“Never Attempt to Win By Force What Can Be Won By Deception” -May 16th Newsletter

Kerr Financial Group

Kildare Asset Mgt.

Jeffrey J. Kerr, CFA

Newsletter

May 18, 2020 – DJIA = 23,685 – S&P 500 = 2,863 – Nasdaq = 9,014

“Never Attempt to Win By Force What Can Be Won By Deception”i

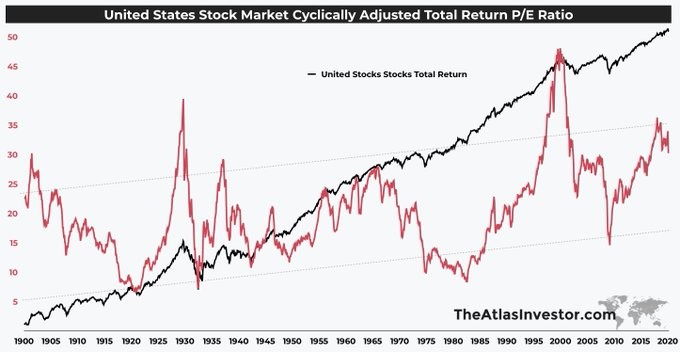

The U.S. stock market’s breathtaking rally from the March lows shows the amount of faith the markets have in fiscal and monetary policies. As our political and bureaucratic leaders announced larger and larger bailouts and stimulus programs, the stock market climbed higher. As perception becomes reality, it’s as if the pandemic and economic shutdown never happened.

Of course, this confidence rises out of the fact that we did recover from the financial crisis of 2008 – 2009. In our collective memories, there is an interconnection between Fed policies and the recovery. In other words, our recollection is that the Fed saved the day and they’ll do it again. Funny thing about our memory, it gets fuzzier with the passage of time.

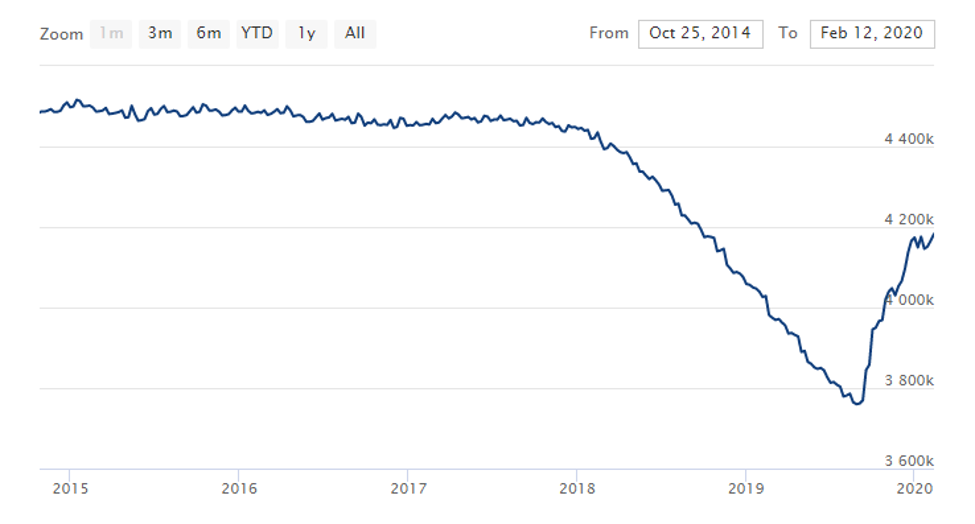

Rewinding 10 years, the path out of the crisis was very unclear. Initially, the Fed relied on their standard practices of cutting interest rates and printing money. As that wasn’t effective, they turned to more aggressive programs which began a string of QE’s (quantitative easing) which involved buying treasury and mortgage backed bonds for the first time (as far as we know).

The QE policies, which were supposed to be temporary, turned into pesky weeds that kept growing. Over several years the Fed continued to introduce new and bigger versions of QE with different names. Wall Street referred to them as ‘QE’, ‘QE 2’, ‘QE 3’ and finally, realizing their permanence, ‘QE infinity’. Obviously, they weren’t temporary.

Ben Bernanke and the Fed admitted at the time that these were radical monetary programs with unknown outcomes and consequences. Further, our central bank leaders characterized themselves as “data dependent” which meant they were unsure of what they were doing. In the end, the economy stabilized and improved, however, the effectiveness of the Fed is a topic of debate. But, assisted by a masterful public relations effort, Ben Bernanke and global central banker were credited for saving the world.

Returning to the present, there is a confident belief that Jerome Powell, the Fed, and our elected leaders can do it again. If they come up short, it won’t be from a lack of trying. Washington, the Fed, and the Department of the Treasury have joined together to combat the impact of shutting down the economy. The size of the proposed plans dwarf those previously used.

The Treasury recently announced that the Federal government will borrow a record $3 trillion just in the 2nd quarter. This number will likely move higher throughout the year. These figures are light years from any amount that we typically deal with and are almost impossible to comprehend.

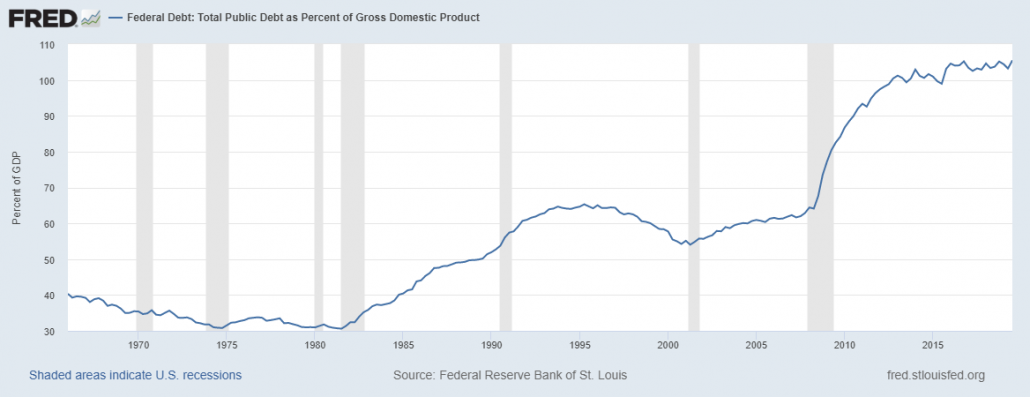

Of course, these borrowings will be added to the current $22 trillion fiscal deficit (which has doubled in the past 10 years). A combination of the media’s reluctance to report on these numbers as well as the talking heads telling us there is no other option has desensitized society to their significance.

Welcome to the world of Modern Monetary Theory. This is an economic view that governments have an unlimited spending ability (kind of what we are doing now). That’s right – they can spend whatever amount they want without repercussions. An important part of the equation is the Federal Reserve because they will print the money to buy the Treasury bonds which supplies the spending.

According to MMT supporters (which includes Bernie Sanders), this apparent shell game does not do any economic damage. The economy gets a steady boost from the federal government and everybody enjoys the benefits. A presumed utopia. In the case that inflation surprisingly rises, spending would be reduced until the supply and demand is rebalanced. It seems, given the path that we are on, the MMT hypothesis could get put to the test.

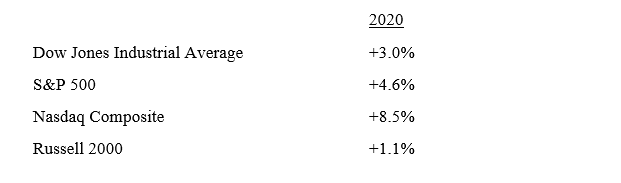

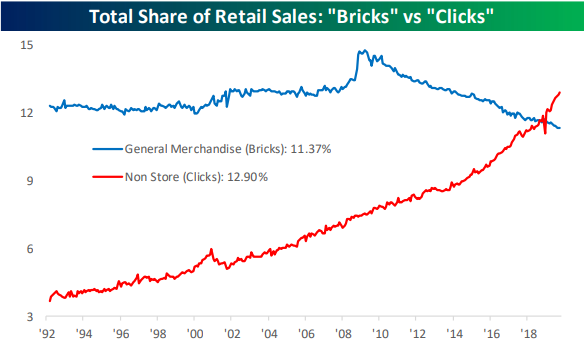

In addition to anticipating an economic recovery, the stock market also gets excited on news of re-openings, vaccines, and, perversely, bad news (which means greater financial support from the Fed). Last week April retail sales tumbled 16.4% from March’s level. Naturally, bad news was expected but this was far worse than the 12% drop that was forecast.

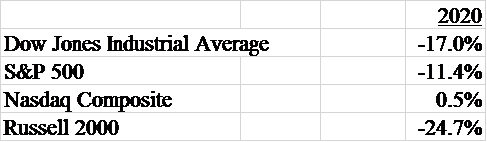

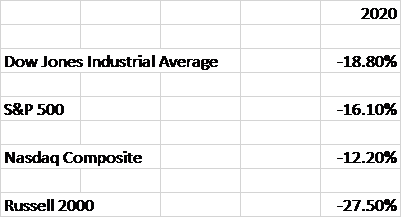

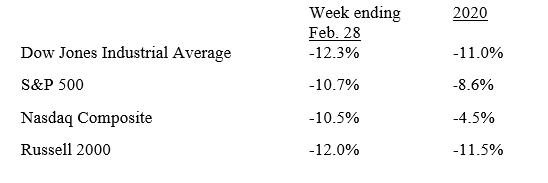

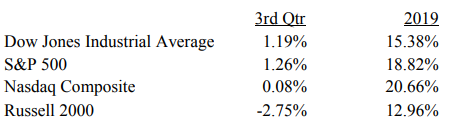

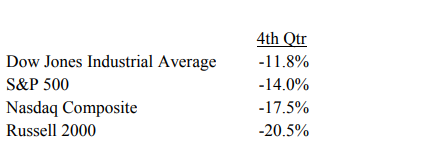

Stocks were lower last week but the selling was contained. Below is a table of the year-to-date returns as of May 15th.

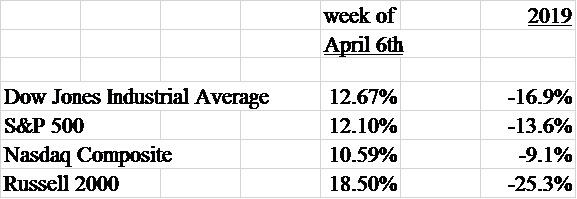

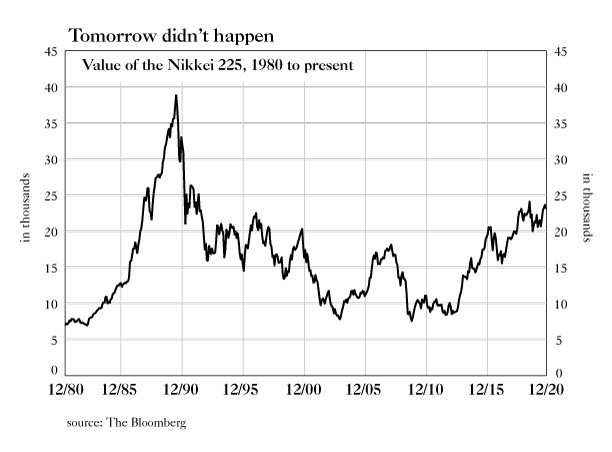

The U.S. stock markets have bounced over 25% from the March lows and are led by the Nasdaq which ended last week flat for 2020. It’s interesting that the bounce seems to be uniquely American. Other major developed and emerging stock markets have not had the rebounds that the U.S. has experienced. In Europe, France is down 28% YTD, the UK is 23% lower, and Germany is down 21%. Brazil is down 33%. In Asia, Japan and Hong Kong are both 15% lower while India is down 24.6%

The U.S. is the largest economy in the world and our currency is used for almost all the global trade. This may have a part in this development. Nevertheless, the contrast of the U.S. stock market rebound vs. the rest of the world is noteworthy. Below is a chart of the relative price of the U.S. stock market as compared to the other developed stock markets.

This ratio is the highest it has been in the last 70 years! This shows the relative price of the U.S. markets being almost 2.5 times the level of the non-U.S. developed economy’s stock markets. Not only is it at the greatest level, it is extremely out of place with the norm. Currently it is approximately 3 standard deviations from the mean.

The two other high points were the Nifty 50 markets of the late 1960’s and the Dot Com bubble of 1990’s. But even these examples are well below the current landscape. These prior peaks were followed by drops in the U.S. markets and outperformance by international stocks. Maybe it’s different this time, but this suggests that the international markets will outperform the U.S. at some point in the future. Keep in mind, this outperformance could come in the form of international stocks declining less than a U.S. drop.

The U.S. stock markets seem to be anticipating a strong recovery and an economic landscape like 2019. Given our culture’s entrepreneurial spirit, it is possible. Our history has many examples of bouncing back and overcoming adversity. However, there has been deep damage and the recovery could take longer than expected.

The Fed has announced mind numbing sized stimulus programs. In addition, Powell and our political leaders have committed to do more if needed. (Could buying stocks and negative interest rates be in their future?) Investors believe in the collective abilities of our policy makers to be successful. Let’s hope we haven’t overestimated their skills.

[i] Niccolo Machavelli