KERR FINANCIAL GROUP

KILDARE ASSET MANAGEMENT

45 Lewis Street, Lackawanna RR Station

Binghamton, NY 13901

Phone: 607-231-6330 email: [email protected]

The following is a copy of the 2022 3rd quarter letter sent to clients. It reviews the markets and the client account’s activity and performance for the 3rd quarter of 2022.

The Federal Reserve (the U.S.’s central bank) was formed in late 1913. The main purpose was to strengthen the banking and monetary systems after some damaging financial crises. The Panic of 1907 was an especially deep and destructive recession (perhaps depression) which included bank runs and closures.

Despite their efforts at reinforcing the financial system and smoothing out the business cycle, our central bank’s report card is far from honor roll material during its 110 years. In addition to numerous recessions, the U.S. economy was ravaged by the Great Depression, suffered through widespread inflation and recession in the 1970’s and early 1980’s, the Dot.Com stock market bubble, and the mortgage and financial crisis of 2008-2009. And there are many critics who believe that the Fed had a hand in each of these or, at a minimum, made them worse.

Regardless of this mediocre performance, the Fed’s influence in the capital markets has grown. Over the past 40 years, the Fed’s role has mutated past strict monetary policy to become intertwined with the capital markets. Consider that before 1994, monetary policy decisions were not formally announced. In the 21st century, the investing world stops whenever our central bank finishes their FOMC meetings and release the accompanying statement.

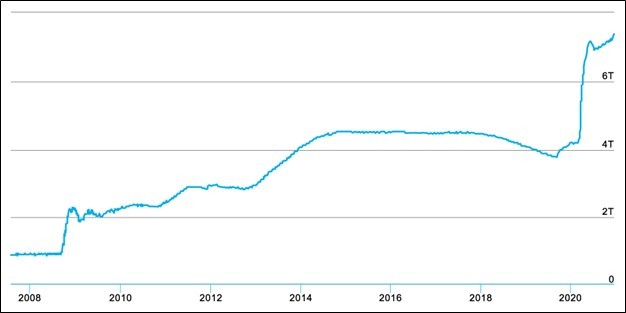

One of the important components of the Federal Reserve’s operations is controlling short term interest rates. The Fed has raised this rate (the federal funds rate) six times in 2022 and it has become one of the biggest news stories of the year. Our central bank tells us higher interest rates are needed to battle inflation which has jumped to 40-year highs.

Rising interest rates and higher inflation signal a new and different environment for investors. For the past 15 years the Fed have been supportive of the economy and financial assets through low interest rates and easy monetary conditions. This is changing and it is upsetting the markets.

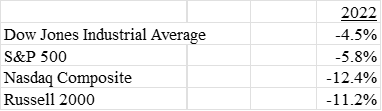

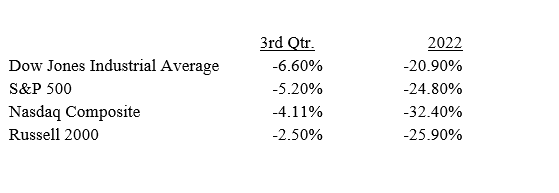

Stocks are having their worst year since the financial crisis of 2008 – 2009. Bond investments have also fallen with losses in many fixed income indexes in the mid-teens for the first nine months of 2022. This double whammy has been especially painful as bonds and stocks have hedged (moved in different directions) for each other in recent years. With rising inflation, higher interest rates, and a restrictive Federal Reserve, the markets are facing headwinds that have not been seen in decades.

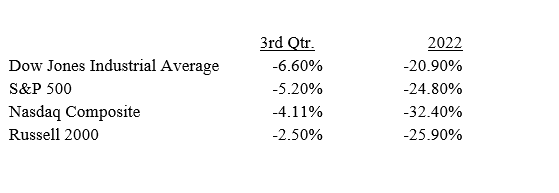

Here are the major indexes’ performance numbers for the 3rd quarter and year-to-date ending September 30th.

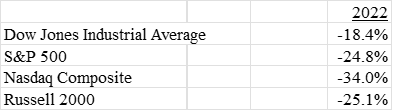

Using a size weighted average, here is how the average Kildare Asset Management – Kerr Financial Group client’s account performed. This is calculated after all fees and expenses.

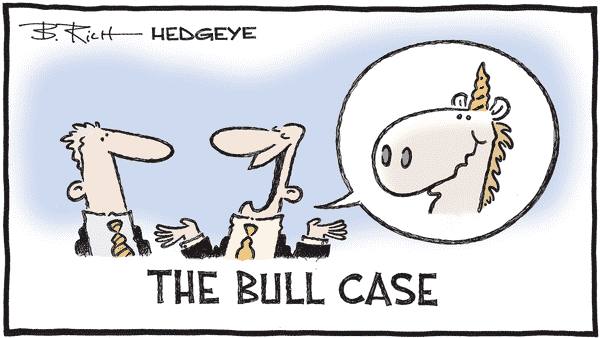

There were some notable market developments during the 3rd quarter. Stocks bottomed in July and rallied into the middle of August. It began to look like a significant turning point had happened and Wall Street become more optimistic.

But interest rates, which had drifted lower, reversed, and started climbing again. These interest rates were the longer-term ones that the Fed can’t directly control. At that time a growing crowd was pushing the belief that the Fed could soon be done rising rates. When the long-term interest rates, led by treasury bond yields, began to rise, it rippled through the capital markets and the turmoil continued.

The stock market gave back the 3rd quarter gains and continued to slide into the end of September, finishing that month at year-to-date lows. The inflation and interest rates challenges that were facing the economy began supporting worries about an upcoming recession. Also, corporations started to present lower sales and earnings guidance.

Your accounts weathered this turbulence reasonably well. The hedging that we’ve used your accounts throughout 2022 has been effective. This hedging has been in the form of inverse mutual funds, put options (for those accounts who allow that) and some selective short sales. These strategies attempt to balance portfolios and manage risks.

As I stated in the 2nd quarter client review letter, I am cautious and will continue to position defensively. I believe that a recession is a very large possibility. Further, I expect the Fed to keep raising rates as they fight inflation. Unfortunately, I worry that they will lose that battle as inflation is now deeply embedded throughout the economy. This is a terrible situation and could result in a deep recession that our government and bureaucratic leaders will not be able to fix.

Despite my expectations, there will be opportunities in the long term. At some point I will be active in unwinding the defensive strategies and changing to the bullish approaches.

Please contact me with questions or comments. I’m happy to explain what I think is going on within these volatile conditions. As always, thank you for your support and confidence in Kerr Financial Group