The following is a copy of the 2019 2nd quarter letter sent to clients. It reviews the markets and the client account’s activity and performance for the 2nd quarter of 2019.

One of the goals of a business is to be profitable. Of course, the end doesn’t justify the means and the path to profitably is important. The typical trail to success involves offering a desired product or service at a reasonable price. Controlling expenses is critical so there must be focus on the cost side of the equation as well. Combine these efforts (some added luck is always helpful) and the result is hopefully a prosperous organization.

If all goes well and an organization becomes successful, the management will need to decide the best use of the excess cash. Thanks to the Federal Reserve, the return on money is very low and barely above the inflation rate. This forces businesses to look for other options.

There are several reasonable possibilities available. The company can pay a dividend to the owners. This is not the most tax efficient use as it is not tax deductible for the business and is taxable to the recipient. Another option is to pay down any existing debt (bonds or bank loans). A further alternative is to expand the business through purchase of additional plant and equipment. Also, a similar move is to acquire another business.

While these choices are all legitimate considerations for cash, another option has risen to become the favorite of publicly traded companies. Share buybacks or purchasing shares of your company in the open market has become an important part of corporate finance. Companies have been very active buyers of their own stock in recent years. And, best of all, if your company doesn’t have the liquidity to execute the buyback, it’s no problem because the bond market has been happy to finance the effort.

Stock buybacks were not always so popular. In fact, before 1982, it was illegal. Regulators viewed it as manipulation of stock price if corporations were able to buy their own stock. Things have changed a lot over the years. Now a company’s stock price is scorned if they aren’t buying back their own shares.

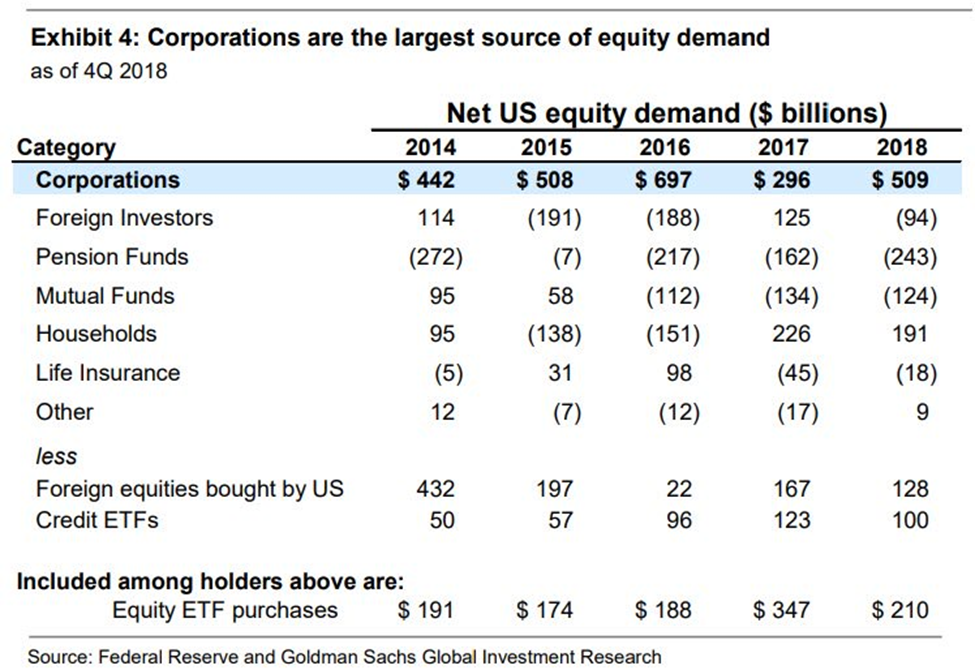

The graph below lists the sources of demand for stocks in the U.S. markets duringrecent years. It shows the overwhelming amount that is purchased by corporations. Corporations is the largest category in every year, and it is the only one that is positive in all years.

Clearly buybacks are an important part of the stock market and has been a tailwind for many years. Another essential player in the corporate buyback craze is the bond market. Fixed income investors have continually provided liquidity to corporations by absorbing the constant flow of offerings. And with widespread demand comes attractive interest rates.

These low interest rates are courtesy of the policies of the global central banks which have held interest rates low. On top of holding down interest rates, the Fed, European Central Bank (ECB), and the Bank of Japan have flooded the system with money. This combination results in large pools of money seeking a return.

Another indication of the importance of stock buybacks is the high amount of cash flow devoted to these programs. As the graph below indicates, over 100% of the S&P 500’s free cash flow is now being used for dividend payments and stock repurchase. Free cash flow is generally thought of as cash that remains after maintaining the company’s capital investments. In other words, upkeep on plant, property, equipment, and other long-lived assets.

Corporate managers must prioritize how they use capital and, as mentioned above, there are many worthy options. The ratio has been at this level or higher in the past, but the current deployment shows how central this is for corporate America.

IBM is one of the world’s greatest success stories. They are a model for success with its history of innovation and execution. It is also a posterchild example of this corporate strategy. Big Blue’s long debt totaled a little more than $18 billion in 2000. It has almost doubled to $35.5 billion at the end of 2018. The use for at least part of this money shows up in a significant reduction in the number of common shares. In 2000, IBM had almost 1.8 billion shares outstanding. That number is approximately half at the end of 2018 coming in around 900 million.

This reduction in share count produces a huge lift in the earnings-per-share calculation without growing the business. The same dollar amount of earnings in 2000 would be twice as much in 2018 when measured on a per share basis. In other words, earnings per share, an essential Wall Street financial measurement, increases without expanding sales and profits. All things being equal, this will translate into a higher stock price. It’s no wonder that this has become such a widespread corporate strategy

This additional debt load is not lost on the credit rating agencies. IBM was once rated AAA (the highest) but has fallen to an A rating. This financial deterioration is a material reason for this. Apparently, conditions haven’t stabilized at this iconic company because Moody’s issued a credit downgrade in July.

As judged by IBM’s stock price appreciation in 2019, investors are willing to forgive the blemishes on the balance sheet. Also, it’s important to remember that IBM is in the Dow Jones Industrial Average and S&P 500. This means if the markets are up, it’s a pretty good chance that IBM is participating.

This has been the case. The stock market, as measured by the S&P 500, just finished its best first half of the year since 1997. As a reminder, this rally was preceded by the worst “December” since just after the 1929 stock market crash. Also, the 4th quarter of 2018 saw a peak to trough drop of 20%. Finally, 2018 was a bad year across many markets as over 90% of all asset classes lost money. Once again, we must go back to the start of the Great Depression to find anything close to this.

It’s natural for markets to bounce after such widespread declines but it’s difficult to figure out the rebound’s timing and length. Part of this process is involves the reasons for the previous turmoil which is difficult to do in real time.

There were a couple of possible sources surrounding 2018’s selloff. The Chinese currency was falling in value against the dollar which increased worries over a systemic problem. Also, tariff and trade war concerns were a constant economic anxiety. Finally, interest rate increases and balance sheet contraction by the Federal Reserve was big market hindrance throughout the year.

While all three were contributors, with hindsight, it appears that the tighter policy by the Fed was the chief culprit. As part of a one-quarter point interest rate increase in December, Fed chairman, Jerome Powell, announced that the balance sheet reduction program was on ‘autopilot’. This meant tighter monetary conditions something the market don’t like. The S&P 500 plunged around 10% in the next week.

In the first week of January, a few weeks after the rate hike decision, Mr. Powell announced a more flexible stance which became to be known as the Powell Pivot. It helped drive U.S. stock prices higher and bond yield lower for the first half of 2019. It is a remarkable reversal that the year began with forecasts of 2 to 3 Federal Reserve interest rate increases in 2019. Seven months later the Fed cuts rates for the first time in over a decade.

The returns for stocks and bonds for the first six months were not without challenges. Continued tariff concerns, geopolitical problems, civil division, and an unknown monetary policy were part of the lengthy list of problems the markets faced. Despite these issues, earnings and economic growth outweighed the negatives and helped push financial assets higher. Here are the major averages’ returns for the 2nd quarter and year to date.

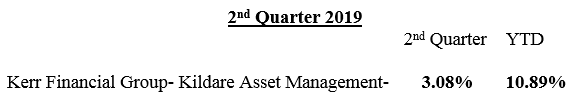

Using a size weighted average, here is how the average Kildare Asset Management-Kerr Financial Group client’s account performed. This is calculated after all fees and expenses.

Looking within the accounts, a couple of developments to note. During the quarter, Pan American Silver Company (symbol is PAAS) became a precious metal play. Gold started to move higher at the end of May and broke out of a trading range in June. I had feared that I missed the move in gold and wanted to wait for a pullback to begin accumulating positions.

Realizing that the price of silver had not rallied as dramatically as gold, I used silver as a cowardly way of having precious metal exposure. While gold and silver can be viewed as complementary, they do not always move together. This ratio recently reached its highest point in over 25 years – meaning gold was historically high relative to silver. If there is a forthcoming return to the mean trade, silver will outperform gold.

Pan American Silver was founded in 1994. It is one of the largest silver mining companies in the world and their mines are in generally safe countries with friendly governments. Pan American’s flagship mine is La Colorado in Mexico which is expected to produce 8.1 million ounces of silver in 2019. The company is profitable and has 1.3 billion ounces of silver equivalent reserves.

Precious metal investments are historically considered safe havens and can offer protection during inflationary periods. Gold and silver have gained additional interest within today’s environment of negative interest rates. Bonds and other securities that have a yield are in competition with these metals for investor capital. Negative interest rates reduce this competition and make precious metal more attractive. This position might be added to if there is a price correction and the global financial conditions deteriorate.

Bath Bed and Beyond (symbol is BBBY) is another 2nd quarter addition. The company has over 1,500 stores two-thirds of which are the namesake brand. The next biggest and other recognizable name is Christmas Tree Shops. Of course, as is the case for every retailer, Bed Bath and Beyond has invested and enhanced their e-commerce platform.

The challenges facing the retail industry are widely known. Going to the mall is no longer a popular pastime. Competition, the internet, and potential tariffs has squeezed margins. All retailers are forced to transform the shopping experience to keep their customers as well as attract new ones.

BBBY is expected to generate around $12 billion of sales in fiscal year 2020 (the current year). The bottom line is forecast to be slightly less than $2.00 per share. They have a strong balance sheet with a little less than $1 billion in cash and $2.6 billion in inventories. There is $1 billion of accounts payable and $1.5 billion of long-term debt.

Of course, little of this matters when a sector falls out favor with investors. The result is the peculiar situation where Bed Bath and Beyond’s dividend yield is higher than its P/E ratio (prices-to-earnings). The P/E is below 5 while the dividend yield is above 6%. Concerning the dividend, management just raised it which demonstrates their confidence in future cash flows (when a company increases its dividend it is a long-lasting decision that not normally reversed).

Investors want nothing to do with retail and there are many good reasons for this. However, as troubled as conditions are, many remain profitable and offer good long-term value. Bed Bath and Beyond is an example of investors overlooking a company’s financial strength and potential. We are down on our BBBY investments. However, these are smaller positions that will be increased at better prices. I think the stock will rebound in the future.

The markets are likely to face many trials in the second half of 2019. While it looks like the Federal Reserve has changed its policy and will be market friendly, there are lots of other issues. The list includes a slowing economy in international markets, trade wars, geopolitical flare ups, and civil unrest.

Domestically, the United States economy is doing well but there are some concerning signs. A few economic data points such as the Purchasing Managers Index have weakened a little. Also, future earnings estimates have been reduced.

The race for the Democratic Party’s presidential candidate will accelerate later this year. While it may not be on the financial markets shopping list yet, there are many economically unfriendly proposals being offered by the 20 plus candidates in the race. It’s safe to say that the markets will not rally with a 70% marginal personal income tax rate.

But the largest problem is the current discussion in Congress about outlawing corporate buybacks. To be sure, buybacks are controversial. However, removing the biggest source of buying would likely be the beginning of material financial market pain.

While it promises to be an exciting period ahead, I will continue to look for opportunities as well as monitor current positions. I think the markets could be volatile and will try to exercise caution in executing decisions. Thank you for your continued support and please call with any questions.

Sincerely,

Jeffrey J. Kerr, CFA

“In Everything, Give Thanks”

/0 Comments/in Financial Planning News /by jkerrKerr Financial Group

Kildare Asset Mgt.

Jeffrey J. Kerr, CFA

Newsletter

November 18, 2019 – DJIA = 28,004 – S&P 500 = 3,120 – Nasdaq = 8,540

“In Everything, Give Thanks”[i]

Wall Street has much to be thankful for. The stock market is having a great year. Fees from IPO’s, mergers, and deals are ringing the cash registers. Corporate earnings remain good. The Fed has returned to cutting interest rates and pumping money into the system. And presidential tweets still move the market higher.

Just in time for Thanksgiving, all three major indexes finished the week at all-time highs. In late October stocks broke out of a trading range that dated back to the spring and climbed to new records. Friday was the 7th record close in November and the 22nd for 2019.

The stock market momentum has caught many off guard as concerns about impeachment, global protests, and some slightly softer economic data increased skepticism. In addition to being unexpected, the move has been widespread with international stock markets rallying too.

As a part of these records, the Dow Jones Industrial Average closed above 28,000 for the first time. It’s only been 4 months since it crossed 27,000. Of course, the percentage move required to move 1,000 point Dow points is much less at large numbers and it only needed a 3.7% move above this threshold. Below is a chart showing the moves between 1,000 point increments for the Dow. It also gives the percentage between the milestones.[ii]

As a painful reminder, 1,000 milestones aren’t always easy to hurdle even when it represents a small percentage move. For example, it took almost 6 years for the Dow to move from 14,000 to 15,000 (a 7% move) as the financial crisis ravaged the markets.

The latest corporate earnings reports helped the stock market move to record levels. In the 3rd quarter reports, 64.8% of companies exceeded their earnings estimate. This is in contrast to the 2nd quarter numbers when less than 60% of the companies beat their estimate. This 3rd quarter success rate might be a sign that the lower earnings in the 2nd quarter earnings was a one-time event.

Expenses can be managed and adjusted which can help make the bottom line hit the quarterly forecast. Revenues aren’t as easy to massage so investors closely watch these numbers as well. In the 3rd quarter, 57.9% of the companies beat their sales estimates. This is a higher rate than the 1st and 2nd quarter but lower than the high numbers in late 2018 and early 2019 when almost 70% of reporting companies were exceeding their revenue estimates. If the outlook for corporate earnings remain positive, stocks should continue to push higher.

Here are the year-to-date returns for the major averages.

Unlike Thanksgiving, this rally has global participation. International stock markets are having good years and are moving higher with the U.S. The major indexes in Australia, Canada, France, Germany, and Japan are all near 52-week highs. Among developed economies, the United Kingdom and Spain are positive for 2019 but behind the returns from other markets.

While there are not many turkeys in the developed international sector, not all of the emerging market sector have enjoyed the rally. Russian (up 35%), Brazilian (up 21%) and Indian (up 12%) investors are thankful, but some markets are not so rewarding. Chile is down 7.4% this year and Hong Kong is ahead by less than 2%.

Returning to the U.S., Black Friday, the second uniquely American holiday in November, is upcoming. This official start to Christmas and holiday shopping is late this year as November 2019 has 5 Fridays. This has some retailers worried about the decreased number of days between Thanksgiving and Christmas. Given that smartphones and computers are strong alternatives to driving to a store, it would seem that there will not be a shortage of time.

Below is a chart showing the growth of “clicks” and the decline of traditional buying of general merchandise.[iii] From the peak around 2009, “bricks” shopping has been in a steady decline and was overtaken in recent years by the online purchases. These trends are likely to continue as retailers have widely invested in their online experience and shoppers are comfortable using their phones and computers for shopping.

In a report last week, retail sales rose 0.3% in October which reversed a drop in September. It signaled increased confidence in the U.S. consumer which is a large part of the economy. This is a welcome sign for 2019’s holiday shopping and could drive further overall economic growth. It could easily continue in 2020.

The bulls have much to be thankful for. It’s been a great year and the recent breakout for U.S. stocks likely signals the direction for the rest of 2019. That’s not to suggest it will be a smooth, steady climb but it appears that the downside is limited. Furthermore, professional investors who are underperforming the indexes will be anxious to use any pullback as an opportunity to put money to work.

On the other hand, the bears, naturally, aren’t so grateful. To be sure, there will come a time when they will be on the right side of the markets. But in the meantime, let’s hope they can enjoy some turkey and watch some football.

[i] 1 Thessalonians, 5:18

[ii] Charlie Bilello, November 15, 2019

[iii] The Bespoke Report, November 15, 2019

October Newsletter

/0 Comments/in Financial Planning News /by jkerr“…where the water ran deep and black, was found the hat of the unfortunate Ichabod, and close beside it a shattered pumpkin.”

October 21, 2019 – DJIA = 27,018 – S&P 500 = 3,000 – Nasdaq = 8,157

Halloween involves things like trick-or-treating, dressing up in costumes, playing pranks, scary stories and haunted houses. While it is an annual occurrence that takes place in late October, given the events during the past few years, it appears that Halloween traditions have become a year round, ongoing part of our culture.

For those in search of haunted houses, look no further than Washington, D.C. There is plenty of demonic activity taking place in both houses of Congress, the White House, the FBI, CIA, and, of course, the Federal Reserve.

When it comes to trick-or-treating, it’s hard to compete with Robert Mueller and James Comey. However, the crew of politicians seeking the Democratic nomination certainly deserve consideration for tops in this category. And the most recent entry of LeBron James and the NBA choosing to protect their wallets over human rights is making its way higher on the list. The financial markets have negative interest rates which might be the cruelest trick of all.

There are abundant spooky stories too. Impeachment, the Democratic debates, Brexit, the Green New Deal, Adam Schiff, We Works, Trump rallies, Hunter Biden, Greta Thunberg, 97% marginal tax rates, Ukraine, and the repo market.

The capital markets have a history of frightening Octobers. Two stock market crashes plus things such as the failure of Long Term Capital Management and Lehman Brothers were autumn happenings. As recent as last year, October was a painful beginning to a miserable end of the year.

The start to this year’s October was a rough one as the markets fell hard. The major averages dropped around 3% in just the first two trading days of October. This was on top of some stock market weakness in the second half of September. Justifiably, traders began to chatter about another nightmarish October. But by the end of October’s first week the stock market stabilized and started to move higher.

The major averages were approaching the mid-September highs at the close of last week. As a reminder, these levels are still below the all-time highs reached in July and are only modestly above where prices were last October. Here are the year-to-date returns for the major averages.

Interest rates, which have been declining all year, have been a big driver of stock prices. Lower yields are partially a function of slowing economic growth. However, the Federal Reserve’s switch in strategy from tightening to interest rate cuts and more stimulus has played a large role in the markets.

Besides this policy pivot, there has been a great deal of angst over an explosion in the amount of money borrowed in the repo market. First, the repo (repurchase) market is where funds are loaned and borrowed between banks for short term purposes. It is often an overnight arrangement where one institution has too much cash and another has a shortfall as measured by banking regulations. They enter into a deal in which the lender sends cash to the borrower in exchange for high quality securities (typically treasury notes) with the condition that this loan will be reversed and unwound at some date in the future.

The Federal Reserve has a role in this market as the party that borrowers can come to. However, the Fed is considered the last option as it carries the stigma that the borrower can’t find funds through normal options.

In mid-September the overnight borrowing rates between banks ran into problems and rates spiked. The Fed stepped in and went from being a behind the scenes observer to the major supplier of funds. Below is a chart showing the spike in borrowing from the Fed.

The Fed’s explanation included things such as seasonal funding needs by banks and that they expected this condition to only be temporary. Skeptics called it another form of QE and questioned if some large financial institution is impaired.

More likely it seems that banks with more than sufficient liquidity began to hold the cash rather than enter into a short term loan. In other words, banks are hoarding cash. Part of the reasoning behind this is increased regulations from the financial crisis on liquidity levels and the quality of banking collateral. Of course, it’s possible that the banks see a problem ahead and are positioning for it.

The Fed’s repo window hasn’t been used at this level since the financial crisis. Naturally, that draws comparisons together with concerns that another systemic problem is around the corner. The Fed dismisses these worries and forecasts a return to normal conditions soon.

Regardless the specific reasons for this spike in Fed repos, one of the obvious results is a significant increase of money in the financial system. Logically, some of this liquidity finds its way into the capital markets which usually means higher prices.

Another forthcoming monetary easing event is a Fed decision which, ironically, will be on Halloween. There is wide belief that Jerome Powell and the committee will cut short term interest rates again. Our monetary leaders have a long history of telegraphing their decision and since many traders are anticipating a cut, it’s unlikely that they change their mind.

Fed critics (there are many) question the need to cut interest rates and inject money into the system when unemployment is near record low levels and the economy is expanding. The extension of this worry is that cutting rates now wastes their ammunition. And when something bad does happen, they will have limited options and the situation will deteriorate further.

Central bank supporters are optimistic that proactive decisions will help avoid any problem. Further, we must keep in mind that the U.S. dollar is the world’s reserve currency and, consequently, the Fed plays a partial role as global central banker. Within this context, there are many economically troubled areas throughout the worldwide system. Agree or not, the Fed is aware of this interconnected backdrop.

This likely results in more easing at some point in the future. While this could eventually lead to bigger and far reaching financial problems, it could, in the short run, bring higher asset prices.

Scary stories fill the history of financial markets in the month of October. While the beginning of the 2019 version looked like a repeat of previous spooky spells, things have been surprisingly pleasant. It’s always possible that someone or something suddenly yells “Boo!” and shocks everyone. In the meantime, it looks like a good time for gathering treats with little fear of the tricks.

[i] “The Legend of Sleepy Hallow”, Washington Irving

[ii] Bianco Research, October 2019

2nd Quarter Review Letter sent to Clients

/0 Comments/in Financial Planning News /by jkerrThe following is a copy of the 2019 2nd quarter letter sent to clients. It reviews the markets and the client account’s activity and performance for the 2nd quarter of 2019.

One of the goals of a business is to be profitable. Of course, the end doesn’t justify the means and the path to profitably is important. The typical trail to success involves offering a desired product or service at a reasonable price. Controlling expenses is critical so there must be focus on the cost side of the equation as well. Combine these efforts (some added luck is always helpful) and the result is hopefully a prosperous organization.

If all goes well and an organization becomes successful, the management will need to decide the best use of the excess cash. Thanks to the Federal Reserve, the return on money is very low and barely above the inflation rate. This forces businesses to look for other options.

There are several reasonable possibilities available. The company can pay a dividend to the owners. This is not the most tax efficient use as it is not tax deductible for the business and is taxable to the recipient. Another option is to pay down any existing debt (bonds or bank loans). A further alternative is to expand the business through purchase of additional plant and equipment. Also, a similar move is to acquire another business.

While these choices are all legitimate considerations for cash, another option has risen to become the favorite of publicly traded companies. Share buybacks or purchasing shares of your company in the open market has become an important part of corporate finance. Companies have been very active buyers of their own stock in recent years. And, best of all, if your company doesn’t have the liquidity to execute the buyback, it’s no problem because the bond market has been happy to finance the effort.

Stock buybacks were not always so popular. In fact, before 1982, it was illegal. Regulators viewed it as manipulation of stock price if corporations were able to buy their own stock. Things have changed a lot over the years. Now a company’s stock price is scorned if they aren’t buying back their own shares.

The graph below lists the sources of demand for stocks in the U.S. markets duringrecent years. It shows the overwhelming amount that is purchased by corporations. Corporations is the largest category in every year, and it is the only one that is positive in all years.

Clearly buybacks are an important part of the stock market and has been a tailwind for many years. Another essential player in the corporate buyback craze is the bond market. Fixed income investors have continually provided liquidity to corporations by absorbing the constant flow of offerings. And with widespread demand comes attractive interest rates.

These low interest rates are courtesy of the policies of the global central banks which have held interest rates low. On top of holding down interest rates, the Fed, European Central Bank (ECB), and the Bank of Japan have flooded the system with money. This combination results in large pools of money seeking a return.

Another indication of the importance of stock buybacks is the high amount of cash flow devoted to these programs. As the graph below indicates, over 100% of the S&P 500’s free cash flow is now being used for dividend payments and stock repurchase. Free cash flow is generally thought of as cash that remains after maintaining the company’s capital investments. In other words, upkeep on plant, property, equipment, and other long-lived assets.

Corporate managers must prioritize how they use capital and, as mentioned above, there are many worthy options. The ratio has been at this level or higher in the past, but the current deployment shows how central this is for corporate America.

IBM is one of the world’s greatest success stories. They are a model for success with its history of innovation and execution. It is also a posterchild example of this corporate strategy. Big Blue’s long debt totaled a little more than $18 billion in 2000. It has almost doubled to $35.5 billion at the end of 2018. The use for at least part of this money shows up in a significant reduction in the number of common shares. In 2000, IBM had almost 1.8 billion shares outstanding. That number is approximately half at the end of 2018 coming in around 900 million.

This reduction in share count produces a huge lift in the earnings-per-share calculation without growing the business. The same dollar amount of earnings in 2000 would be twice as much in 2018 when measured on a per share basis. In other words, earnings per share, an essential Wall Street financial measurement, increases without expanding sales and profits. All things being equal, this will translate into a higher stock price. It’s no wonder that this has become such a widespread corporate strategy

This additional debt load is not lost on the credit rating agencies. IBM was once rated AAA (the highest) but has fallen to an A rating. This financial deterioration is a material reason for this. Apparently, conditions haven’t stabilized at this iconic company because Moody’s issued a credit downgrade in July.

As judged by IBM’s stock price appreciation in 2019, investors are willing to forgive the blemishes on the balance sheet. Also, it’s important to remember that IBM is in the Dow Jones Industrial Average and S&P 500. This means if the markets are up, it’s a pretty good chance that IBM is participating.

This has been the case. The stock market, as measured by the S&P 500, just finished its best first half of the year since 1997. As a reminder, this rally was preceded by the worst “December” since just after the 1929 stock market crash. Also, the 4th quarter of 2018 saw a peak to trough drop of 20%. Finally, 2018 was a bad year across many markets as over 90% of all asset classes lost money. Once again, we must go back to the start of the Great Depression to find anything close to this.

It’s natural for markets to bounce after such widespread declines but it’s difficult to figure out the rebound’s timing and length. Part of this process is involves the reasons for the previous turmoil which is difficult to do in real time.

There were a couple of possible sources surrounding 2018’s selloff. The Chinese currency was falling in value against the dollar which increased worries over a systemic problem. Also, tariff and trade war concerns were a constant economic anxiety. Finally, interest rate increases and balance sheet contraction by the Federal Reserve was big market hindrance throughout the year.

While all three were contributors, with hindsight, it appears that the tighter policy by the Fed was the chief culprit. As part of a one-quarter point interest rate increase in December, Fed chairman, Jerome Powell, announced that the balance sheet reduction program was on ‘autopilot’. This meant tighter monetary conditions something the market don’t like. The S&P 500 plunged around 10% in the next week.

In the first week of January, a few weeks after the rate hike decision, Mr. Powell announced a more flexible stance which became to be known as the Powell Pivot. It helped drive U.S. stock prices higher and bond yield lower for the first half of 2019. It is a remarkable reversal that the year began with forecasts of 2 to 3 Federal Reserve interest rate increases in 2019. Seven months later the Fed cuts rates for the first time in over a decade.

The returns for stocks and bonds for the first six months were not without challenges. Continued tariff concerns, geopolitical problems, civil division, and an unknown monetary policy were part of the lengthy list of problems the markets faced. Despite these issues, earnings and economic growth outweighed the negatives and helped push financial assets higher. Here are the major averages’ returns for the 2nd quarter and year to date.

Using a size weighted average, here is how the average Kildare Asset Management-Kerr Financial Group client’s account performed. This is calculated after all fees and expenses.

Looking within the accounts, a couple of developments to note. During the quarter, Pan American Silver Company (symbol is PAAS) became a precious metal play. Gold started to move higher at the end of May and broke out of a trading range in June. I had feared that I missed the move in gold and wanted to wait for a pullback to begin accumulating positions.

Realizing that the price of silver had not rallied as dramatically as gold, I used silver as a cowardly way of having precious metal exposure. While gold and silver can be viewed as complementary, they do not always move together. This ratio recently reached its highest point in over 25 years – meaning gold was historically high relative to silver. If there is a forthcoming return to the mean trade, silver will outperform gold.

Pan American Silver was founded in 1994. It is one of the largest silver mining companies in the world and their mines are in generally safe countries with friendly governments. Pan American’s flagship mine is La Colorado in Mexico which is expected to produce 8.1 million ounces of silver in 2019. The company is profitable and has 1.3 billion ounces of silver equivalent reserves.

Precious metal investments are historically considered safe havens and can offer protection during inflationary periods. Gold and silver have gained additional interest within today’s environment of negative interest rates. Bonds and other securities that have a yield are in competition with these metals for investor capital. Negative interest rates reduce this competition and make precious metal more attractive. This position might be added to if there is a price correction and the global financial conditions deteriorate.

Bath Bed and Beyond (symbol is BBBY) is another 2nd quarter addition. The company has over 1,500 stores two-thirds of which are the namesake brand. The next biggest and other recognizable name is Christmas Tree Shops. Of course, as is the case for every retailer, Bed Bath and Beyond has invested and enhanced their e-commerce platform.

The challenges facing the retail industry are widely known. Going to the mall is no longer a popular pastime. Competition, the internet, and potential tariffs has squeezed margins. All retailers are forced to transform the shopping experience to keep their customers as well as attract new ones.

BBBY is expected to generate around $12 billion of sales in fiscal year 2020 (the current year). The bottom line is forecast to be slightly less than $2.00 per share. They have a strong balance sheet with a little less than $1 billion in cash and $2.6 billion in inventories. There is $1 billion of accounts payable and $1.5 billion of long-term debt.

Of course, little of this matters when a sector falls out favor with investors. The result is the peculiar situation where Bed Bath and Beyond’s dividend yield is higher than its P/E ratio (prices-to-earnings). The P/E is below 5 while the dividend yield is above 6%. Concerning the dividend, management just raised it which demonstrates their confidence in future cash flows (when a company increases its dividend it is a long-lasting decision that not normally reversed).

Investors want nothing to do with retail and there are many good reasons for this. However, as troubled as conditions are, many remain profitable and offer good long-term value. Bed Bath and Beyond is an example of investors overlooking a company’s financial strength and potential. We are down on our BBBY investments. However, these are smaller positions that will be increased at better prices. I think the stock will rebound in the future.

The markets are likely to face many trials in the second half of 2019. While it looks like the Federal Reserve has changed its policy and will be market friendly, there are lots of other issues. The list includes a slowing economy in international markets, trade wars, geopolitical flare ups, and civil unrest.

Domestically, the United States economy is doing well but there are some concerning signs. A few economic data points such as the Purchasing Managers Index have weakened a little. Also, future earnings estimates have been reduced.

The race for the Democratic Party’s presidential candidate will accelerate later this year. While it may not be on the financial markets shopping list yet, there are many economically unfriendly proposals being offered by the 20 plus candidates in the race. It’s safe to say that the markets will not rally with a 70% marginal personal income tax rate.

But the largest problem is the current discussion in Congress about outlawing corporate buybacks. To be sure, buybacks are controversial. However, removing the biggest source of buying would likely be the beginning of material financial market pain.

While it promises to be an exciting period ahead, I will continue to look for opportunities as well as monitor current positions. I think the markets could be volatile and will try to exercise caution in executing decisions. Thank you for your continued support and please call with any questions.

Sincerely,

Jeffrey J. Kerr, CFA

To Infinity & Beyond!!

/0 Comments/in Financial Planning News /by jkerrKerr Financial Group

Kildare Asset Mgt.

Jeffrey J. Kerr, CFA

Newsletter

September 23, 2019 – DJIA = 26,935 – S&P 500 = 2,992 – Nasdaq = 8,117

To Infinity and Beyond!!

Ten years ago, central banks slashed interest rates in an effort to stabilize the global economy from the financial crisis. Since reducing interest rates had worked in prior recessions, it was the “go to” strategy and considered the proper move. We were confidently assured that this was temporary, and rates would be back to normal in a jiffy. Yet, for the past decade, despite forecasts of rates returning to historically normal levels, it has been a path of steadily lower interest rates.

In addition to cutting interest rates, the world’s monetary leaders included additional strategies to combat the downturn. On top of pumping the system with money and reducing interest rates, these bankers implemented aggressive steps such as broad financial bailouts of total industries and key companies. They pulled out all of the stops.

Again, we were told that these radical and untested tactics were necessary and that it would be only short-lived. Ten years later, this transient remedy has become the norm. And like the frog in a pot as the heat is turned up, we have gradually become immune to dangers and risks that the global bureaucrats have shoveled on the system in name of saving it.

Two weeks ago the European Central Bank announced another round of “quantitative easing”. Specifically, the ECB lowered interest rates to an even lower negative level. The short term rate is now set at minus 0.5% for the reserves that banks hold at the ECB. This means that banks will lose approximately €9 billion per year on these funds that they are required to keep at the ECB .

Another important part of the announcement involves a new asset purchase program. The ECB will be buying €20 billion of bonds per month. This was less than the €30 billion that was expected but, to offset the disappointment, this program is open ended or has no set termination. Traders quickly began calling it “QE Infinity”.

In summary, Mario Draghi and the ECB are re-cycling and re-implementing the same policies that haven’t worked despite over 10 years of trying them. It is astonishing that these people have any credibility. Strangely, it seems, that as long as the system doesn’t implode, they are consider competent.

Of course, it’s not much different on this side of the Atlantic Ocean. Last week the Federal Reserve cut its benchmark interest rate one-quarter of 1%. It was the second cut in the past couple of months. There was some dissention concerning the decision to cut as three of the ten members of the committee voted against it. Chairman Powell pointed to a global slowdown and trade tensions as the chief reasons.

While this interest rate decision was broadly expected by the markets, the Fed was involved in some other unexpected developments last week. The banks have a system of borrowing and lending on an overnight basis. This is based on whether a bank has surplus liquidity or a shortfall according to regulatory measurements. The Fed stands as a lender if needed but, historically, banks view them as a last resort and would rather find the liquidity elsewhere.

Last week, for the first time in a decade, the Fed loaned around $200 billion over three days to banks in the form of short term loans. Many were alarmed and questions were raised on the cause of these developments. Mr. Powell downplayed the news and said it had no economic impact or shift in monetary policy. The capital markets will be watching to see if this is a single occurrence or if this becomes an ongoing problem.

The markets have a lot of confidence in the Federal Reserve’s ability. Perhaps too much. The Fed employs hundreds of PhD’s who are paid several billions of dollars annually. They have access to unlimited technology and computer models to assist in their analysis. Yet, despite all of these abilities and tools, they refer to themselves as being data dependent. In other words, instead of having definitive forecasts of future conditions, as is considered their critical role, they react to economic data as it is released. Apparently, advanced academics and the best programming is a lot more fluff than substance.

The U.S. 10-year note’s yield closed last week at 1.75%. This is a little higher than the start of September (around 1.5%) but down from 2.7% in March. It’s a surprising statistic that the 10-year U.S. Treasury note has provided a total return well above 10% so far in 2019. Likewise, the Bloomberg Barclays U.S. Aggregate Bond index (the main U.S. fixed income index that includes all bond sectors) has an approximate total return of 10% in 2019. These are attractive returns for a traditionally less volatile asset class (fixed income).

Turning to the stock market, the major indexes slipped around 1% last week. The recent action has been a sell off from record levels in late July and a bounce from mid-August. We remain below July’s highs. Obviously, there are strong economic, social, and political crosscurrents that the markets are digesting. Here are the major indexes year-to-date returns through last Friday.

Contrary to the gains of 2019, the returns for the past 52-weeks (year over year) are much less exciting. The Dow, S&P 500, and Nasdaq are barely positive. The Russell 2000, which may be a closer representation of the average stock, is down almost 9%. As a reminder, 2018’s 4th quarter was one worst in recent years with December being especially bad.

The reality is that stocks have not gained much since the highs in late January 2018. There has been a lot of movement but it’s been a back and forth variety without material progress. This is shown in the chart of the S&P 500. Each bar (candlestick) represents 1 week and the time frame begins in January 2018. The selloffs in February, 2018 and last year’s 4th quarter are clear reminders that stocks have risk.

The future direction of the capital markets will be influenced by interest rates. They are a critical part of the environment and are being controlled global central banks. The following quote from Jim Grant is an accurate painting of the landscape.

Interest rates are probably the most sensitive and consequential prices in capitalism. They balance savings and investment, discount future cash flows, define investment hurdle rates, measure financial risk.

Yet the Fed and its foreign counterparts seek to manipulate, or, at least, to influence, interest rates both long- and short-term. They can’t seem to keep their hand off them.

Wall Street raises no protest against these intrusions. The artificially low rates of the past 10 year have advantaged investors, speculators, and corporate promoters. They have deadened the risk sensors of even professional investors. They are the Jack Daniel’s-grade financial disinhibitors.

The same low rates – by some measure, the lowest in 4,000 years – have penalized savers incentivized dubious risk-taking, expedited the growth in federal indebtedness and perpetuated the lives of businesses that would have ended in the absence of easy credit. They have widened the gulf between rich and poor, thrown a spanner into our politics and inflated the cost of retirement.

The trouble is that the costs of radical monetary policy are dark and prospective; the gifts they bestow are bright and immediate. These gifts are likewise transitory.[i]

During the past 10 years monetary policy has shifted to a higher level of intrusion. Free markets are unarguably less free. So far, the markets have accepted and adjusted to this development. This leads to perhaps the largest risk in the capital markets – a loss of the market’s confidence in central banks and their policies. A confidence crisis is hard to forecast especially since the markets have seemingly approved the current conditions. However, if investors start to doubt monetary leaders, the adjustment could be long and painful.

[i] Grant’s Interest Rate Observer, May 17, 2019

“I Will Follow You, Will You Follow Me”

/0 Comments/in Financial Planning News /by jkerrKerr Financial Group

Kildare Asset Mgt.

Jeffrey J. Kerr, CFA

Newsletter

August 26, 2019 – DJIA = 25,628 – S&P 500 = 2,847 – Nasdaq = 7,751

“I Will Follow You, Will You Follow Me”

One year ago, on August 14, 2018, the S&P 500 closed at 2,839.96. Earlier this month on August 14, 2019, the S&P 500 closed at 2,840.60. As usual when dealing with the markets, the tranquil appearance of stocks running in place for the past 12 months is a misleading picture compared to reality.

The market mayhem began last fall when stocks dropped over 20% in the 4th quarter. As you may remember, the Fed was raising interest rates and reducing the size of its balance sheet (another monetary tightening mechanism) throughout the year. The market buckled in October and then nosedived in December as interest rate rose to multi year highs and international economies wobbled. Further, market strategists were predicting more interest rates increases in 2019.

Things changed in the first week of January. Federal Reserve chairman Jerome Powell softened his view on future interest rate hikes (this was quickly named the ‘Powell Pivot’) which became music to the market’s ears. Wall Street recognized the importance of this policy switch and began an impressive upswing. The S&P 500 went on to have its best first half of a year in over 20 years (1997).

While a good economy and corporate earnings helped drive stocks higher, it was clear that the markets were intensely following the Fed. But just as important, the Fed was following the markets. Similar to January 4th’s Powell Pivot, which was in response to the market’s upheaval in December, the Fed chairman openly ‘hinted’ on June 4th that the next interest rate decision would be a cut and that it would be happening soon. This triggered a rally that reversed weakness in May and stocks moved to record levels in July.

The Fed’s dual mandate is price stability and full employment. But there is little doubt that the central bank is closely following developments in capital markets. In turn the markets are following every syllable in speeches and news releases from the Fed. Within this reciprocal watching, let’s hope one of these parties knows what they are doing.

Recently the stock market has undergone some indecision. Prices fell at the beginning of August and then have spent the past weeks zig zagging with almost daily 1% moves. Each trading day’s direction is seemingly driven by breaking news about trade wars escalating or subsiding together with rising and declining risks of a possible recession.

Unfortunately, there have been some nasty air pockets in August with daily declines of 600, 700, and 800 points for the Dow Jones Industrial Average. This has resulted in a 4 week losing streak for U.S. stocks. If Mr. Powell is indeed watching, it looks like the stock market might be in need of some soothing words. In the meantime, here are the year-to-date performances for the major stock averages.

Despite the August selloff, U.S. stocks have had a good year. Likewise, the fixed income market has had a good 2019 as interest rates, contrary to expectations, have declined. In addition to last month’s cut in the overnight lending rate by the Fed, the 30-year U.S. Treasury bond recently fell to a record low yield. In fact the longer maturities yields have dropped further than the short end of the yield curve. This has the yield curve inverted (shorter maturities with higher yields than longer maturities) and could be a sign of a forthcoming recession.

Falling interest rates are not exclusively a U.S. development. Interest rates throughout the global financial markets have fallen. The remarkable part to this situation is that many in the world are already below zero! Over $15 trillion of bonds have a negative yield which is up from less than $10 trillion earlier in 2019. Not surprisingly, Bloomberg has developed an index that just tracks the amount of negative yielding debt.

Below is a table of the developed economies’ sovereign debt and the yields for various maturities.[i] As shown, positive yielding government debt (the green color) is at risk of being added to the endangered species list. It is astonishing that all maturities for leading countries such Germany, Sweden and Switzerland have yields below zero. France and Japan are close with only the longest dated bonds still above zero.

The United States offer the best yields among developed economies. The financial media commonly refers to this as the “the cleanest dirty shirt”. A question that is being debated is whether U.S. yields ultimately drop below zero. Several Federal Reserve speakers have suggested using more aggressive strategies when dealing with the next recession or financial system upheaval. This has led to speculation that negative interest rates will eventually part of the U.S. financial landscape.

A recent The Wall Street Journal article reported that the 2nd half of 2019’s earnings estimates are being lowered.[i] S&P 500 companies’ earnings for 2019 were originally forecast to grow 6% as compared to 2018’s level. Now they are expected to be up 1.5% for the year with the 3rd quarter number to be a contraction when compared to the 3rd quarter of 2018. Analysts predict profit growth will return in the 4th quarter. The reasons for these earnings cuts include the usual suspects – tariff uncertainty, slowing global economies, and worries over financial conditions.

The current financial and economic backdrop is a blend of inverted yield curves, negative interest rates, and slowing growth. A big worry is that central banks are fighting this battle with the same methods that have not worked for the past 10 years. One of the largest obstacles is the record amount of debt throughout the world. Government, consumer, and corporate debt totals have been growing for years. At some point the financial system will stop supporting this trend. Some adult decisions on fiscal policy are long overdue.

On the positive side, the U.S. economy is growing. While worries over a recession have increased, there is no definitive sign of one impending. Another, tailwind will likely to come in the form of more interest rate cuts by Jerome Powell and the Fed. If the unknowns around tariffs and trade decrease, global economic conditions might become more balanced.

The S&P 500 was flat over the past 12 months. However, the volatility within this timespan was noteworthy. The markets had a horrid 4th quarter last year. A friendly Fed helped calm investors’ fears and conditions stabilized. However, the crosscurrents impacting the environment are just as serious as last year which is part of the reason markets have been so hard to understand. As the Fed and the capital markets follow each other, there’s hope that working together will result in continued economic growth and calm markets.

“Duck, Duck, Goose”

/0 Comments/in Financial Planning News /by jkerrKerr Financial Group

Kildare Asset Mgt.

Jeffrey J. Kerr, CFA

Newsletter

July 15, 2019 – DJIA = 27,332 – S&P 500 = 3,013 – Nasdaq = 8,244

“Duck, Duck, Goose”

Within Wall Street’s lexicon, there are numerous animal references. Obviously, the most recognizable are the bull and the bear. But there are others including dog (underperforming stock), pigs (greedy investors), sheep (investors following the crowd), and unicorn (startup company).

As it’s widely known, the “bulls” represent optimists who are expecting higher prices. On the other hand, “bears” are worried that there is trouble ahead and believe that financial asset prices will decline. The origin of these metaphors are unclear but one explanation refers to the animals’ respective motion of attack. The bull thrusts his horns upward while a bear swipes his claws in a downward motion.

Another eccentric animal reference within Wall Street’s jargon involves ducks. Despite the vast reach of the capital markets, it’s hard to associate ducks with finance. Like many aphorisms, the origin is uncertain but the meaning is clear. The saying is “When the ducks are quacking, feed them.” The meaning is that when the public demands something new and exciting, Wall Street will find a way to give it to them. Or in other words, offer the assets that meet the demand of the buyers.

The current situation involving quacking ducks is in the IPO (Initial Public Offering) market. The flock is being fed as there was a one-month record dollar volume of IPO’s in May ($16.6 billion). The February to June stretch was the largest four month period of issuance on record.

Some of the noteworthy and highly anticipated deals in 2019 include Uber, Lyft, Beyond Meat, Chewy, The RealReal, and Slack Technologies. Further, there is excitement about upcoming offerings for WeWork, Peloton, and Postmates. Also, Saudi Arabia is considering listing ARAMCO, their government owned oil producing company. The rumors are that the deal could value the company at $2 trillion.

Of course, hot IPO’s are reserved for the largest clients. This means that the public is often shutout of the most desired deals. But remember, if the demand is there Wall Street will find a solution. In this instance, they fed the fowl by forming funds that invest in IPO’s. For example, in 2014, Renaissance Capital launched an ETF that buys IPO’s – naturally the symbol is IPO.

While the ducks are being fed, it may be the equivalent of fast food. Uber’s latest quarterly results showed revenues of $3 billion and a $1 billion loss. Lyft reported $776 million of first quarter revenue and a $1.13 billion dollar loss. WeWork’s 2018 bottom showed a loss of nearly $2 billion. None of these companies are forecasting profitability in the near future.

At the moment, investors don’t have a problem with massive and astounding losses. Of the more than 100 companies that completed a venture capital IPO since 2010, 64% were losing money.[i] Renaissance’s IPO ETF, whose holdings are bleeding red ink, outperformed the S&P 500. The ducks are indeed quacking.

One of the primary reasons such lunacy exists is low interest rates. Global central bank meddling in the fixed income markets is the main culprit. The European Central Bank (ECB) has cornered the continent’s fixed income market. They and the Bank of Japan (BOJ) have bought so many bonds in the name of stimulus that large parts of the fixed income markets trade at negative yields. It’s gotten so bad that some European junk bonds now have negative yields. In other words, some of the least credit worthy borrowers are able to issues debt without paying any interest.

While we don’t have negative interest rates in the U.S. (yet), the Fed is expected to cut rates perhaps as soon as the July meeting. As they make their decision, they are likely sensitive to the unicorn market’s needs for pre-IPO funding. Further, the Fed understands the significance of the sector’s stock market popularity.

Whether admitted or not, another Fed consideration is the stock market itself. On this front everything seems ducky. The three major averages all closed last week at record highs. Furthermore, the S&P 500 had its best “June” since 1955 and the Dow Jones Industrial Average had its best first half of the year since 1999. Here are the year to date performance number at last week’s close.

The second half of July will be the height of quarterly earnings reports. While expectations have been lowered, management’s guidance will be the focus of investors. The reports so far indicate companies don’t have a clear vision of the conditions for their markets. Trade issues and tariff uncertainty are a big part of this problem.

As mentioned in the last newsletter, there is a fair amount of caution. Professional managers had the highest levels of cash in several years and were defensively positioned. This cash won’t stay on the sidelines long especially if June’s move continues. This would result in a self-fulfilling rally as investment managers experience FOMO (fear of missing out).

This might be happening now as there are rumors of hedge funds and trading operations shutting down their short books. This is part of the portfolio that does short selling which is a bearish strategy that looks to profit from market declines. The unwinding of a short position is to buy the stock or bond back (having previously sold it). If this is what is happening, bears will become an endangered species on Wall Street as stocks keep climbing.

If the markets trade higher, it will create a favorable backdrop for upcoming IPO’s. Also, it’s possible that the current exhilaration is actually the early innings of this cycle. Nevertheless, given the lack of profitability of these unicorn companies, the IPO craze could suddenly stop. History contains prior periods of IPO euphoria ending in tears.

Being a bull on Wall Street has been fun this year. Stocks recovered from 2018’s horrible 4th quarter and December sell offs and have returned to record levels. Unicorn investing has probably been a little more fun than being a bull as the investors providing the early capital are getting a chance to cash out. In other words, the ducks are eating well. On the other hand, the bears in the Wall Street zoo have been bruised. While their population is definitely smaller, they are not totally extinct. The bulls shouldn’t get too overconfident as the ursine sloth can start to grow at any time.

[i] Tech Crunch, March 2019

“Changes in Latitude, Changes in Attitude, Nothing Remains Quite the Same”

/0 Comments/in Financial Planning News /by jkerrKerr Financial Group

Kildare Asset Mgt.

Jeffrey J. Kerr, CFA

Newsletter

June 24, 2019 – DJIA = 26,719 – S&P 500 = 2,950 – Nasdaq = 8,031

“Changes in Latitude, Changes in Attitude, Nothing Remains Quite the Same”[i]

Change is all around us and it’s all happening fast. While some changes are fleeting and only around for a short time, others have broader impacts which results in longevity. For example, fax machines are now as scarce as pay phones. On the other hand\, smartphones keep getting “smarter” and will probably be a part of our lives for many years.

Likewise, the financial markets undergo continual change. There was a time when stock trades were executed on the floor of the New York Stock Exchange. Over the years floor brokers have been replaced by computers. Further, investors used to call their brokers for quotes and market updates. Today we open an app. It used to take days or weeks to build a portfolio to simulate the S&P 500 – now it happens with the push of a button.

Aside from technological improvements, there are other notable changes in the markets. The role of central banks is among the largest and most important as they have expanded their involvement beyond the traditional tools involving monetary policy.

In times past, the Fed focused on the overnight interest rate (the fed funds rate) and money supply as their main tools to reach their goals of full employment and price stability. Depending on the chairman’s approach, interest rates were lowered or money supply increased if the economy needed assistance. It’s only in the past decade that far reaching and radical (and unproven) strategies such as quantitative easing, bank bailouts, massive money creation took place.

Within the new strategies, the foremost course of action for the world’s monetary authorities has been to buy bonds. They print money and buy the fixed income securities in the market with the goal of lowering long term interest rates and stimulating the economy. This was an ambitious effort but our monetary bureaucrats have been up to the challenge.

The big three central banks (Federal Reserve, European Central Bank, and Bank of Japan) have increased their balance sheets by approximately 355% since the beginning of the financial crisis. That’s a lot of bond buying. The graph illustrates the steady climb of central bank assets to the peak in 2018.[ii]

This graph breaks down the big three’s individual growth in holdings.[iii] The Fed stopped expanding their asset holdings in 2014 and started to reduce their balance sheet. Some believe that this played a key role in 2018’s stock market turbulence.

Central bankers claim that this policy was the most effective way to deal with the fallout from the global financial meltdown. This is a much debated point in the financial markets. Unlike the NFL, the markets don’t have replay and the ability to reverse the call. But we can question the effectiveness of the decision.

Currently, there is approximately $13 trillion of global debt that trades with a negative interest rate. Within the government bond market, the 10-year German Bund trades at a -0.326%, while the Japanese 10-year bond is at -0.158%. To be clear, those are NEGATIVE yields. In other words, investors who buy those bonds today and hold to maturity will lose money. As a point of comparison, Australian, Canadian, and English 10-year bonds trade with positive yield but all below 1.5%.

The main reason for this head shaking, illogical situation is central bank policy. The ECB and BOJ have taken over these markets. They have bought so many bonds for so long (and continue to do so) that yields are below zero. Traditionally, borrowers pay lenders an interest rate. In the modern financial system, that is not always the case.

Another debatable central bank decision is their practice of buying stocks. The Swiss National Bank’s stock portfolio is around $140 billion. They own $3 billion of Apple common stock. Further they own over $1 billion in 6 other companies – Google, Microsoft, Facebook, Amazon, Johnson & Johnson, and Exxon.

The Bank of Japan began buying stocks and ETFs (exchange traded funds) in 2010. It has accumulated around 4% of the value of the Tokyo Stock Exchange at the same time as becoming a major holder of approximately 40% of Japanese listed companies. The total of their holdings is around $225 billion.

Everyone is aware of negative interest rates, but the central bank stock portfolios are less publicized. Beyond the philosophical consideration of whether public funds should be invested in risky assets, it distorts the stock market’s price discovery function. A common response is, as long as prices go up, it has little impact. That is ok in a bull market, but any material drop could be accelerated by nervous central bankers.

Returning to the U.S. central bank, the short term interest rate was left unchanged last week but the Fed indicated that a rate cut could come as early as the July meeting. This news helped drive the S&P 500 to a new all-time high and stocks have now fully recovered May’s declines. This strong month was unexpected as past “Junes” have been a troublesome month. Here are the major averages’ performance for 2019.

As mentioned this latest rally has surprised many. Sentiment surveys showed that investors had turned pessimistic recently. In fact a recent Bank of America Merrill Lynch survey revealed that stock allocations by professional money managers had the second biggest drop in history. Also, cash holdings rose to the highest amount since 2011 when everyone was expecting further market turmoil from the crisis.[iv]

This is partially in response to worries over slowing economic growth, trade wars, and geopolitical tensions. Of course, last week’s Fed signal that interest rates will be going lower and not higher changes the perception. It would be unlikely that stocks sell off dramatically when everyone is expecting a drop.

As a reminder, the stock market went on a 6 year winning streak after 2011. Of course there are many different factors currently vs. 2011. But this extreme level of cautiousness would suggest that a lot of bad news is priced in. Further, given the punishing amount of pressure on performance, if stocks begin to rally, this money on the sidelines could chase prices higher and it could last for a while.

A few months ago the markets were struggling to determine whether the Fed would raise interest rates 2 or 3 times in 2019. Instead, faster than Apple can replace that new phone, we learned last week, Chairman Powell has softened his stance and the markets are now expecting a cut in July. There is an example of sudden change. The key to the markets isn’t about being bullish or bearish, it is now about adapting to change.

[i] Jimmy Buffett, 1977

[ii] Yardeni Research, June 2019

[iii] Ibid.

[iv] Bloomberg.com, June 18, 2019

Death and Taxes are certain…well maybe not so certain!

/0 Comments/in Financial Planning News /by jkerrKerr Financial Group

Kildare Asset Mgt.

Jeffrey J. Kerr, CFA

Newsletter

“The only difference between death and taxes is that death doesn’t get worse every time Congress meets.”

Will Rogers

Much has been written about the inescapability of death and taxes. Healthier living combined with medial progress offers some of us a mortality rescheduling. Nevertheless, there is a terminal aspect of our existence.

Concerning the second item, on July 1, 1862 President Abraham Lincoln signed the law that appointed the first Commissioner of Internal Revenue. The law also implemented a 3% tax on income between $600 and $10,000 and a 5% tax on incomes over $10,000.

Public opposition resulted in the income tax being repealed in 1872. After some back and forth in the late 19th and early 20th centuries, the 16th Amendment to the Constitution was ratified in 1913. This allowed Congress to “lay and collect taxes on incomes…” The first Form 1040 was introduced and strategies for tax reduction and tax avoidance soon followed.

From the beginning, taxes have been a controversial topic. Taxpayers constantly seek ways to reduce the amount they owe and Wall Street is always willing to assist in the effort. To this end, there is a new program that actually helps.

Within the Tax Cuts and Job Act of December 2017, there is a section “Invest in Opportunities Act” which sets up Qualified Opportunity Zones (QOZ). State governors have already chosen the areas that were designated as QOZs. If an individual or company has a realized capital gain, that amount is eligible for investment into a QOZ and will receive preferential tax treatment. QOZ assets must be used to develop and revitalize these areas.

This is how the tax deferral and reduction work. Investing your realized capital gain in a Qualified Opportunity Zone Fund will defer the tax owed. There is a 10% tax reduction if the funds are invested for 5 years and an additional 5% tax reduction if held for 2 more years (7 years total). Lastly, and perhaps most importantly, if the original Qualified Opportunity Zone Fund investment is held for 10 years, any appreciation in the value of the investment is completely tax free.

The eligible capital gains can be from the sale of any asset – property, building, business, stocks, bonds, artwork, collectables, etc. But to capture the full 15% tax reduction, the investment must done in 2019.

Below is a time line illustration from Griffin Capital. It provides a 10-year projection of key tax related events.

The formation of Qualified Opportunity Zone Funds has started. And as this is being done, there are distinct differences on the how the investment vehicles are being structured. The investment funds are generally being setup as either Real Estate Investment Trusts (REIT) or limited partnerships. Further there are differences in the type of real estate development being done. The appropriate choice is dependent on the investor’s goals, needs, and risk tolerance.

Death and taxes are certain. However, taxes driven from capital gains have a new and unique chance to be deferred and reduced. To get more information or learn more about this exciting opportunity, please contact us.

“Everyone wants to be part of the scene – See themselves pretty in a magazine”

/0 Comments/in Financial Planning News /by jkerrKerr Financial Group

Kildare Asset Mgt.

Jeffrey J. Kerr, CFA

Newsletter

April 29, 2019 – DJIA = 26,543 – S&P 500 = 2,939 – Nasdaq = 8,146

“Everyone wants to be part of the scene – See themselves pretty in a magazine”[i]

In a former time, magazines were an important part of our lives. Those of a certain age can easily remember their mailboxes being stuffed with their favorite subscriptions. In the age of smartphones and social media, millennials will never understand the excitement around the delivery of an anticipated issue by the U.S. Postal Service.

Further, magazine stands were full of periodicals on seemingly every topic and interest. And we used to casually look through various periodicals while waiting in an office lobby or doctor’s waiting room. Indeed, they were an important part of our culture.

As with the current electronically delivered versions, magazines cover issues and events in more detail than a newspaper. Further magazines often reveal and influence prevailing cultural trends. For example, Time’s “Person of the Year” is often a controversy with much debate.

Within this literary universe, there are countless magazines covering finance and economics. Naturally, covering the various topics surrounding the capital markets, viewpoints and opinions are offered. And, as with everyone who prognosticates, some forecasts are good and some miss the mark.

Professional investors and traders use magazine covers for another type of analysis. They generally believe that when a topic hits the cover of a business magazine it is an inflection point. In other words, when a trend or development become so popular that it hits the cover of newspapers and magazines, it is often a peak of its popularity, success, or usefulness.

One of the more infamous business magazine’s cover involves a stock market call that turned out to be wrong. In August 1979, Business Week ran a cover story entitled “The Death of Equities”. It was a valid viewpoint considering that in the early 1970’s stocks topped out and fell 40% before trading sideways for most of the decade. Further there was a general cultural gloom after Watergate, the Vietnam War, U.S. hostages in Iran, an oil embargo, and rapidly rising inflation. The Dow Jones Industrial Average was below 1,000 and there was very little optimism toward the stock market.

While the Business Week cover was logical, it became a sign that things were about to dramatically change. In 1982 stocks bottomed and began one of the greatest bull markets ever. Of course, there was a lot of change in those 3 years as Fed Chairman Paul Volker increased short term interest rates to double digits levels to reduce inflation. Mr. Volker began reducing interest rates in 1982 which combined with Ronald Reagan’s tax cuts and widespread economic deregulation led to a strong economy.

Another example was a March 1980 Newsweek issue with the cover asking the question “Is Inflation out of Control?” Once again, the 1970’s were marked by higher prices. This time the magazine cover timing was almost perfect with the peak of inflation. As the chart below shows, inflation topped out in 1980 and has moved lower since.

This periodical reminiscence is due to another recent magazine cover that could prove to be another historical reversal of trends. This one involves Bloomberg Businessweek which asks the question, “Is Inflation Dead?”

It is a reasonable question given the low levels of the Consumer Price Index (CPI). Also this is despite the Federal Reserve being very vocal that their goal is higher inflation. After years of printing money and buying bonds in an effort to stimulate the economy and levitate the inflation rate, the financial press is throwing in the towel. Is this a signal that conventional wisdom now believes inflation is terminally low? Also, how much of this is discounted by the markets? And finally, is it time to bet on a return of inflation?

Traditionally, real assets do well during inflation. Stocks and bonds underperform as margins get pressured and profits stagnate. In the 21st century’s global system, maybe inflation hedges take different form. Perhaps crypto currencies or other new age assets replace gold and real estate as inflation hedges. But first, let’s see if the magazine indicator does actually point to an inflation change.

If the risks of inflation are increasing, it’s being ignored by the bond market. Treasury bond yields have been plunging which means that investors are not demanding higher inflation premiums. Bondholders receive the majority of their return in coupon or interest payments. This is normally a fixed rate. This income would obviously have less buying power when we have inflation. Under these conditions, Wall Street normally sells bonds which results in yields moving up.

Last week the 10-year Treasury note closed at 2.32% which is down from 2.60% in mid-April. The 30-year Treasury bond’s yield finished the week at 2.75%. Turning to the shorter maturities, the yield on the 6-month Treasury bill was 2.4% and 3-year Treasuries were at 2.08%. The result is a flat yield curve with some inversion across some maturities. This is a more a sign of a recession than inflation. (Please see the last newsletter for information on the yield curve.)

This bond buying might be a shift to safety as the markets deal with a long list of unknowns. Trade disputes widen, global economic challenges, geo-political tensions, and a deepening political divide in the U.S.

Stocks have reacted too. The Dow Jones Industrial Average had declined for 5 straight weeks which is the longest weekly string since 2011. That sounds much worse than the actual pain as the Dow is only down 3.7% during the 5 weeks and remains 9.7% higher for 2019. Here is the breakdown of the year-to-date numbers for the major averages.

The stock and bond markets are the classic glass half full vs. half empty. Yields have been declining and the curve is flat to inverted. This is a message of economic weakness. Meanwhile, stocks have had a great year as the employment and GDP data have been supportive. The equity market’s recent dip might indicate that stocks are noticing the drop in bond yields.

The news flow can offer insight into the capital markets emotional condition. Some believe that the headlines drive the markets. Others think the markets anticipate developments and by the time it’s a headline or magazine cover, it is useless information. Inflation’s obituary by Bloomberg Businessweek is a bold extrapolation. It’s probably a good idea to watch for a resurrection in the next couple of years.

[i] Jack Antonoff, “A Magazine”

“We Can Evade Reality but We Cannot Evade the Consequences of Evading Reality”

/0 Comments/in Financial Planning News /by jkerrKerr Financial Group

Kildare Asset Mgt.

Jeffrey J. Kerr, CFA

Newsletter

April 29, 2019 – DJIA = 26,543 – S&P 500 = 2,939 – Nasdaq = 8,146

“We Can Evade Reality but We Cannot Evade the Consequences of Evading Reality”[i]

With the Mueller Report released, we’ve learned that there was no Trump – Russian collusion. Of course, this did little to reduce the controversy surrounding the Trump administration and both sides claimed the report defended their view. The investigators, now that they are done with the President, should turn their focus to the stock market because it sure looks like some collusion is going on.

The mystery in U.S. equities is the incredible and historic start to 2019 despite a backdrop of weaker fundamentals. As stocks have recovered from the last year’s 4th quarter selloff, many are wondering what is driving the buying. The global economy is slowing, the U.S. Treasury bond yield curve is flat and flirting with inversion, and corporate earnings estimates are declining. Yet stocks keep climbing.