

Binghamton, NY 13901

Phone: 607-231-6330 email: [email protected]

The following is a copy of the 2023 2nd quarter letter sent to clients. It reviews the markets and the client account’s activity and performance for the 2nd quarter of 2023.

August 16, 2023

The financial markets are constantly changing. This happens through adopting innovative technologies as well as offering new and different securities to trade. For example, the New York Stock Exchange had thousands of floor traders at the Big Board in the 1990’s. They conducted trades, provided liquidity, and managed bid-offer spreads. Today, there are a couple hundred traders on the floor as most trading is done electronically.

Once upon a time, mutual funds were groundbreaking and, as the industry grew, it became a big part of the Wall Street landscape. As the public learned about them, the money flowed in and everyone rushed to open a mutual fund. Then mutual funds morphed into other products such as exchange traded funds. ETF’s have exploded in popularity with offerings that match sectors, industries, counties, and strategies.

This evolution is continuing, and the latest version is stock “baskets” that Goldman Sachs is allowing institutions to trade. These are “unique vehicles to track and trade thematic baskets” (Goldman Sachs website). They have 38 thematic baskets and 10 sector baskets. Here are some of the offerings –

· “Interest Rate Sensitive”

· “High Hedge Fund Concentration”

· “Low Hedge Fund Concentration”

· “Mutual Fund Overweight Positions

· “Mutual Fund Underweight Positions”.

Besides the Goldman Sachs baskets, Wall Street has another creative security that is related to another widely traded one. In 2022, the markets began trading stock index options on the S&P 500 and Nasdaq 100 that expire every day. These became known as “0 DTE” or 0 days to expiration options. Regardless of the lack of history, 0 DTE’s are playing a very big role in daily and short-term trading.

Institutional investors have dominated the 0 DTE market. They discovered that they could gain market exposure (long call options) or hedge risk (long put options) quickly and at a much cheaper cost as compared to buying futures or individual stocks. And as they got experienced with this market, traders increased their sizing of 0 DTE positions.

Another key part of this strategy is the option dealer’s role. When the dealer sells the institution a call options on the S&P 500, they have risk to a rising market. They hedge this risk through buying the S&P 500 futures or the stocks that make up the index. Naturally, these dealer purchases give the stock market a tailwind and prices can climb.

Due to the short timeline of the 0 DTE strategy, the motivation behind the trades may have little to do with the economic and fundamental backdrop. Dealer positioning appears to have a role in these trades which then influences the overall market direction. As the market rises, dealers need to hedge further which drives prices higher. This potentially becomes circular as higher prices force dealers into more buying.

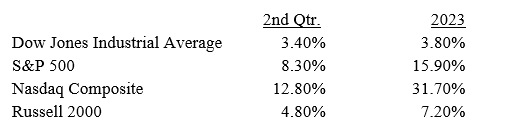

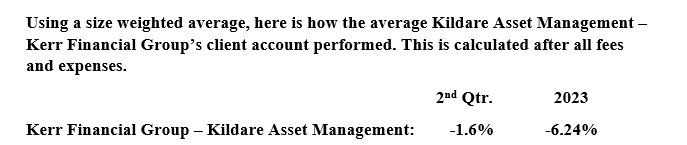

This appears to be happening in 2023. The stock markets have been resilient despite many economic difficulties. Inflation, although lower than 2022, remains a problem. The Federal Reserve is still raising interest rates. Corporate earnings are declining. Banks have failed and the system is stressed. Despite this, the U.S. stock market has had a good year. Here are the major averages performance in the 2nd quarter and year-to-date.

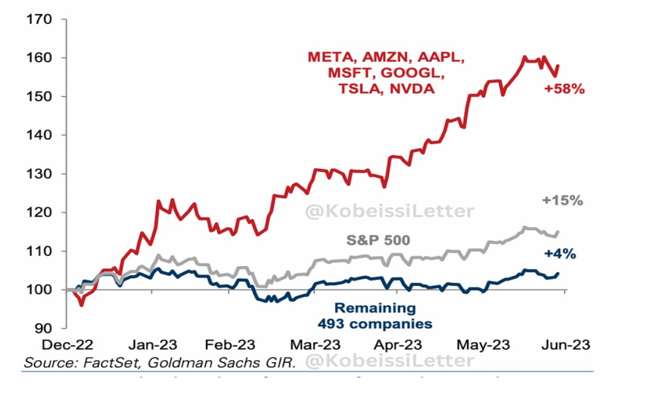

In addition to the growth of 0 DTE trading, 2023’s stock market has had very narrow leadership. Seven stocks (Amazon, Apple, Google, Meta/Facebook, Microsoft, Nvidia, and Tesla) represent the vast amount of the year’s performance. These seven stocks are up 58% in the first half of 2023 and, if they are removed from the S&P 500, the index would be up 4% instead of 15%. Please see the chart below from the Kobeissi Letter.

As this narrow leadership and new option trading have dominated the markets, it introduces additional risks. The seven stocks that are leading the rally trade at expensive valuations. If there is an earnings hiccup in any of these, it could lead to a rush to liquidate these positions.

While change and innovation are a constant in the capital markets, they don’t always reduce risk. I believe that a cautious and defensive approach remains the best strategy as we work through the second half of 2023. I will look for opportunities as the various crosscurrents work through the economy and the markets.

Please contact me with questions or comments. As always, thank you for your support and confidence in Kerr Financial Group.

Leave a Reply

Want to join the discussion?Feel free to contribute!