“Bad News is Good News”

Kerr Financial Group

Kildare Asset Mgt.

Jeffrey J. Kerr, CFA

Newsletter

February 3, 2023 – DJIA = 34,053 – S&P 500 = 4,179 – Nasdaq = 11,816

“Bad News is Good News”

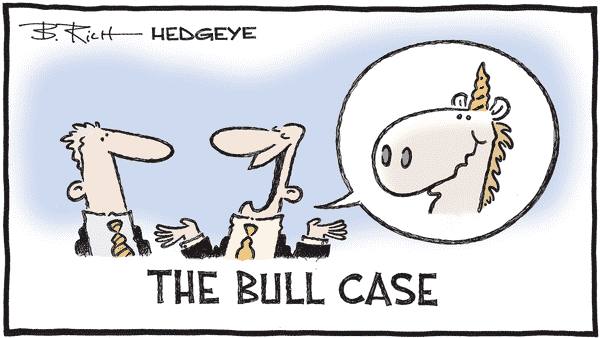

Bad news is good news. This has become the rally cry of a lot of Wall Street bulls. The logic is that economic bad news will mean that the Federal Reserve will stop raising interest rates, reducing their balance sheet and other restrictive monetary machinations sooner.

Fortunately for the bulls, when it comes to bad news, they have had plenty of ammunition. Recessionary economic statistics, falling consumer confidence, widespread layoffs, and tumbling corporate profits are some examples. While many would apply common sense and conclude that these signals are a negative for the financial markets, the current investor attitude is that this will force the Fed to back off and then it is back to party time.

This mentality has helped stabilize the stock market in recent months after a horrible first half of 2022. It further assisted a strong stock market rally in January 2023. The Nasdaq Composite jumped 11% in January which is the best start to a year in over 20 years. The S&P 500 climbed 6.2% in the month.

At risk of raining on the bull’s parade, it might be useful to look past the intense emotional state of the capital markets. Taking a glance at the financial fundamentals, it shows an extremely overvalued condition. This may not matter in the short term, but it will likely be a headwind if it continues.

At the end of December 2022, the S&P 500 P/E (price to earnings ratio) stood at 28.7. To put this in perspective, the 50-year average of this number is 21. So, if there is any type of reversion to the mean, it is a bad binary outcome. The S&P 500’s price has to tumble while the earnings stay the same. Or the earnings number does a rocket launch which will reduce the multiple.

Unfortunately, recent earnings reports and the guidance for 2023 does not foretell any material increase in earnings. But if things like 0 days-to-expiration options (0DTE) and similar trading strategies continue to squeeze prices higher, maybe it buys enough time for the Fed to back off. This seems like a low probably outcome but so did an 11% monthly increase for the Nasdaq.

Leave a Reply

Want to join the discussion?Feel free to contribute!