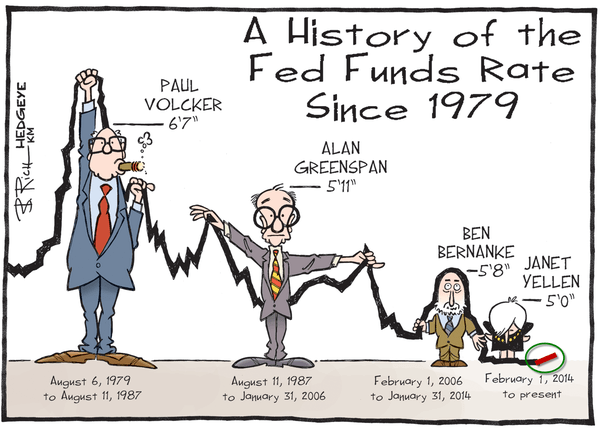

“How Do You Measure Yourself with Other Golfers? By Height.[ii]

Some interesting data related to this debate is that the St. Louis Federal Reserve released business loan numbers recently. Commercial and industrial loan (C&I) growth has been stagnate over the past 7 months at just under $2.1 trillion. As a point of reference, C&I loans grew 49% from 2012 to 2016.[iv] A strong, expanding economy should be generating increasing loan demand.

Leave a Reply

Want to join the discussion?Feel free to contribute!