Kerr Financial Group

Kildare Asset Mgt.

Jeffrey J. Kerr, CFA

Newsletter

–

October 26, 2020 – DJIA = 28,335 – S&P 500 = 3,465 – Nasdaq = 11,548

–

“You can look around and there’s not a sign of hypocrisy. Nothing but sincerity as far as the eye can see.”

One of the highlights of October is Halloween. A time of the year when deception and trickery is encouraged. Of course, if you are in politics, trickery is not just limited to the end of the October – it’s an everyday event. And with this being an election year (what else would you expect from 2020!), the shenanigans have increased exponentially.

Naturally, the financial markets also have their level of chicanery. Stock prices are near record highs while Main Street struggles, small businesses try to stay afloat, and the unemployment numbers remain stuck at uncomfortable levels. Many are counting on a “V” shaped economic recovery and anything different could be a material disappointment.

In addition to the economic troubles, another mystery involves the market’s rally given the massive cultural division, civil unrest, and the uncertainty over the election. Turmoil and doubt about the county’s future path would often result in volatile markets and a move to safety. Currently, however, that doesn’t appear to be the case. Rather, the capital markets are driven by optimism that the stimulus packages and economic bailouts will save the day.

Stocks are not the only asset class that is masquerading. There was a time when bonds were considered a boring but safe investment. But thanks to central banks’ intervention, they no longer fit that description. Interest rates across the markets are down to inconceivable levels. The 10-year Treasury note closed last week (October 23rd) with a yield of 0.84% which is up from a recent yield of 0.71%. The 30-year bond closed at 1.64% This means that to receive an interest rate of 3 or 4%, investors must get creative or assume a lot more risk.

Instead of offering investors interest payments, many of today’s fixed income securities exchange hands with negative yields. In other words, the price of the bond (the price that it is traded at after it has been issued) is so high that the interest payments don’t offset the premium paid. The total return is negative.

The European Central Bank, the Bank of Japan, and other central banks buy bonds in the secondary market as a stimulus tool This massive demand forces prices higher and the result is that the higher price outweighs the interest rate received – a negative yield. With central banks cornering the fixed income markets, those who are forced to buy bond (fixed income mutual funds, insurance companies, etc.) must overpay for the securities they need.

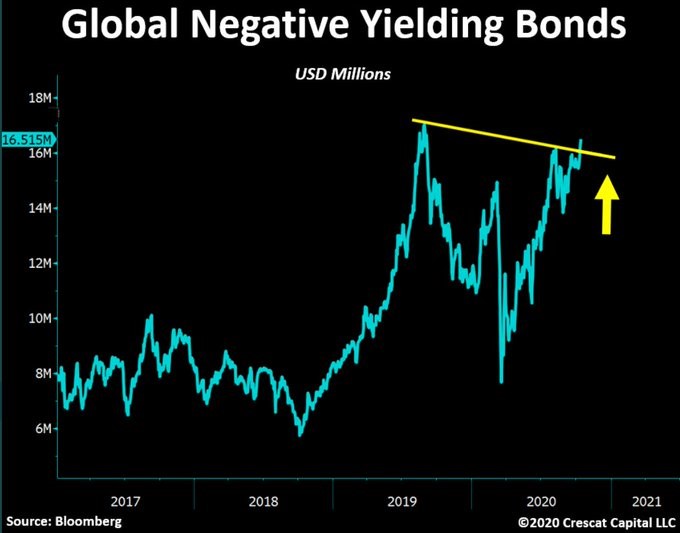

The graph below shows the total amount of bonds (as measured in U.S. dollars) that have negative yields. After a drop in the amount of negative yielding bonds in the spring, we are again approaching record levels. Massive stimulus, which includes central banks (the Federal Reserve) buying bonds to save the economy, is the chief reason behind this.

With so much of the world’s bonds trading at prices that result in negative interest rates, fixed income securities are massively mispriced. This impacts many other sectors of the financial markets as fixed income securities can no longer offer lower risk. This forces conservative capital to move somewhere else. Which then causes imbalances in other markets.

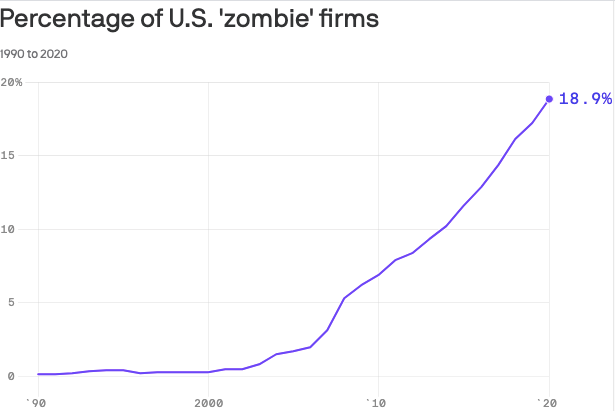

An example of this rippled distortion is the high number of zombie companies. A zombie company is a highly leveraged, unprofitable organization that uses the bond market as a source of cash and capital. Unfortunately, these zombies, if they can get funding, survive past Halloween.

Under normal conditions, these companies would go out of business because a lack of profits and additional funding. Central bank manipulation and bond buying injects money into the markets which eventually reaches the riskiest sectors including the zombies. Without this liquidity, they would fail. That wouldn’t be all bad as their demise would reward the zombies’ profitable competitors which would strengthen the economy with higher growth rates.

Along with Halloween, it is also earnings season. This raises the question of which one will be scarier. The quarterly results, in general, have been good but the stock market’s reaction has not reflected these earnings reports. The major stock averages declined last week as spooked investors were more concerned the possibility of an increase in Covid-19 and delays in the getting another round of stimulus approved. Given that a lot of the economy remained constricted or shutdown, the better than expected corporate earnings could be an encouraging sign for a continued recovery.

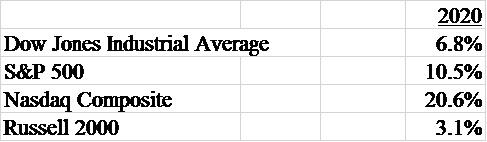

Here is where the major averages closed on October 23rd.

Everyone is aware of the Great Pumpkin’s reputation of only visiting sincere places so clearly, the corner of Wall and Broad Streets and Washington D.C. won’t be on the itinerary. However, like the Great Pumpkin’s mystical power, there might be a larger force behind the stock and bond markets peculiar ability to remain higher as the world is crumbling.

Modern Monetary Theory (MMT) is a controversial approach that might be the driving force behind the capital markets. First, MMT uses fiscal policy to impact the economy. It calls for printing unlimited amounts of money and giving to the federal government to spend. Budget deficits, according to this, are not a concern. The only risk is inflation. But if that happens, taxes are raised, and this is supposed to slow demand and eventually calm inflation.

One of the first to embrace MMT was Bernie Sanders as he included it as his economic policy for his latest presidential campaign. It was the cornerstone as the method of financing the expansive social programs that he was to implement. Outside of Sanders’ supporters, MMT has been widely criticized and disparaged by traditional economists.

Difficult times call for desperate decisions and it sure looks like the Federal Reserve and the Federal Government borrowed Bernie’s playbook in battling the economic shutdown. During 2020 we have printed a lot of money and expanded the Federal Governments deficit to unimaginable levels.

A measurement of the money that is in circulation is the Federal Reserve’s balance sheet. The Treasury Department may print the currency, but the Fed puts the money into the banking system. This distribution process puts the dollar bills on the Fed books.

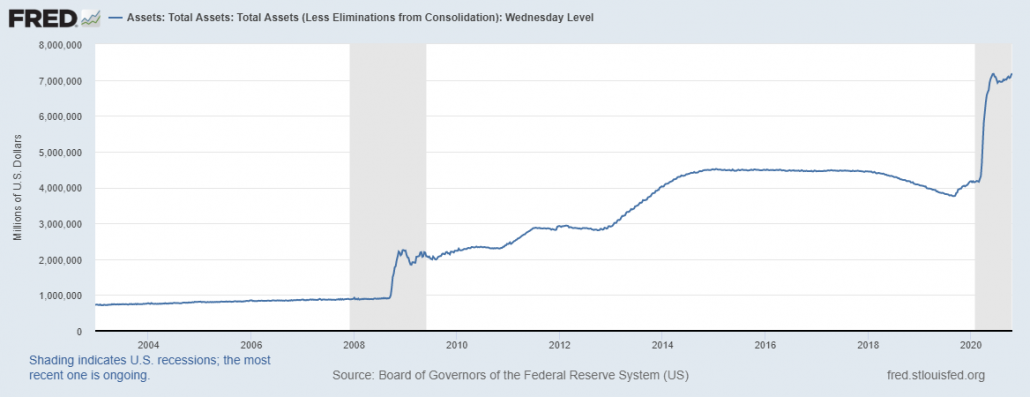

Below is a graph of assets held by the Fed. To be clear, these ‘assets’ were bought by the dollars the Fed put into the banking system so money supply is the other side of the ledger. Before the financial crisis on 2008-09, these assets totaled less than $1 trillion. This quickly quadrupled to over $4 trillion by 2014 through the countless QE programs.

The Fed attempted to normalize monetary policy and return their balance sheet to more traditional levels in 2018 and 2019. However, the bailouts, PPP, and various stimulus programs have pushed the total of assets held at the Fed to the current heights. Of course, the Federal Government’s budget deficit will be equally astounding which gives the current situation all the markings of Modern Monetary Theory.

As measured solely by the rebound of the financial markets and the economy, so far so good. This incredible amount of liquidity injected into the economy has certainly helped in pushing up the financial markets. And until there some signs of inflation, central bankers have little appetite to turn off the printing presses.

However, there is typically some unintended consequences when untested theories are put into place. It’s not being discussed but there is risk that inflation isn’t brought under control as easily as predicted. Further, history has shown that high growth in the money supply causes bubbles to arise. The downside to MMT aren’t limited to these goblins as there are many other dangers that could develop. We must remember, there’s no free lunch.

In the meantime, whether Bernie Sanders gets credit or not, further increases in stock prices and financial assets could be in the future. This economic trick or treat could keep going until everyone fills their bags with candy. But like believing in the Great Pumpkin, as long as there is confidence in the Fed’s ability to deliver, the system carries on with only Charlie Brown getting the rocks.

“We Are All Pilgrims in Search of The Unknown”

/0 Comments/in Financial Planning News /by jkerrKerr Financial Group

Kildare Asset Mgt.

Jeffrey J. Kerr, CFA

Newsletter

November 30, 2020 – DJIA = 29,910 – S&P 500 = 3,638– Nasdaq = 12,205

“We Are All Pilgrims in Search of The Unknown”

In the early 1600s the Pilgrims moved from England to Holland seeking separation from the Church of England. While the Netherlands provided religious tolerance, the Pilgrims didn’t completely fit into the culture and in 1620 they left Europe looking to start a community in the New World.

One wonders what was stronger – desperation or determination. It’s hard to understand what would cause a group to give up an established but perhaps unpleasant existence to risk their lives to travel to an unknown and uninhabited part of the world and completely start over. It gives a hint to the cultural and religious persecution of the 17th century.

The difficult trip took over 60 days and Mayflower landed in what would become Massachusetts in November. The ship was blown off course and landed north of the intended destination which was near the Hudson River and within the jurisdiction of the Virginia Company. Only about half of those who set foot on Plymouth survived the winter.

Since they were outside of the Virginia territory, they felt they should establish their own rules of governance. An agreement was written which became to be known as the Mayflower Compact and everyone signed it including many non-Pilgrims. It setup a representative government with elected leaders and played a key role as the area flourished and, 150 years later, it influenced the United States Constitution.

Progress has improved many parts of our lives in the last 400 years. Unfortunately, human nature doesn’t change which means we are constantly at risk of repeating past mistakes. This might explain what looks to be a return of religious intolerance.

As part of the pandemic shutdown, churches, synagogues, and other places of worship were closed. Upon re-opening, occupancy restrictions were implemented which were similar to what were imposed to other organizations. However, as time passed it seemed that churches and synagogues were scrutinized for violations.

In early October, synagogues in Brooklyn were ordered to be limited to 10 people. The order was handed down just before two holidays that are traditionally involve large gatherings. Elsewhere in the state, churches were ordered to limit attendance while looser restrictions were imposed on other parts of our lives.

Last week the United States Supreme Court ruled against New York State and Governor Andrew Cuomo’s restrictions on places of worship. The Court determined that the regulations on religious facilities were more restrictive than secular ones. The ruling opinion cited the First Amendment and included “But even in a pandemic, the Constitution cannot be put away and forgotten” as reasons for the ruling.

The divide and acrimony taking place throughout the United States will likely result in a revisiting of this issue. The recent Supreme Court ruling will initiate other efforts against churches and religious groups. The intolerance that the Pilgrims sought to escape is becoming a larger part of today’s culture.

Religious oppression reaches beyond limiting the size of worship services. Being a person of faith is culturally unacceptable and results in being stereotyped as a Bible hugging, smallminded, luddite. And religion is only one sector of the multi-faceted on-going civil war.

Despite the historic upheaval and discord, the financial markets function as if we have arrived in heaven. U.S. stocks are having one of their best months in history. The Russell 2000 has jumped 20% in November and the Dow Jones Industrial Average, the S&P 500, and the Nasdaq have all rallied over 10% in the month. What a remarkable move.

The Russell is the largest of these four indexes and is comprised of smaller companies. Its outperformance is a sign of broadening within the U.S. equities market. Historically, this can be a sign of further gains.

Here are the major averages year-to-date performance as of November 27th.

The mystery behind the market’s climb in face of widespread turmoil has several explanations. First, there appeared to be a lot of nervousness going into the election. The wide differing implications of the outcome forced many to get defensive. It’s not clear which candidate caused more market fear, but when everyone realized that life would go on, investors stopped selling and returned to buying.

Along with getting past the election, the markets are anticipating an effective COVID vaccine and a complete economic re-opening. This would include re-hiring of the idled workers, increased consumer spending, and capital investments. The expectation of starting on the path of economic growth helped drive the recent rally.

From a corporate earnings perspective, 2021 will look a lot better than 2020. Markets discount future events and Wall Street believes that the U.S. will get through the pandemic. This will help company bottom lines and the capital markets love to see an improving trend more than the absolute level of the numbers. So, if the data is moving from lower left to upper right, the markets will be happy.

Another development that has helped the stock market has been a declining U.S. dollar. The dollar index (symbol = DXY) began November at 94.12 and ended last week at 91.79. This is normally a low volatility index, so this is a material move. The 30-day correlation between the S&P 500 and the U.S. dollar is -.87. The negative number indicates the two factors move in opposite directions and it strengthen as it approaches 1 or -1. This recent weakening of the dollar has undoubtedly helped push the stock market higher.

This landscape could remain supportive for a while longer. Our fiscal deficits and the prospect of increased borrowings are a significant drag on the greenback. If the correlation remains deeply negative, stocks could keep rising.

The United States is facing several historic crises. The pandemic, the election, the possibility of adding new states, and social division can strongly impact the direction of the country which will influence the economy and the markets. As the Pilgrims’ bold actions changed history, we could be at a similar point. The resolution of the issues we are facing will have a long-lasting effect.

“You can look around and there’s not a sign of hypocrisy. Nothing but sincerity as far as the eye can see.”

/0 Comments/in Financial Planning News /by jkerrKerr Financial Group

Kildare Asset Mgt.

Jeffrey J. Kerr, CFA

Newsletter

–

October 26, 2020 – DJIA = 28,335 – S&P 500 = 3,465 – Nasdaq = 11,548

–

“You can look around and there’s not a sign of hypocrisy. Nothing but sincerity as far as the eye can see.”

One of the highlights of October is Halloween. A time of the year when deception and trickery is encouraged. Of course, if you are in politics, trickery is not just limited to the end of the October – it’s an everyday event. And with this being an election year (what else would you expect from 2020!), the shenanigans have increased exponentially.

Naturally, the financial markets also have their level of chicanery. Stock prices are near record highs while Main Street struggles, small businesses try to stay afloat, and the unemployment numbers remain stuck at uncomfortable levels. Many are counting on a “V” shaped economic recovery and anything different could be a material disappointment.

In addition to the economic troubles, another mystery involves the market’s rally given the massive cultural division, civil unrest, and the uncertainty over the election. Turmoil and doubt about the county’s future path would often result in volatile markets and a move to safety. Currently, however, that doesn’t appear to be the case. Rather, the capital markets are driven by optimism that the stimulus packages and economic bailouts will save the day.

Stocks are not the only asset class that is masquerading. There was a time when bonds were considered a boring but safe investment. But thanks to central banks’ intervention, they no longer fit that description. Interest rates across the markets are down to inconceivable levels. The 10-year Treasury note closed last week (October 23rd) with a yield of 0.84% which is up from a recent yield of 0.71%. The 30-year bond closed at 1.64% This means that to receive an interest rate of 3 or 4%, investors must get creative or assume a lot more risk.

Instead of offering investors interest payments, many of today’s fixed income securities exchange hands with negative yields. In other words, the price of the bond (the price that it is traded at after it has been issued) is so high that the interest payments don’t offset the premium paid. The total return is negative.

The European Central Bank, the Bank of Japan, and other central banks buy bonds in the secondary market as a stimulus tool This massive demand forces prices higher and the result is that the higher price outweighs the interest rate received – a negative yield. With central banks cornering the fixed income markets, those who are forced to buy bond (fixed income mutual funds, insurance companies, etc.) must overpay for the securities they need.

The graph below shows the total amount of bonds (as measured in U.S. dollars) that have negative yields. After a drop in the amount of negative yielding bonds in the spring, we are again approaching record levels. Massive stimulus, which includes central banks (the Federal Reserve) buying bonds to save the economy, is the chief reason behind this.

With so much of the world’s bonds trading at prices that result in negative interest rates, fixed income securities are massively mispriced. This impacts many other sectors of the financial markets as fixed income securities can no longer offer lower risk. This forces conservative capital to move somewhere else. Which then causes imbalances in other markets.

An example of this rippled distortion is the high number of zombie companies. A zombie company is a highly leveraged, unprofitable organization that uses the bond market as a source of cash and capital. Unfortunately, these zombies, if they can get funding, survive past Halloween.

Under normal conditions, these companies would go out of business because a lack of profits and additional funding. Central bank manipulation and bond buying injects money into the markets which eventually reaches the riskiest sectors including the zombies. Without this liquidity, they would fail. That wouldn’t be all bad as their demise would reward the zombies’ profitable competitors which would strengthen the economy with higher growth rates.

Along with Halloween, it is also earnings season. This raises the question of which one will be scarier. The quarterly results, in general, have been good but the stock market’s reaction has not reflected these earnings reports. The major stock averages declined last week as spooked investors were more concerned the possibility of an increase in Covid-19 and delays in the getting another round of stimulus approved. Given that a lot of the economy remained constricted or shutdown, the better than expected corporate earnings could be an encouraging sign for a continued recovery.

Here is where the major averages closed on October 23rd.

Everyone is aware of the Great Pumpkin’s reputation of only visiting sincere places so clearly, the corner of Wall and Broad Streets and Washington D.C. won’t be on the itinerary. However, like the Great Pumpkin’s mystical power, there might be a larger force behind the stock and bond markets peculiar ability to remain higher as the world is crumbling.

Modern Monetary Theory (MMT) is a controversial approach that might be the driving force behind the capital markets. First, MMT uses fiscal policy to impact the economy. It calls for printing unlimited amounts of money and giving to the federal government to spend. Budget deficits, according to this, are not a concern. The only risk is inflation. But if that happens, taxes are raised, and this is supposed to slow demand and eventually calm inflation.

One of the first to embrace MMT was Bernie Sanders as he included it as his economic policy for his latest presidential campaign. It was the cornerstone as the method of financing the expansive social programs that he was to implement. Outside of Sanders’ supporters, MMT has been widely criticized and disparaged by traditional economists.

Difficult times call for desperate decisions and it sure looks like the Federal Reserve and the Federal Government borrowed Bernie’s playbook in battling the economic shutdown. During 2020 we have printed a lot of money and expanded the Federal Governments deficit to unimaginable levels.

A measurement of the money that is in circulation is the Federal Reserve’s balance sheet. The Treasury Department may print the currency, but the Fed puts the money into the banking system. This distribution process puts the dollar bills on the Fed books.

Below is a graph of assets held by the Fed. To be clear, these ‘assets’ were bought by the dollars the Fed put into the banking system so money supply is the other side of the ledger. Before the financial crisis on 2008-09, these assets totaled less than $1 trillion. This quickly quadrupled to over $4 trillion by 2014 through the countless QE programs.

The Fed attempted to normalize monetary policy and return their balance sheet to more traditional levels in 2018 and 2019. However, the bailouts, PPP, and various stimulus programs have pushed the total of assets held at the Fed to the current heights. Of course, the Federal Government’s budget deficit will be equally astounding which gives the current situation all the markings of Modern Monetary Theory.

As measured solely by the rebound of the financial markets and the economy, so far so good. This incredible amount of liquidity injected into the economy has certainly helped in pushing up the financial markets. And until there some signs of inflation, central bankers have little appetite to turn off the printing presses.

However, there is typically some unintended consequences when untested theories are put into place. It’s not being discussed but there is risk that inflation isn’t brought under control as easily as predicted. Further, history has shown that high growth in the money supply causes bubbles to arise. The downside to MMT aren’t limited to these goblins as there are many other dangers that could develop. We must remember, there’s no free lunch.

In the meantime, whether Bernie Sanders gets credit or not, further increases in stock prices and financial assets could be in the future. This economic trick or treat could keep going until everyone fills their bags with candy. But like believing in the Great Pumpkin, as long as there is confidence in the Fed’s ability to deliver, the system carries on with only Charlie Brown getting the rocks.

“Now I Know My ABC’s, Next Time Won’t You Sing With Me”

/0 Comments/in Financial Planning News /by jkerrKerr Financial Group

Kildare Asset Mgt.

Jeffrey J. Kerr, CFA

Newsletter

September 28, 2020 – DJIA = 27,173 – S&P 500 = 3,298 – Nasdaq = 10,913

“Now I Know My ABC’s, Next Time Won’t You Sing With Me”

Meteorology has run out of letters. The process of naming tropical storms and hurricanes has reached the end of the alphabetical runway and this has forced weather people to move to Greek letters. To be sure, range of storms that are named is wider and the threshold is lower than in the past. Nevertheless, it becomes another amazing event of 2020.

It’s unclear if this will have any impact the current ongoing civil war, but things are so acrimonious even an insignificant blip like this can push people over the edge. The New York Times will report that it’s all President Trump’s fault for not instituting more letters to our alphabet. FOX News will proclaim that the Democrats wouldn’t allow an expanded alphabet without additional funding for Central Park’s barley farmers.

Ruth Bader Ginsburg’s death will also sharpen the differences between the country’s polarized groups. Controversy on confirming her replacement will add to the extraordinary and lengthy list of events making 2020 an astonishing year.

Impeachment, COVID, economic shutdown, protests, riots, job losses, and all the stressful issues have impacted everyone. Fatigue is commonplace. The graph below is from the Pew Research Center and shows America’s anger, frustration, and dissatisfaction. With so much disagreement within our society, it is easy to understand that 87% of respondents were dissatisfied “with the way things are going in this country today”. As shown, this is up from the 68% area where it has been for the past 3 years.

Further, when having to choose between “Angry”, “Fearful”, “Hopeful”, and “Proud” as the answer to “in thinking about the state of the country these days”, a wide majority say they feel “Angry” and “Fearful”. It’s not a surprise to see that the answer “Proud” was a distant last. It will be a societal marathon to return to anything resembling togetherness, but the United States has faced enormous challenges and will survive.

Another disconcerting divide is the one between Main Street and Wall Street. Job losses continue grow, people battle to pay their bills, and businesses struggle to re-open. At the same time, the stock market reached all-time highs in early September.

The capital markets are obviously expecting a quick and far reaching economic rebound. The popular cliché is a “V” shaped recovery with the letter “V” representing the direction of the economy (sudden and sharp drop followed by a quick recovery to its previous levels). It’s what the stock market is counting on.

Naturally, there are some less optimistic forecasts. Staying with the alphabet, some are predicting a “W” recovery. In other words, a sharp decline followed by a recovery that peaks at a much lower level. This is followed by a return to the depths of the recession which is then followed by a complete recovery of the previous high level of economic activity. The “W” recovery normally has a much longer timeline as compared to a “V” shaped bounce with more pain in finding a base where the system can bounce from.

Another letter that is used for economic predictions is “U”. This is an unpopular character as it suggests that, after the initial drop in the economy, activity stays weak and bounces around the lower level for an extended period. When the recovery finally arrives, it takes the economy back to previous strong levels. Again, this is not an enjoyable process.

Some are pointing to a fourth alternative that is represented by the letter “K”. This is a complicated scenario and is illustrated below. As shown, economic activity bounces as the shutdown is lifted. However, after the initial push, the system fragments into two paths with diverse outcomes for various sectors of our society.

According to JP Morgan, demographic groups like the wealthy and white-collar workers will do well. On the other hand, the middle class, blue collar, and small businesses suffer as these groups encounter further headwinds and don’t benefit from the Fed’s programs and Washington’s bailout of large companies. Under this development, there would likely be more social division rather than healing. The paths of economic convergence after the separation have many and unpredictable possibilities.

The “W”, “U” and “K” scenarios are the least desirable and maybe the stock market is realizing that the “V” is far from certain. After peaking in early September, the Dow Jones Industrial Average and S&P 500 have declined 4 weeks in a row. The Nasdaq had a small gain last week after falling for 3 consecutive weeks. The major indexes fell below their 50-day moving averages for the first time since April.

Despite the recent dip, the stock market benchmarks remain near record highs. Here are the year-to-date returns for the major averages as of September 25th.

After a bounce in economic data during the summer, there are signs of slowing. Initial jobless claims last week were 870,000. Although this was higher than forecast, the number has been declining in recent weeks and the 4-week moving average is at 878,250. Nevertheless, this number means that almost 1 million people are filing for unemployment benefits for the first time each week. This needs to be a lot lower in order for the economy to return to normal conditions.

August’s reported unemployment rate was 8.4%. This was a significant decline from 10.2% in July and was below the forecasted 9.8% level. As the economy reopens, the number of people returning to work naturally increases and the unemployment rate decreases. The headwind to future progress in this area is the prospect of small businesses not reopening. This number will have a material multiplier effect on the economy.

The Conference Board’s Leading Economic Index reading rose 1.2 percent in August to 106.5. That is good but is lower that July’s 2 percent gain and June’s 3.1 percent increase. The press release included the following, ““While the US LEI increased again in August, the slowing pace of improvement suggests that this summer’s economic rebound may be losing steam heading into the final stretch of 2020”.

As troublesome as the current state of society is, there is a good chance it worsens. The replacement for Justice Ruth Bader Ginsburg, the presidential campaign, the ongoing protests and riots, and a contested election are events that we must work through in the next couple of months. It’s easy to think that these developments will contribute to our country’s angst.

How this impacts the economy and the markets is a difficult forecast. Stocks have set records in the face of cities being burned and a modern civil war. Perhaps the capital markets can continue to move higher despite our discord. However, some worry that like running out of letters in the alphabet, the financial markets will run out of optimism over the arrival of cultural healing and a rebounding economy.

“We the People of the United States…”

/0 Comments/in Financial Planning News /by jkerrKerr Financial Group

Kildare Asset Mgt.

Jeffrey J. Kerr, CFA

Newsletter

August 24, 2020 – DJIA = 27,930 – S&P 500 = 3,397 – Nasdaq = 11,311

i

“We the People of the United States…”

The battle between individual freedom and the public good is rarely at rest. But in 2020, of course, this friction has erupted into an out of control, five alarm fire. An economic shutdown and quarantine requirements were enforced as government officials accessed the situation. It’s unclear what risk analysis was undertaken but it’s unmistakable that individual freedoms were sacrificed for the public good.

As the world tried to navigate the pandemic, the daily count of cases and deaths was the focus. This is a direct and easy to understand measurement. Other costs of the shutdown are harder to quantify and they were not widely discussed. In economic terms, GDP might be an acceptable approximation. But looking at the cost in terms of increased mental illness, abuse, depression, and suicide has not been widely examined. Granted, these are complicated, but they were clearly deemphasized.

The lack of balance between the individual and the state combined with the historic social division and an economic shutdown has resulted in extraordinary times and unprecedented uncertainty. A logical person would conclude the capital markets were in chaos.

In fact, it’s been the opposite. The Dow Jones Industrial Average and the S&P 500 just finished their best 100 days since 1933. It is the best 100 day move for the Nasdaq Composite since 2000. The Dow and S&P 500 are both up over 50% during this time while the Nasdaq has jumped over 60%.

Of course, there was an equally historic plunge preceding this surge. As stocks have returned to record levels, it is easy to forget the pain of late February into March. The S&P 500 dropped 34% in 5 weeks. The day after what subsequently became the bottom in the stock market (March 24th), The Wall Street Journal’s headline declared “Markets Melt Down at Fastest Pace Ever”.

What a ride is has been! Putting these developments into a picture, below is a chart of the S&P 500 for the past 12 months.

S&P 500 closed last week at a record high and it was the 4th consecutive week of advancing. Here are the year-to-date returns for the major averages as of August 21st.

The bounce from the March lows has been momentous but also selective. Large cap technology stocks (Nasdaq) have been the big winners with Apple, Amazon, Facebook, Microsoft and Google responsible for most of the lifting. Apple recently became the first company to reach a $2 trillion valuation.

The narrowness of the rally is also shown in the difference between the performance of the Nasdaq Composite and the S&P 500. The Nasdaq had outperformed the S&P 500 by over 25 percentage points. While there is overlap within the composition of both indexes, especially among the largest companies, S&P has less concentration in technology and consequently it is lagging the Nasdaq. The Russell 2000, which is mostly smaller companies, is trailing the Nasdaq by over 33 percentage points.

As wide as the gap is between the Nasdaq and Russell, it’s nothing compared to the abyss between Wall Street and Main Street. While the Nasdaq has made over 30 record highs, much of the economy is straining to stay afloat.

Stores and restaurants form the foundation of Main Street and they have been destroyed by the shutdown. Retailing and operating a restaurant are difficult ventures in a good economy but are exponentially harder now. Aaron Allen & Associates, industry consultants, expect 35% of U.S restaurants to permanently close.

It’s a similar story for retailers as many have filed bankruptcy. Some of the iconic names are J.C. Penney, Lord + Taylor, J. Crew, Brooks Brothers, and Modell’s. Including all businesses, 2020 is seeing record bankruptcies. Below is a chart with the number of companies filing this year through August 9th. 2020 trails 2010 but this year could easily exceed the record as forbearances end.

With record unemployment and economic uncertainty, consumers could reduce spending habits for an extended period. The pain would travel past stores and eateries to such things as cars, travel, and entertainment. As a reminder, our pre-Covid economy was highly dependent on consumption and a timid consumer would hurt any recovery.

As a possible sign of things to come, here is a chart that compares the unemployment rate with the delinquency rate on consumer loans. The data covers over 50 years and there is a material correlation between the two. Consumer loans include loans such as personal, car, home equity, and property improvement.

This brings us back to the seemingly universal question, why is the stock market doing well when everything is so bad. A partial explanation is the confidence in a quick and strong recovery after the shutdown ends. This might happen but it gets more priced in every day that stocks rise as the shutdown lingers. This could result in disappointment if we don’t rebound or do get a second wave of the virus.

Another important boost for the capital markets is the Fed. Besides the stimulus programs by the federal government, the Fed has been active in the bond market by buying bonds and providing systemic liquidity.

Some indicators of their involvement are the money supply and the size of their balance sheet. The money supply has expanded by 62% in the past 3 months and 78% in the past 6 months. Their balance sheet (a sign of how big their programs are) has grown from $3.8 trillion to $6.2 trillion in the past 5 months. They have used a lot of ammunition to support the economy.

The Federal Reserve can print money, and this is an important tool. The markets understand it and have responded by rising. There will be unintended consequences but Jerome Powell and staff are willing to take that chance. If investors remain confident in their abilities, the markets will continue to behave. On the other hand, any doubts by Mr. Market will be tumultuous.

Whether designed or not, 2020 has produced a series of events that have disrupted society and appear to be threatening the foundation of the United States. Censorship vs. freedom of speech, economic authoritarianism vs. opening the economy, and Democrats vs. Republicans to name a few. Our country has survived other chaotic situations and frenzied challenges. It’s a good bet that we do it again. The markets are counting on it.

“We Steal From the Rich and Give to the Poor”

/0 Comments/in Financial Planning News /by jkerrKerr Financial Group

Kildare Asset Mgt.

Jeffrey J. Kerr, CFA

Newsletter

July 20, 2020 – DJIA = 26,671 – S&P 500 = 3,224 – Nasdaq = 10,503

“We Steal From the Rich and Give to the Poor”

As with so many other parts of our lives, the capital markets are doing things differently. The New York Stock Exchange, for example, had to close the trading floor for several weeks and all business was done remotely. Tax deadlines were moved which pushed back some filing and reporting requirements. And like the rest of the country, Wall Street has incorporated Zoom meetings and webinars as a method of communicating.

Another pandemic related change is the spike in the popularity of the Robinhood trading platform. Robinhood Financial is a securities brokerage company that is trying to make the investing process easy. According to their website, they offer “Investing for Everyone”.

Their goals go beyond simplicity as they also offer unlimited free trading. And if a Robinhood user doesn’t have the money to buy a single share of Amazon (closed last week at $2,961 per share) or even Google ($1,515 per share), users can buy fractional shares of any stock.

However, Robinhood accounts don’t always buy blue chips. In fact, it seems that the most popular positions are the junkiest companies. One of the largest positions on the Robinhood platform was Hertz (symbol HTZ). In case you didn’t know, Hertz filed for bankruptcy protection earlier in the year. Chapter 11 filings typically make the company’s common stock worthless. That didn’t stop the “Robinhoodies” from trading the stock and moving it from $1 per share at the end of May to over $6 in June. It has since fallen back below $2 per share. It’s no mystery that there are websites devoted to tracking the largest Robinhood positions.

It’s unclear what role Robinhood investors played in the stock markets’ bounce from the March lows. Of course, it could an inverse relationship – the stock markets’ rebound has encouraged Robinhood users to flock to the stock market. With sports gambling closed because there was nothing to bet on, bettors could have been lured to the financial markets for some action.

This leads to another related development – the return of day trading. Brokerage accounts, including Robinhood, are seeing a surge in new accounts being opened by individuals. Retail trading volume (individuals) set a record in March. April and May both approached the March level and June is forecasted to exceed March.

The stock markets’ allure is not exclusive to Americans. According to Grant’s Interest Rate Observer (July 10, 2020), individuals are responsible for 20.5% of all of Tokyo’s trading since the beginning of April. That compares to a 16.6% share in 2019. Thailand saw record high volumes last month helped by retail orders. In Singapore, household accounts have net purchased 5.46 billion of Singapore dollars ($3.9 billion) of stock between March 2 and June 22. This exceeds the S$5.13 billion of net sales by institutions. As Jim Grant summarized, “Soccer move over. The world has a new universal pastime.”

It’s easy to believe that all of this fits into a financial fairytale and everybody lives happily ever after. Unfortunately, there have been numerous nightmares for Robinhood users. The New York Times reported that after analyzing filings “More than at any other retail brokerage firm, Robinhood’s users trade the riskiest products and at the fastest pace” (July 8, 2020). It takes unique talent to trade risky securities or to trade frequently. To do both is special.

The company admits that their average customer is young and inexperienced. Unfortunately, The NYT article tells the tale of a 20-year old college student who committed suicide after seeing his Robinhood balance had dropped over $700,000. Sadly, the information was not completely accurate as some trades that would have reduced the loss in value were not included.

As the stock markets have rallied, investors naturally looked for good advice and information. And just like Robinhood provided a new way to trade, Dave Portnoy offered advice. Mr. Portnoy founded Barstool Sports which began life as a Boston newspaper. It covered the local sports including betting guidance and fantasy sports forecasts. However, the Celtics and Red Sox weren’t the only topics. Pizza reviews became a staple as Dave Portnoy would rank various restaurants. As the internet took off, Mr. Portnoy moved his content there and it became a media sensation. Barstool Sports sold a majority stake to a larger media company in 2016 and then sold 36% of the company to Penn National Gaming earlier this year. It is worth an estimated $450 million.

With sports gambling, bars and pizza parlors shut down, Portnoy switched his attention to trading stocks. “Davey Day Trader” offered trading tips via webcasts and, like Robinhood, ruffled some Wall Street feathers. Portnoy took on Warren Buffett as he blasted him for selling airline stocks in March. Davey Day Trader was buying them and after they recovered, he told his viewers “I’m sure Warren Buffett is a great guy but when comes to stocks he’s washed up. I’m the captain now”.

As stocks kept climbing, Portnoy took a victory lap telling viewers, “Say it with me…stocks only go up! Only losers take profits!”. A recent “Davey Day Trader” strategy involved randomly picking letters from a game of Scrabble to determine the next stock symbol to buy. Obviously, this is a slightly different method from scouring financial statements or developing a sophisticated computer algorithm.

Robinhood users, Davey Day Trader, and investors of all types are delighted with the stock markets’ rally since March. In recent weeks the markets have been influenced by COVID-19 news and policy responses from Washington. Increasing case numbers are bad news while vaccines developments and increased relief programs encourage the bulls.

COVID and Washington might play a lesser role over the next several weeks as 2nd quarter financial results will be reported. With the pandemic and shutdown, the expectations are low. An important part of this will be managements’ view of the future. Most companies have stopped giving guidance because of widespread economic uncertainty, but investors will be eager for any nugget on future business conditions. Here are the year-to-date returns for the major averages as of July 17th.

In other markets, bond yields remain at record lows with the 10-year yield closing at 0.63% on July 17th. The dollar weakened slightly last week. The dollar index (a basket of foreign currencies relative to the U.S. dollar) was down to 96. This is approaching the low for the past 52 weeks at 94.90. A weaker currency often leads to higher inflation – something the Fed has been unable to accomplish.

Inflation might be in the future. Lumber prices spiked 60% in the second quarter after falling in the first quarter due to the economic shutdown. The precious metals have been on a steady climb and gold is up 19% in 2020. Oil has recovered from the plunge earlier in the year and base metals, agriculture, livestock are all gradually moving higher.

There has never been a year like 2020. Apps offering free stock trading and sports gamblers giving investing advice are not out of place. It should be no surprise that both have, with some exceptions, a good year while Wall Street veterans have been challenged. Robinhood and Davey Day Trader have carved out a place in the markets. It will be interesting to see how they do in the next correction or bear market.

“Ignorance is Bliss”

/0 Comments/in Financial Planning News /by jkerrKerr Financial Group

Kildare Asset Mgt.

Jeffrey J. Kerr, CFA

Newsletter

June 29, 2020 – DJIA = 25,015 – S&P 500 = 3,009 – Nasdaq = 9,757

“Ignorance is Bliss”

According to the stock market, there isn’t much to worry about. Equities in the U.S. have rebounded from the nasty pandemic selloff and are sending a signal that the economy has returned to the road of stability and growth.

On the other hand, according to the headlines, there isn’t much not to worry about. Social division, conflict, and turmoil dominate our existence. Add to this the economic shutdowns, historic unemployment, and widespread rioting and we get a different story than that of the upbeat stock market.

Logic would suggest that these opposing worlds cannot diverge forever. The equity markets trade as if humanity has risen to a utopian state. This is happening while society faces countless challenges and uncertainties as we adjust to a vastly different way of life. Never have we encounter so many cultural unknowns. Either our society and economy regain the vitality of past couple of years or stock prices need to retreat.

As far as achieving an idyllic cultural condition, some may already have. With enhanced unemployment benefits, one-time stimulus checks, mortgage forbearance, and suspended car and credit card payments, workers are being paid for staying home while having their financial commitments suspended.

Below is a chart showing the number of weekly unemployment claims. Everyone knows that a lot of people are out of work, but this picture is worth a thousand words. It illustrates how remarkable the situation is. Continued weekly claims filed reached 25 million in June which is 5 times the peak in the last financial crisis. Continuing claims or those filing for unemployment each week remains at around 20 million.

Here is a related chart showing the amount of stimulus money households received in April. The total is $3.12 trillion dollars. Again, we know the Treasury sent out a lot of stimulus, but this shows how astounding that amount is. There has never been anything close to this level of assistance.

These numbers paint a picture of what is happening on Main Street. It is gravely different from the stock market’s view. Hopefully, the job market and the general economy begin to improve as businesses re-open. In other words, the much predicted “V” shaped bounce. However, given the severity of unemployment, there is a much to recover. Also, there is risk of a day of reckoning with some portion of stimulus recipients that must start making mortgage, car, and credit card payments when the super-sized stimulus ends.

In the meantime, the stock market is making a bet that everything ends well. Of course, plan “B” centers on the Federal Reserve. Our central bank has played enormous role in supporting the stock and bond markets. They have been buying all forms of debt which has injected enormous liquidity through all markets.

While they haven’t admitted to directly buying any stocks, equities have visibly benefited. Below is a table of the year-to-date returns as of June 26th.

Large caps and technology sectors have been the best performers. The Nasdaq is making new all-time highs while the S&P and Dow have trimmed their losses. Small caps continue to lag.

There is even further concentration within the winning sectors. As of the middle of June, three stocks accounted for 89% if the S&P 500’s returns. Amazon, Apple, and Microsoft have combined to provide an incredible amount lifting within the stock market. Owning or not owning these three stocks has made a huge difference in 2020.

Another revealing statistic is the fact that only 150 stocks in the S&P 500 were up YTD. With 70% of the stocks declining for the year, it is remarkable that the S&P 500 is only down single digits. Once again, this demonstrates the performance power of Amazon, Apple, and Microsoft.

One large headwind facing stocks is the decline of profitability. Below is a chart showing the value of the stock market and the amount of corporate profits. As shown, there is a high correlation between profits and equity prices. A divergence began around 2016 and has widened in 2020. Despite the Fed’s involvement in the markets it is hard to imagine this continuing. Once again, profits need to catch up to stock prices or equities will retreat toward profits.

The conflicting messages being sent by Main Street and Wall Street are a mystery. An economy that includes historic numbers of people getting paid not to produce (many incidences getting more money to stay home than they made while employed) is normally a troubling sign. Add to this a cultural civil war and a break down of moral standards. It is remarkable that the markets are functioning at all.

As the financial markets have stabilized and rebounded, it communicates a belief that these problems are temporary. Further it says that the recovery will be speedy and complete. And if for some unknown reason it doesn’t work out that way, the Federal Reserve will save the day. The biggest risk is that of record high stock prices.

The pandemic has impacted our lives in countless ways. One interesting thing at is relates to the stock market is the arrival of those who previously gambled on sports and at casinos. The popularity of the Robinhood app (and its free trading) has drawn in this new group of ‘investors’. It is largely comprised of people trading stocks for the first time. This inexperienced gang have caught the stock market recovery and have made money. Let’s hope they understand that stocks move both ways.

The ability to connect the economic and cultural realities to the financial markets might be a challenge for some. History has shown that there is a definite connection between the two. But, as the old Wall Street saying goes, “Don’t confuse brains with a bull market”.

“One morning I shot an elephant in my pajamas. How he got into my pajamas I’ll never know.”

/0 Comments/in Financial Planning News /by jkerrKerr Financial Group

Kildare Asset Mgt.

Jeffrey J. Kerr, CFA

Newsletter

June 8, 2020 – DJIA = 27,110 – S&P 500 = 3,193 – Nasdaq = 9,814

“One morning I shot an elephant in my pajamas. How he got into my pajamas I’ll never know.”i

The stock market’s robust rebound continues. In April and May, the S&P 500 completed its best two-month stretch since the last financial crisis in 2009. Last week it added another 4.9% while the Dow Jones Industrial Average gained 6.8% and the Nasdaq Composite reached a new all-time high.

However, last week’s U.S. stock market party was tame when compared to the European markets. The Euro Stoxx 50 (a continent-wide index) jumped 10.95%. Here are the weekly performances of some individual countries – Austria +11.32%, Belgium +10.52%, France +10.7%, Germany +10.88%, Italy, +10.94%, and Spain +10.94%. Greece was a laggard (only up 4.73% for the week) which proves that a sliver of logic remains – at least for now.

The European bourses were celebrating the announced €1.35 trillion ($1.52 trillion) ECB stimulus program. This new package will focus on buying government and corporate bonds and will be added to the current €750 million plan. Before this was released, forecasts called for a more than 8% contraction in European economies.

Critics have claimed that the ECB and European officials have not been aggressive enough in combating their economic and social challenges. While they have not yet reached the size that have been implemented on this side of the Atlantic, European equities welcomed the effort. Perhaps this is a new version of “Made in America”.

Of course, euphoric stock markets seem to contradict a backdrop of civil unrest and violence, deep social division, a record number of job losses, pandemic conditions, and a very uncertain economic path. The rally is partially based on optimism that the economy briskly bounces back, a vaccine can be developed, and our world returns to something resembling 2019.

Another important part of the stock market rebound is the role of global central banks. The various multi trillion-dollar stimulus programs have provided increased liquidity which has eventually impacted stock prices. A more cynical suggestion is that the Fed is directly supporting the stock market.

Despite the Fed’s mandated focus being restricted to inflation and employment, many have long suspected that it closely watches stock market prices. The term ‘Plunge Protection Team’ or PPT is widely known among professional traders and refers to a department within the Fed whose alleged function is to buy S&P 500 futures contracts during times of intense selling and thus supporting the stock market.

Naturally, as the U.S. stock markets have rallied back to pre-shutdown levels, skeptics look for nefarious motives driving the move. The tales encircling this latest rally is that the PPT has been active in the overnight trading sessions.

The S&P 500 futures essentially trade 24 hours a day beginning on Sunday evening (Monday morning in Asia) and stop when U.S. trading concludes on Friday afternoon. During the overnight session (for the U.S.), trading volumes are lower than regular trading hours and it is here that some are accusing the PPT of interference.

Below are two charts showing the S&P 500’s move both during regular trading hours and during the overnight session. The first shows the returns from the overnight session only in blue and the returns from regular trading hours in red. The chart begins on April 1, 2020. The difference is easily seen and the quote accompanying the chart states that the overnight trading is up 16.5% during this period while the regular (cash) trade time is up less than 1%.ii

The second chart is another version of this phenomenon but only covers from the beginning of May.[iii] The point is that the majority of the price gains during the bounce from the March lows took place while the U.S. was snoozing. Overall, the gains have been impressive and long-term investors have benefited as they are not concerned about when prices move higher as long as they move higher.

This overnight activity has resulted in a new investment fad which is called ‘pajama trading’. This is trading the U.S. markets from home throughout the night presumably in our PJ’s. Instead of getting comfy with a good book, households are slipping on their pajamas and logging into their investment accounts.

It’s difficult to determine what role (if any) the Fed has in the overnight price appreciation. Given the lower trading volume levels during this time, they would likely get a bigger bang for their buck. This leads to the question of what type of pajama does the Fed chairman wear?

As mentioned above, last week was very good for the stock markets. Below is a table of the year-to-date returns as of June 5th.

While the stock markets have stabilized and bounced, other sectors of the capital markets remain in a much different state. Bond yields, which plunged to record low levels, remain at absurd levels. The 10-year Treasury note’s yield closed last week at 0.9% while the 30-year bond ended at 1.67%. This is at odds with the confidence being reflected in the stock market as strong economic growth would typically be accompanied by higher interest rates.

Crude oil has enjoyed a bounce after trading in the single digits per barrel in April. Last week West Texas Intermediate (WTI) was up 11% to $39.55 per barrel. It is still down 35% year-to-date. Natural gas was down 3.6% last week and is 18.5% lower for 2020. There have been production cuts by energy producers as they struggle to reduce supply to match falling demand.

May employment data was reported last week and surprisingly showed job growth instead of expected losses. While the unemployment rate jumped to 13.3% there were forecasts around the 20% level. Unemployment benefits and stimulus checks help, but there will need to be sustained income in the form of paychecks to displaced individuals in order to help the economy.

There is much uncertainty about the path of reopening and rebuilding the economy. The stock markets are expecting a smooth and healthy recovery. Bonds and commodities are reflecting a different view. The amount of turmoil and hostility expanding throughout the country makes economic forecasts educated guesses. Unfortunately, beyond the demand for plywood, very little is clear.

[i] Groucho Marx

[ii] Hedge Fund Telemetry, May 28, 2020

[iii] Hedgeye, May 28, 2020

“Never Attempt to Win By Force What Can Be Won By Deception” -May 16th Newsletter

/0 Comments/in Financial Planning News /by jkerrKerr Financial Group

Kildare Asset Mgt.

Jeffrey J. Kerr, CFA

Newsletter

May 18, 2020 – DJIA = 23,685 – S&P 500 = 2,863 – Nasdaq = 9,014

“Never Attempt to Win By Force What Can Be Won By Deception”i

The U.S. stock market’s breathtaking rally from the March lows shows the amount of faith the markets have in fiscal and monetary policies. As our political and bureaucratic leaders announced larger and larger bailouts and stimulus programs, the stock market climbed higher. As perception becomes reality, it’s as if the pandemic and economic shutdown never happened.

Of course, this confidence rises out of the fact that we did recover from the financial crisis of 2008 – 2009. In our collective memories, there is an interconnection between Fed policies and the recovery. In other words, our recollection is that the Fed saved the day and they’ll do it again. Funny thing about our memory, it gets fuzzier with the passage of time.

Rewinding 10 years, the path out of the crisis was very unclear. Initially, the Fed relied on their standard practices of cutting interest rates and printing money. As that wasn’t effective, they turned to more aggressive programs which began a string of QE’s (quantitative easing) which involved buying treasury and mortgage backed bonds for the first time (as far as we know).

The QE policies, which were supposed to be temporary, turned into pesky weeds that kept growing. Over several years the Fed continued to introduce new and bigger versions of QE with different names. Wall Street referred to them as ‘QE’, ‘QE 2’, ‘QE 3’ and finally, realizing their permanence, ‘QE infinity’. Obviously, they weren’t temporary.

Ben Bernanke and the Fed admitted at the time that these were radical monetary programs with unknown outcomes and consequences. Further, our central bank leaders characterized themselves as “data dependent” which meant they were unsure of what they were doing. In the end, the economy stabilized and improved, however, the effectiveness of the Fed is a topic of debate. But, assisted by a masterful public relations effort, Ben Bernanke and global central banker were credited for saving the world.

Returning to the present, there is a confident belief that Jerome Powell, the Fed, and our elected leaders can do it again. If they come up short, it won’t be from a lack of trying. Washington, the Fed, and the Department of the Treasury have joined together to combat the impact of shutting down the economy. The size of the proposed plans dwarf those previously used.

The Treasury recently announced that the Federal government will borrow a record $3 trillion just in the 2nd quarter. This number will likely move higher throughout the year. These figures are light years from any amount that we typically deal with and are almost impossible to comprehend.

Of course, these borrowings will be added to the current $22 trillion fiscal deficit (which has doubled in the past 10 years). A combination of the media’s reluctance to report on these numbers as well as the talking heads telling us there is no other option has desensitized society to their significance.

Welcome to the world of Modern Monetary Theory. This is an economic view that governments have an unlimited spending ability (kind of what we are doing now). That’s right – they can spend whatever amount they want without repercussions. An important part of the equation is the Federal Reserve because they will print the money to buy the Treasury bonds which supplies the spending.

According to MMT supporters (which includes Bernie Sanders), this apparent shell game does not do any economic damage. The economy gets a steady boost from the federal government and everybody enjoys the benefits. A presumed utopia. In the case that inflation surprisingly rises, spending would be reduced until the supply and demand is rebalanced. It seems, given the path that we are on, the MMT hypothesis could get put to the test.

In addition to anticipating an economic recovery, the stock market also gets excited on news of re-openings, vaccines, and, perversely, bad news (which means greater financial support from the Fed). Last week April retail sales tumbled 16.4% from March’s level. Naturally, bad news was expected but this was far worse than the 12% drop that was forecast.

Stocks were lower last week but the selling was contained. Below is a table of the year-to-date returns as of May 15th.

The U.S. stock markets have bounced over 25% from the March lows and are led by the Nasdaq which ended last week flat for 2020. It’s interesting that the bounce seems to be uniquely American. Other major developed and emerging stock markets have not had the rebounds that the U.S. has experienced. In Europe, France is down 28% YTD, the UK is 23% lower, and Germany is down 21%. Brazil is down 33%. In Asia, Japan and Hong Kong are both 15% lower while India is down 24.6%

The U.S. is the largest economy in the world and our currency is used for almost all the global trade. This may have a part in this development. Nevertheless, the contrast of the U.S. stock market rebound vs. the rest of the world is noteworthy. Below is a chart of the relative price of the U.S. stock market as compared to the other developed stock markets.

This ratio is the highest it has been in the last 70 years! This shows the relative price of the U.S. markets being almost 2.5 times the level of the non-U.S. developed economy’s stock markets. Not only is it at the greatest level, it is extremely out of place with the norm. Currently it is approximately 3 standard deviations from the mean.

The two other high points were the Nifty 50 markets of the late 1960’s and the Dot Com bubble of 1990’s. But even these examples are well below the current landscape. These prior peaks were followed by drops in the U.S. markets and outperformance by international stocks. Maybe it’s different this time, but this suggests that the international markets will outperform the U.S. at some point in the future. Keep in mind, this outperformance could come in the form of international stocks declining less than a U.S. drop.

The U.S. stock markets seem to be anticipating a strong recovery and an economic landscape like 2019. Given our culture’s entrepreneurial spirit, it is possible. Our history has many examples of bouncing back and overcoming adversity. However, there has been deep damage and the recovery could take longer than expected.

The Fed has announced mind numbing sized stimulus programs. In addition, Powell and our political leaders have committed to do more if needed. (Could buying stocks and negative interest rates be in their future?) Investors believe in the collective abilities of our policy makers to be successful. Let’s hope we haven’t overestimated their skills.

[i] Niccolo Machavelli

“Are you telling me that you built a time machine…out of a DeLorean?” -April 27th

/0 Comments/in Financial Planning News /by jkerrKerr Financial Group

Kildare Asset Mgt.

Jeffrey J. Kerr, CFA

Newsletter

April 27, 2020 – DJIA = 23,775 – S&P 500 = 2,836 – Nasdaq = 8,634

“Are you telling me that you built a time machine…out of a DeLorean?”

As the restlessness of limited social interaction expands to unbearable levels, memories of an unbounded life bring yearnings to a return to our unfettered ways. Ahh, the good ole days – from just a couple of months ago!

As society looks to de-quarantine, there is a big wish to return to our pre-Covid-19 lifestyles. But there are many unknowns. What will be the ongoing health risks? How do we address them? What will be the impact on our society? What will the economy look like?

Putting the science and medicine aside, there is a recognition that things will change. Stopping by your favorite crowded watering hole for a happy hour cocktail will unleash condemnation. Social distancing is here to stay. The workplace will likely see a lot more online meetings as many will spend time working from home.

That is assuming that our workforce regains its previous strength. We have had the lowest unemployment rate and the best job market in a generation. But all the jobs created in the last 10 years have been lost in the weeks since the quarantine began. Certainly, much of this will be temporary. However, as not every business is going to reopen, higher unemployment could turn into an ongoing inconvenience.

Joblessness assures less money flowing into the economic system. This will cause less buying by consumers. In other words, there could be much lower demand for such things as gasoline, clothing, going out to dinner, travel, going to a concert or sporting event, a new car, vacations, and iPhones.

In the face of this risk and uncertainty, there are those who are working to turn our future into our past. The Federal Reserve is doing everything in its power (and some things not within its power) to contain the economic damage from the shutdown. They eagerly want to get the U.S. economy to return to something like January 2020.

The breadth and speed at which the Fed is throwing money at the system is unfathomable. They have committed to buying a wider spectrum of the fixed income market than previous programs. Newly targeted sectors are municipal and junk bonds. Furthermore, Chairman Jerome Powell has indicated that there will be more if needed.

The total amount of securities purchased and held by the Fed is expected to exceed $10 trillion. To put this in perspective, this number was approximately $4 trillion at the start of 2020. Prior to the financial crisis of 2008 – 2009, the Fed’s holdings totaled around $800 billion. A $9 trillion increase in the involvement in our capital markets is a lot of manipulation. Adam Smith please meet Karl Marx.

The Federal Reserve certainly has strong support. Their fans reason that Fed’s QE programs after the last financial crisis worked so well (longest economic expansion in history) that an exponentially larger effort must be the answer. And this time don’t spread the stimulus over several years, do it big and do it quick. This, the optimists believe, will be the best and fastest way to get our economic future to go back in time.

The U.S. stock market did not waste any time second guessing our central bank and the various federal government assistant programs. Stocks have had an amazing bounce from the March lows. The S&P 500 had rebounded 23% by the end of last week while the Nasdaq has led the way during this rally and closed last week down less than 4% year-to-date. Below is a table of the year-to-date returns as of April 24th.

While the U.S. stock market has the DeLorean cruising at 88 MPH, some other areas are stuck in 1955. The bond and crude oil markets are not functioning properly. Last week crude oil futures (May expiration) traded at negative prices. In other words, buyers of the contract not only acquired the contract they got paid (instead of having to pay for the contract).

The issue behind this anomaly is that there is too much oil and not enough storage. Crude oil producers continue pumping oil while the demand for refined products has shut down. At the current rates, forecasts are for the system to run out of available storage by mid-May. Oil drillers can slow the rate that oil is pumped but complete closure is a lengthy and expensive process. Unless the Fed starts buying it, crude will likely remain under pressure until demand returns.

For those expecting a quick and complete economic recovery, the treasury bond market is disagreeing. The 10-year T-note yield closed last week at 0.56% while the 30-year T-bond ended with a yield of 1.17%. Recognizing that the Fed is trying to suppress yields in this market, if the economy is to regain its strength in the upcoming quarters, treasury bond yields should be moving up.

International economies also conflict with the “V” shaped recovery theory. Australia is in its first recession in 30 years. Its main stocks market index fell 4.46% last week and is down 21.6% year-to-date. Here are some other notable international stock markets’ YTD performances – Brazil -34.9%, France -26.5%, Germany -22%, and India -24.1%.

The Fed has committed a lot of ammunition to support the financial markets which they believe will help the economy make a quick and strong recovery. If it doesn’t work, they claim they have more tools to use. Stock market bulls are believers. Critics point out they are using essentially the same policies that got us into this mess and that they are a big part of a flawed equation. They predict much more damage.

U.S. stock markets have bounced sharply form the March lows. At some point, when the economy reopens, pent up demand from a quarantined population will provide an economic jolt. The hope is that it provides a sustainable return to an upward trajectory and not a short-lived celebration.

As much as we want to return to our pre-pandemic society, that’s not likely to happen – even if we had a time machine. It is hard to predict the changes that will take place to our lives but things like social distancing and working from home could become normal conduct. These cultural adjustments will take time and we will adapt. Actually, there are some people where practicing social distancing would be a blessing.

Is It Safe? -April 13th Newsletter

/0 Comments/in Financial Planning News /by jkerrKerr Financial Group

Kildare Asset Mgt.

Jeffrey J. Kerr, CFA

Newsletter

April 13, 2020 – DJIA = 23,719 – S&P 500 = 2,789 – Nasdaq = 8,153

“Is It Safe?”

During the 1976 movie Marathon Man, Dr. Christian Szell (Laurence Olivier), asks the question “Is it safe?” Szell is a Nazi war criminal who wants to know if he is still being pursued. He asks the question to Thomas Levy (Dustin Hoffman) as he is torturing Levy. Like everyone currently enduring a different torture, Levy doesn’t know the answer.

Is it safe? Is it safe to leave the house? Is it safe to go to a store? Is it safe to go to work? Is it safe to go to church? President Trump, health officials, politicians, citizens, society, and of course, Wall Street want to know “Is it safe?”.

The world is searching for answers to situations that we have never encountered before. How does the country function when so little is known about the cause of its closing? What are the proper steps to ensure the safety of as many as possible? What is the right balance of safety and civil liberties?

Here are some of the economic goings-on as we grope for solutions. The entire country has been declared a federal disaster area. The Cheesecake Factory restaurant chain announced in mid-March that it would not be paying April’s rent. There are other chains and retailers who will not be making their April rent payment.

There has been an unprecedented amount of job losses. Weekly jobless claims have totaled over 22 million people during the past four weeks with each week’s new claims exceeding 5 million. These are astonishing numbers as the previous record 4-week total of jobless claims was 2.7 million (about 10% of the current run rate) which was in the fall of 1982.

Crude oil has plummeted to 20-year lows as demand disappears. Entire industries are asking for assistance or a complete bailout. Treasury bond yields have nosedived to unthinkable levels in a race to safety. For the first time, the 3-month and 6-month Treasury bills recently showed negative yields. Thankfully this only lasted for a brief time.

Everyone dislikes uncertainty and the markets especially detest it. This partially explains the reaction when the news on Covid-19 started to break. The stock market suffered its worst quarter in 12 years, and it was one of the fastest drawdowns in history.

Since then the stock markets have stabilized somewhat. On the other hand, the credit, currency, and commodity markets have not. Last week the stock market strongly believed that ‘it is safe’ as the S&P 500 was up 12% which was its best weekly gain since 1974. The Dow Jones Industrial Average had its best week since the 1930’s which included a 1,600-point one day jump. This happened in a 4-day trading week as the markets were closed for Good Friday.

Below is a table of the year-to-date returns as of April 9th. Also included is last week’s gains for the major averages.

Is it safe? As with Thomas Levy, we don’t know. The bulls point to the news on Covid-19 getting less worse. But perhaps more importantly, the Federal Reserve has been using bazookas to support the markets. Last Thursday, as another horrible jobless claims report was announced, the Fed unveiled a new $2.3 trillion program for addition loans. This is in addition to the previous trillion-dollar packages.

As part of this decision, the Fed also said it would be buying and supporting riskier debt than the previous efforts. Junk bonds, states, and cities would be funded by the new program. Many on Wall Street also viewed this as a wink and nod from the Fed and the Treasury Department. In other words, don’t fret if this doesn’t work because we’ll keep printing money to throw at the problem. For supporters of Bernie Sanders and Modern Monetary Theory, this is a real time version.

Since its birth in 1913, the Fed has had its critics. Today is no different. Current skeptics look at central bankers as both arsonists and firefighters. Their policies have a hand in creating the economic and financial calamities that they eventually attempt to fix.

The Fed and other global central banks have suppressed the level of interest rates for the past decade. This encouraged corporations to sell more debt at lower interest costs. The companies then used the proceeds to buy their stock in the open market which provided a floor under their share price. It clearly helped the stock market as well as anyone in top management whose compensation was tied to their stock price. As a result, these companies don’t have the financial flexibility when a catastrophe happens. As a result, they plead to the government for a bailout.

Part of the markets’ belief that ‘it is safe’ is the view that 2020 will be like 2008. The Fed got us through that disaster so they should be able to steer us through this mess and everything will be back to what it was. Maybe it’s as simple as that. Besides the Fed has told us they’ll keep printing dollars and do whatever it takes.

While there are some parallels, there are some crucial differences. The U.S. economy has never been shutdown to this level. While this may lead to a huge amount of pent up demand that will be unleashed in the months ahead, there could be a large amount of demand destruction. Permanently closed businesses, lost jobs, lower incomes, and higher inflation are economic possibilities. A change in cultural behavior that offer new and different challenges would make 2020 vastly different from 2008.

In some respects, we are hopefully getting safer. Concerning the financial and economic systems, the answer depends on one’s confidence in the Federal Reserve and our government leaders. Those with confidence believe that Jerome Powell has the answers and the ability to address the problems. Those without confidence believe the Fed is using the wrong or ineffective tools and that the consequences to their decisions will cause larger systemic damage. The key question remains, “Is it Safe?”