Copy of the 4th Quarter Review Letter

KERR FINANCIAL GROUP

KILDARE ASSET MANAGEMENT

45 Lewis Street, Lackawanna RR Station

Binghamton, NY 13901

Phone: 607-231-6330 email: [email protected]

The following is a copy of the 2021 4th quarter letter sent to clients. It reviews the markets and the client account’s activity and performance for the 4th quarter of 2021.

February 10, 2022

The S&P 500 has had three consecutive years of double-digit gains. It was up 27% in 2021. Given the challenges and turmoil that we have endured, this is a remarkable outcome. These three-peats of double-digit returns have only happened 9 times in the history of the index. The last time was 2012 – 2014 as the economy was recovering from the Great Financial Crisis.

Looking at the year-end numbers, one could naturally assume it was all unicorns and rainbows. In other words, every decision was a good one and trading profits abounded. This is not what happened. The year began with the controversies surrounding the meme stocks (GameStop, AMC, etc.) and the Robinhood gang.

These stocks rocketed early in the year as individual investors targeted companies high short interest positions which caused pain and consternation throughout Wall Street. The established old guard of the financial industry fought back, and some trading platforms restricted “buy” orders in the meme stocks. Eventually, the battle calmed a bit and many of the stocks returned to their previous levels.

Another development of 2021 was the growth and popularity of SPACs (special purpose acquisition company). These organizations raised money from selling stock and then used that money to buy another company that had, unlike the SPAC, business operations. There was a high level of excitement and speculation around SPACs and their potential targets. The price of many SPACs dropped in the second half of 2021.

Commodities prices captured some headlines. Lumber futures began the year below $1,000 per 111,000 per board feet (one 73-foot railcar). The price jumped to $1,700 and then plunged to $500 before ending the year above $1,100.

Bitcoin had a similar roller coaster trip. It started the year around $37,500 and reached $60,000. It plummeted 50% and then recovered to above $47,000 at year end. As with the meme stocks and lumber, if you bought bitcoin or another cryptocurrency at the wrong time it was a regretful decision.

Back in the stock market there were rotations between industries and sectors which offered rewards to those navigated these changes. It was a challenging trip for those who may have been a step behind.

For example, the Russell 2000 (small cap index) was the best performing of the major indexes in the first 6 months (+17%). The Russell lost 2.8% in the second half of the year. Most of this drop came in November and December as the index peaked on November 8th. The Nasdaq also peaked in November and drifted sideways into year end.

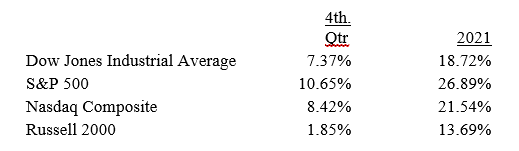

Despite all the gyrations, it was a good year the stock markets. The S&P 500 logged 70 all-time highs during the year. Here are the major indexes’ performance numbers for the 4th quarter and for the entire year.

In 2021, the markets overlooked and overcame such obstacles as inflation, covid variants, widespread shortages of goods, intense cultural division, and geopolitical tensions. Those probably continue in 2022 and then could be compounded with other headwinds. The biggest of the new issues could come from interest rate increases by the Federal Reserve.

The Fed is projecting that they will raise interest rates at least four times this year. Our monetary officials are targeting inflation and believe that the economic momentum is strong enough absorb this reversal in monetary strategy. The first-rate hike is expected to be in March.

There is widespread confidence that the Federal Reserve can successfully raise interest rates without inflicting damage. An extension of this is that Wall Street thinks the Fed has its back and won’t let the stock market fall. This has developed over the past decade as the Fed has implemented multiple versions of quantitative easing which primarily supported the capital markets.

The current trust in the Fed might be misplaced as our central bankers, unfortunately, have s a long history of blunders. As an example, the Fed told us for many years that they would generate a 2% inflation rate. Until last year’s spike in prices, they failed.

Another policy misstep happened in 2018. The Fed attempted to cut back on stimulus (bond purchases) and raise interest rates. As the Fed acted the stock market fell. When it became clear that the Fed was going to keep tightening, stocks collapsed. The S&P 500 lost 20% in the 4th quarter of 2018. In early January 2019, Fed Chairman Powell ‘pivoted’ and announced the interest rates increases would end. The stock markets stabilized and started to move higher.

I worry that 2022 could be a replay of 2018. The Fed is strongly committed to multiple interest rate increases this year. Currently, the markets appear to be understanding. I fear that there could be significant harm as interest rates go up while inflation remains elevated, and growth slows. As a reminder, this would be within an overleveraged financial system which increases risk.

The capital markets have a lot of factors to deal with under normal conditions. This year will present an even greater number of issues for the economy to understand and digest. This could result in a step up in volatility. This landscape could be tricky but will likely present many opportunities.

Please contact me with questions or comments. As always, thank you for your support and confidence in Kerr Financial Group.

Sincerely,

Jeffrey J. Kerr, CFA

President

Leave a Reply

Want to join the discussion?Feel free to contribute!