Copy of the 3rd Quarter Review Letter

KERR FINANCIAL GROUP

KILDARE ASSET MANAGEMENT

45 Lewis Street, Lackawanna RR Station

Binghamton, NY 13901 | Phone: 607-231-6330 | email: [email protected]

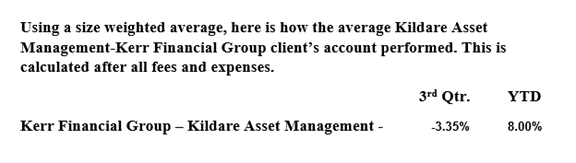

The following is a copy of the 2021 3rd quarter letter sent to clients. It reviews the markets and the client account’s activity and performance for the 3rd quarter of 2021.

November 3, 2021

In the past 40 years, inflation became an accepted part of our economy. This is partially a result of it being at low levels and not an obstacle to economic progress. After the financial crisis, inflation became an encouraged outcome of monetary policy. Our government and monetary bureaucrats have been telling us for the past decade that a “little” inflation is good thing. The Federal Reserve repeatedly told us they were working hard to achieve higher inflation levels.

While we were being sold that we needed inflation, we were also assured that that our leaders could manage all negative developments if any arose. What was absent in promotion of inflation is who it hurts. Inflation does the most damage on the middle and low classes as well as retirees on a fixed income. At the same time, the elites and wealthy feel little pain from the increases in gasoline, groceries, and the necessities of everyday life.

P.T. Barnum reportedly claimed that “Many people are gullible, and we can expect this to continue.” The modern public’s acceptance of such propaganda as a little inflation is good is evidence of the showman’s wisdom. The public’s unwillingness to hold leaders accountable for inflicting harmful policies and running up astounding amounts of debt is a head scratcher.

Inflation has soared in 2021. As measured by CPI (Consumer Price Index), the inflation rate was 1.4% in January 2021 and rose to 5% in May and has been above 5% for every month since. Government officials tell us it is transitory and will fall when the economy reopens. This is also the same gang that told they were working hard to get the inflation rate to 2% but couldn’t do it. Here is a chart of the recent monthly CPI readings.

Despite the claims that it is temporary, inflation could easily turn into a long-term issue. Labor shortages and supply chain disruptions will contribute to keeping prices higher. This could become circular in that businesses raise prices to cover higher costs and payrolls which causes other businesses along the food chain to do the same.

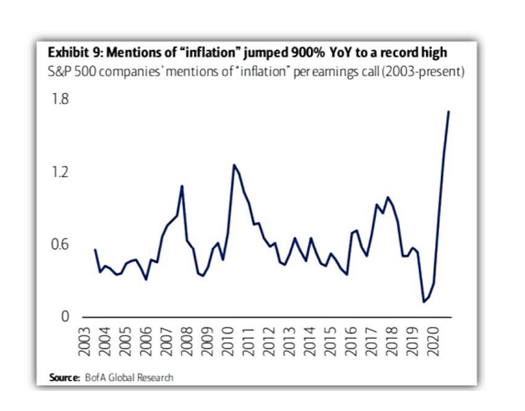

Concerning the markets, inflation has moved to the forefront of corporate mindsets. Few executives and managers have any history of decision making during high inflation environments which increases the possibility of bad ones. Nevertheless, rising prices is a clear corporate worry. The number of times that “inflation” was mentioned on 2nd quarter S&P 500 earnings conference calls jumped 900% year-over-year. Here is the chart.

How the financial markets cope with inflation could cause important variations from recent years. Increasing prices should hurt long maturity bonds which many investors think is “safe”. Further some industries will be challenged in passing along their higher costs. If shortages continue, some sectors will be able to command their price. It promises to be a different investing world.

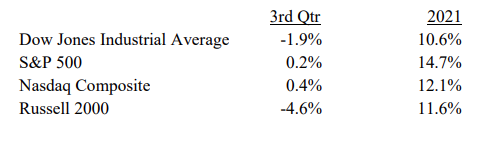

Looking back at the 3rd quarter, the stock market finished flat to down. Despite just being a sideways slither, it was the worst quarterly stock market performance since 1st quarter 2020 (the Covid shutdown). The S&P 500, Dow Jones Industrial Average, and Nasdaq Composite climbed during July and August but gave back the quarter’s gains in September. For the year-to-date, all the averages are showing gains. Here are the major indexes’ performance number for the 3rd quarter and 2021.

The markets could be facing a classic case of be careful of what you wish for because you may get it. Our elected and unelected leaders have been telling us for years that the economy needs inflation. Until 2021, they couldn’t provide any lift in prices. Now that inflation has arrived, we are supposed to believe it is temporary. The Federal Reserve has a long history of being wrong so it would be prudent for investors to consider that inflation is a longer-term problem.

This new landscape will present new risks and opportunities. I will continue to take advantage of the favorable situations in this environment.

As a new part of this quarterly communication, we are attaching a video. I try to cover some specific positions and get into more detail on the how the markets have impacted your account. Please let me know any comments, questions, or suggestions.

As always, thank you for your support and confidence in Kerr Financial Group.

Sincerely,

Jeffery J. Kerr, CFA

Leave a Reply

Want to join the discussion?Feel free to contribute!