2018 3rd. Qtr. Kildare Asset Mgt.-Kerr Financial Group client review letter

The following is a copy of the 3rd quarter letter sent to clients. It reviews the markets and the client account’s activity and performance for the 3rd quarter and year to date 2018.

Kerr Financial Group

Kildare Asset Mgt.

Jeffrey J. Kerr, CFA

Economic statistics tell a story that the financial markets interpret and, ultimately, convert into prices at which trades occur. Of course, understanding the data is only one part of the process. Another critical step is the interrelationships between the various statistics as well as the magnitude of their importance. In other words, some data influences other economic reports and some statistics have greater importance than others.

For example, the monthly employment report is given much more attention than a release on business inventories. This is natural as jobs growth has a widespread economic influence as it directly impacts things such as consumer spending and inflation (through wage growth).

As sign of its importance, the financial world seems to stop on the first Friday of the month at 8:30 AM eastern time when the U.S. employment report is released. It is amazing that this news release attracts so much attention with countless beforehand forecasts and then subsequent dissection of the details. All this hype for a report that is revised numerous times in the months following its original release.

Accurately analyzing the various economic numbers is a significant step in making good investment decisions. However, an additional part of navigating the markets goes beyond the economy. Politics, fiscal policy, and international relations impact stocks, bonds, currencies and commodities. Reviewing 2018’s 3rd quarter, investors had to deal with a lot of this news.

The domestic economic news was strong. During the quarter, we learned that the estimated growth rate for the U.S. economy was 4.2% and it was the best back to back quarters since 2011. The unemployment rate fell to 3.7% in September which was the lowest rate since 1969. These broad numbers translated into surging corporate earnings.

It was a much more challenging quarter for the international economies. Headwinds such as rising crude oil prices and a stronger U.S. dollar resulted in painful obstacles for some countries. Nations that have to import oil (India and Japan for example) encountered higher commodity costs.

Within emerging markets, Turkey and Argentina were pressured by the stronger U.S. dollar that ended up stressing their financial systems. The Italian budget dispute added uncertainty to the international financial system. And, of course, talks over tariffs generally hurt global trade.

The result was a disturbing divergence between the rest of the world and the U.S. stock markets. At the end of September, the Dow Jones Global index (excluding the U.S.) showed a year-to-date decline of 5.2% while the U.S. indexes traded near all-time records. Here is a list of 2018 year-to-date returns through September for some noteworthy international indexes:

| 2018 | ||

| Shanghai Composite (China) | -14.70% | |

| Hang Seng (Hong Kong) | -7.10% | |

| Nikkei 300 (Japan) | 1.30% | |

| DAX (Germany) | -5.20% | |

| FTSE (London) | -2.30% | |

To compare, here are the U.S. major indexes.

| 3rd. Qtr | 2018 | |||

| Dow Jones Industrial Average | 9.0% | 7.0% | ||

| S&P 500 | 7.2% | 9.0% | ||

| Nasdaq Composite | 7.1% | 16.6% | ||

| Russell 2000 | 3.2% | 10.5% | ||

Today’s global economic system is interwoven through trade and the financial system. The separation in direction between the foreign stock markets and the U.S. averages is noteworthy. Obviously, there are times when one country or area outperforms the rest of the world, but for the U.S. stocks to be moving in a dramatically different direction from other major indexes is worrisome.

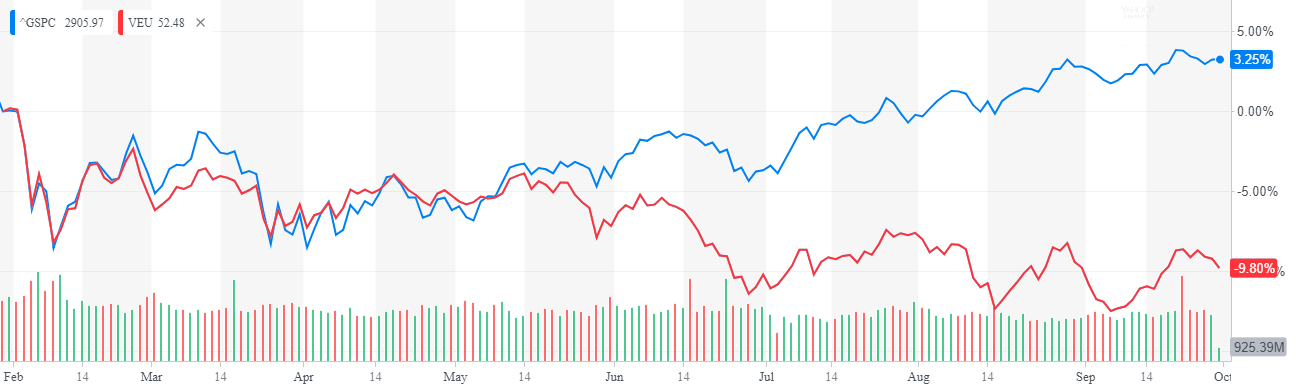

I included the chart below in a September newsletter. The two lines are the S&P 500 (blue line) and the Vanguard All-World Index that doesn’t include the U.S. markets (red line). It clearly shows the two indexes trading closely together before diverging in May. Since then, the gap has widened.

Focusing on the U.S. stock markets the 3rd quarter saw a continuation of the recovery from the painful drop in February. As a reminder, the Dow was down year-to-date at the end of June while the S&P 500 showed very modest gains. In the 3rd quarter, the Dow and S&P recaptured the losses from earlier in the year and traded to new record highs in September. As mentioned in the September newsletter, the markets’ leadership was narrow with the four largest U.S. stocks accounting for 50% of the S&P 500’s gain in 2018. This was disconcerting as advances with more participation are normally more sustainable.

Using a size weighted average, here is how the average Kildare Asset Management-Kerr Financial Group client’s account performed. This is calculated after all fees and expenses.

| 3rd Qtr | 2018 | |||

| Kerr Financial Group – Kildare | -0.46% | 6.19% | ||

| Asset Management |

Normally I review some of the details of your account during the quarter, but, given recent market developments, it’s important to review October and November. October was the worst ‘October’ since 2008. Also, it was the worst of any month since 2011. Recently there have been rough months such as August 2015, January 2016 and February 2018. While these suffered monthly losses, October 2018 exceeded them

Some important changes in the market backdrop have taken place. The U.S. dollar has risen in value as compared to other currencies. This has strained some foreign financial systems and, with today’s global system so connected, any small problem can have far reaching impacts.

Interest rates have moved higher in the U.S. throughout 2018. This has been partially driven by the Federal Reserve on the short end of the yield curve but also driven by the markets. There is a lot of debt in our economic system and higher interest costs will be a problem.

Lastly, 3rd quarter earnings reports were released in October and the numbers were good. However, guidance and forecasts for future profits were lowered which surprised the Wall Street. The markets are continually discounting future events and if profits are expected to be flat or lower, market prices will decline.

I have tried to use various hedges in client accounts together with cash balances as an attempt to avoid the declines. October’s action was so widespread that this wasn’t as effective as anticipated. As a result, I have raised more cash and will likely continue to do so if markets don’t begin to stabilize. Ultimately, this will provide ammunition when prices reverse this decline.

Please feel free to call with any questions. Thank you for your business and continued confidence placed in me.

Leave a Reply

Want to join the discussion?Feel free to contribute!