Kerr Financial Group

Kildare Asset Mgt.

Jeffrey J. Kerr, CFA

Newsletter

March 8, 2024 – DJIA = 38,791 – S&P 500 = 5,157 – Nasdaq = 16,273

“An investment in knowledge pays the best interest.” — Benjamin Franklin

The financial markets have greatly changed. The days of reading through financial statements and economic reports as a part of investing might be going the way of pay phones and fax machines. In a world of video clips and tweets, investors have decided that reading a 10-page earnings report is unnecessary.

Of course, Wall Street, who is always trying to sell stuff, is happy to offer quick and easy solutions that fit our shortened attention spans. Over time, Wall Street accommodates investors’ demands with new strategies and products. This has led to the development and popularity of passive investing.

Passive investing is the approach where inflows into a security have a predetermined strategy. For example, one of the most popular passive investments is buying funds and ETFs that mirror the S&P 500. These vehicles deploy their assets across the components of the index according to the proper weighting.

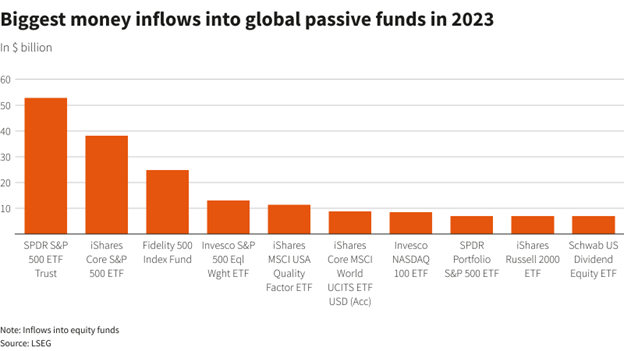

Passive investing can be implemented across many asset classes. Within the stock and fixed income markets, there are multiple indexes many of which have passive vehicles. Also, indexing can be done for international markets. Here is a chart which shows the largest inflows to the various passive funds in 2023. As you can see, the S&P 500 funds took in well over $100 billion in the top three funds.

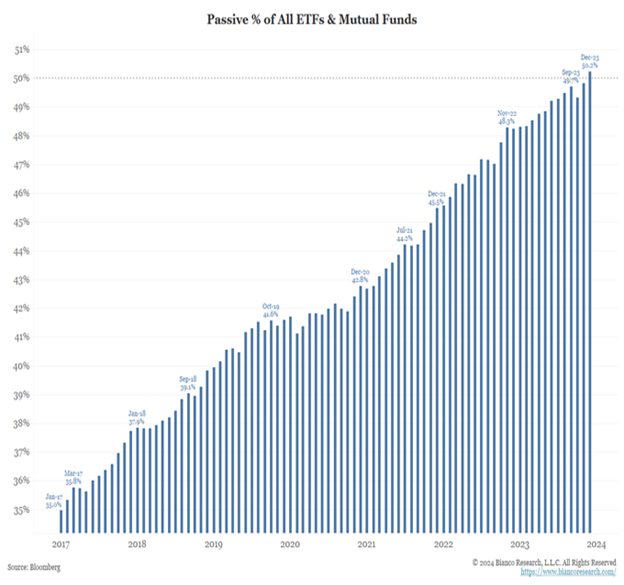

These investing options have gained enormous popularity and these securities have seen the assets invested in them skyrocket. Bloomberg recently reported that passive investing mutual funds and ETF has exceeded over 50% of all mutual fund and ETF assets. This chart shows how the passive ETFs and mutual funds have grown vs. all investment assets in ETFs and mutual funds.

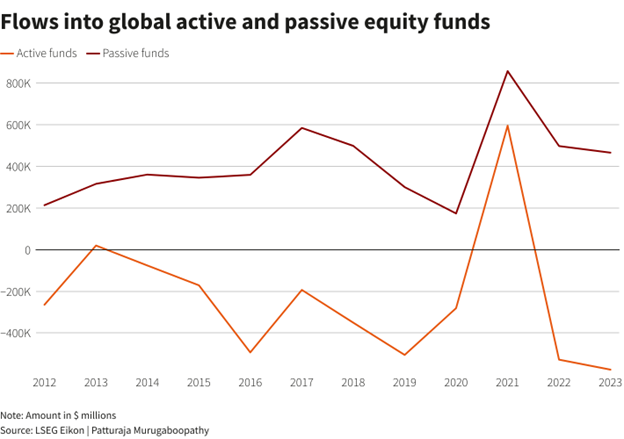

Not only have passive and indexing approaches increased, but it is not just from new investment dollars. This graph shows the shift of assets from global active funds to passive and indexing products during the past decade.

Despite the many offerings that the industry has created, passive investing is heresy to traditional Wall Streeters. Brokerage houses spend a lot of time and resources on research. Indexing and passive strategies don’t consider these efforts as constructive. Things such as the economy, interest rates, inflation and corporate earnings are irrelevant.

When a passive security receives new investment dollars, they are put to work immediately. There is no analysis on whether it’s a good or bad time to buy. There is no thought process on upcoming events (inflation report, earnings announcement, etc.) which could provide a better entry point for this fund’s inflow. The money is invested on the day of receipt, and it goes into the components of the index in the same amount as the weighting of the index.

This leads to another passive investing characteristic. The S&P 500 is weighted upon the stock’s market capitalization (the total value of a publicly traded company’s outstanding common shares). Microsoft and Apple are the two largest stocks in the index and account for 14% of the index. The top 10 stocks make up over 30% of the index while the bottom 250 only make up around 15%.

This is hardly the diversification that most people sign up for when they invest in an index. Further this concentration is self-fulfilling. The top companies get more of the incoming money which makes their stock value rise further which means that these stocks will get more of next week’s flows, and so on and so on. It becomes a cyclical process where the big get bigger which could lead to an extremely concentrated and overvalued market.

The growth of indexing and passive investing has its critics. David Einhorn founded and president of Greenlight Capital, a leading hedge fund, recently referred to the markets as “fundamentally broken” by passive and quantitative investing (Bloomberg, February 8, 2024). Einhorn and Greenlight were noted for their value and deep analytical investing approach. Einhorn has adapted his approach because of the growth in passive and algorithmic trading. He is partially implementing indexing and similar strategies.

While things like dial up internet go out of style, passive investing and computerized trading are likely here to stay. They may even continue to become a bigger part of the capital markets. As they do, it’s important that investors better understand these strategies, their widespread influence, and the risks that they contain.

Market Update Series April 15-22

/0 Comments/in Financial Planning News /by jkerrMarket Update Series April 5-12

/0 Comments/in Financial Planning News /by jkerrMarket Updates April 1-3

/0 Comments/in Financial Planning News /by jkerr“An investment in knowledge pays the best interest.” — Benjamin Franklin

/0 Comments/in Financial Planning News /by jkerrKerr Financial Group

Kildare Asset Mgt.

Jeffrey J. Kerr, CFA

Newsletter

March 8, 2024 – DJIA = 38,791 – S&P 500 = 5,157 – Nasdaq = 16,273

“An investment in knowledge pays the best interest.” — Benjamin Franklin

The financial markets have greatly changed. The days of reading through financial statements and economic reports as a part of investing might be going the way of pay phones and fax machines. In a world of video clips and tweets, investors have decided that reading a 10-page earnings report is unnecessary.

Of course, Wall Street, who is always trying to sell stuff, is happy to offer quick and easy solutions that fit our shortened attention spans. Over time, Wall Street accommodates investors’ demands with new strategies and products. This has led to the development and popularity of passive investing.

Passive investing is the approach where inflows into a security have a predetermined strategy. For example, one of the most popular passive investments is buying funds and ETFs that mirror the S&P 500. These vehicles deploy their assets across the components of the index according to the proper weighting.

Passive investing can be implemented across many asset classes. Within the stock and fixed income markets, there are multiple indexes many of which have passive vehicles. Also, indexing can be done for international markets. Here is a chart which shows the largest inflows to the various passive funds in 2023. As you can see, the S&P 500 funds took in well over $100 billion in the top three funds.

These investing options have gained enormous popularity and these securities have seen the assets invested in them skyrocket. Bloomberg recently reported that passive investing mutual funds and ETF has exceeded over 50% of all mutual fund and ETF assets. This chart shows how the passive ETFs and mutual funds have grown vs. all investment assets in ETFs and mutual funds.

Not only have passive and indexing approaches increased, but it is not just from new investment dollars. This graph shows the shift of assets from global active funds to passive and indexing products during the past decade.

Despite the many offerings that the industry has created, passive investing is heresy to traditional Wall Streeters. Brokerage houses spend a lot of time and resources on research. Indexing and passive strategies don’t consider these efforts as constructive. Things such as the economy, interest rates, inflation and corporate earnings are irrelevant.

When a passive security receives new investment dollars, they are put to work immediately. There is no analysis on whether it’s a good or bad time to buy. There is no thought process on upcoming events (inflation report, earnings announcement, etc.) which could provide a better entry point for this fund’s inflow. The money is invested on the day of receipt, and it goes into the components of the index in the same amount as the weighting of the index.

This leads to another passive investing characteristic. The S&P 500 is weighted upon the stock’s market capitalization (the total value of a publicly traded company’s outstanding common shares). Microsoft and Apple are the two largest stocks in the index and account for 14% of the index. The top 10 stocks make up over 30% of the index while the bottom 250 only make up around 15%.

This is hardly the diversification that most people sign up for when they invest in an index. Further this concentration is self-fulfilling. The top companies get more of the incoming money which makes their stock value rise further which means that these stocks will get more of next week’s flows, and so on and so on. It becomes a cyclical process where the big get bigger which could lead to an extremely concentrated and overvalued market.

The growth of indexing and passive investing has its critics. David Einhorn founded and president of Greenlight Capital, a leading hedge fund, recently referred to the markets as “fundamentally broken” by passive and quantitative investing (Bloomberg, February 8, 2024). Einhorn and Greenlight were noted for their value and deep analytical investing approach. Einhorn has adapted his approach because of the growth in passive and algorithmic trading. He is partially implementing indexing and similar strategies.

While things like dial up internet go out of style, passive investing and computerized trading are likely here to stay. They may even continue to become a bigger part of the capital markets. As they do, it’s important that investors better understand these strategies, their widespread influence, and the risks that they contain.

Market Update Feb 19 – 23

/0 Comments/in Financial Planning News /by jkerrSt. Valentine’s Day

/0 Comments/in Financial Planning News /by jkerrHappy St. Valentine’s Day. The day is associated with love, courting, marriage, romantic dates, and chocolate. In addition to these, the day is in honor of Saint Valentine. Here are some facts about him.

St. Valentine was a 3rd century Roman – he died in 269. According to Catholic.org, he is the Patron Saint of affianced couples, bee keepers, engaged couples, epilepsy, fainting, greetings, happy marriages, love, lovers, plague, travelers, and young people.

The details about Saint Valentine’s life are limited, but there are stories about his accomplishments. Again, this is from Catholic.org. St. Valentine was Bishop of Temi, Narnia, and Amelia, and was under house arrest with Judge Asterius. While discussing religion and faith with the Judge, Valentine pledged the validity of Jesus. The judge immediately put Valentine and his faith to the test.

St. Valentine was presented with the judge’s blind daughter and told to restore her sight. If he succeeded, the judge vowed to do anything for Valentine. Placing his hands onto her eyes, Valentine restored the child’s vision.

Judge Asterius was humbled and obeyed Valentine’s requests. Asterius broke all the idols around his house, fasted for three days and became baptized, along with his family and entire 44-member household. The now faithful judge then freed all of his Christian inmates.

St. Valentine was later arrested again for continuing to try to convert people to Christianity. He was sent to Rome under the emperor Claudius Gothicus (Claudius II). According to the popular hagiographical identity, and what is believed to be the first representation of St. Valentine, the Nuremberg Chronicle, St. Valentine was a Roman priest martyred during Claudius’ reign. The story tells that St. Valentine was imprisoned for marrying Christian couples and aiding Christians being persecuted by Claudius in Rome. Both acts were considered serious crimes. A relationship between the saint and emperor began to grow, until Valentine attempted to convince Claudius of Christianity. Claudius became raged and sentenced Valentine to death, commanding him to renounce his faith or be beaten with clubs and beheaded.

St. Valentine refused to renounce his faith and Christianity and was executed outside the Flaminian Gate on February 14, 269. However, other tales of St. Valentine’s life claim he was executed either in the year 269, 270, 273 or 280. Other depictions of St. Valentine’s arrests tell that he secretly married couples so husbands wouldn’t have to go to war. Another variation of the legend of St. Valentine says he refused to sacrifice to pagan gods, was imprisoned and while imprisoned he healed the jailer’s blind daughter. On the day of his execution, he left the girl a note signed, “Your Valentine.”

I hope you enjoyed this note and had a great St. Valentine’s Day.

Market Update: Jan 16th, 2024

/0 Comments/in Financial Planning News /by jkerrMarket Update: CPI January 12th 2024

/0 Comments/in Financial Planning News /by jkerrMarket Update Focus on CPI. Jan 10th, 2024

/0 Comments/in Financial Planning News /by jkerrMarket Update Jan 8th, 2024

/0 Comments/in Financial Planning News /by jkerr